April 7, 2011 (last updated August 9, 2021)

April 7, 2011 (last updated August 9, 2021)

Since the financial crisis in 2008, a truly mind-boggling array of fixes for the repurchase market have been proposed by analysts, economists, traders and bankers.

(Editor’s note: Below these introductory paragraphs is a litany of proposals.)

But in the meantime, repos have grown by leaps and bounds. That’s because financial markets and regulators love repo and they have convinced political leaders worldwide that it’s is the best engine to drive economies in the 21st century.

Yes, all agree, something needs to be done about the occasional panic. Currently the solution to that problem is for the Federal Reserve to ride to the rescue, as it did in March 2020 to an extent that previously would have been unimaginable.

The 2020 event at least clarified what the problem is: The fundamental problem isn’t the quality of the collateral, as many experts thought when mortgage-backed collateral triggered the 2008 panic. In 2020 the collateral was U.S. Treasuries, which are the highest-quality repo collateral possible and are thought to secure about three-fourths of the U.S. repurchase market.

Instead, the problem with repo is that it is very short-term debt and lenders can withdraw at a moment’s notice. To some, this is not news.

“To be clear, financial crises are always about short-term debt that debt holders no longer want,” wrote Yale professor Gary Gorton in 2018 in Fighting Financial Crises – Learning from the Past.

Put short-term debt at the heart of the $13 trillion in repo transactions that global financial institutions conduct with each other every day, and that can be a problem, nearly everyone now seems to agree. So the March 2020 panic evoked another flurry of ideas for reform, this time with a new edge of concern.

Notable were 10 urgent proposals on July 28, 2021, from a Working Group headed by former Treasury Secretary and New York Fed president Timothy Geithner. Citing “the ‘flash rally’ of 2014, the Treasury repo market stress of

September 2019, and the COVID-19 shock of March 2020,” they focused on stabilizing repo so it can expand, not on reining it in. This time the problem wasn’t too many mortgages, it was too many Treasuries.

Repo needs to expand, Geithner’s group said, because the U.S. needs to sell lots of Treasuries to pay for rising congressional spending and financial institutions won’t buy them if they can’t finance the buying and subsequent trading on the repurchase market.

“The Treasury market is the most important financial market in the world and should have the highest standards for resilience, transparency, and oversight. Confidence in the U.S. Treasury market, and its ability to function efficiently even in times of stress, is critical to the stability of the global financial system,” Geithner said in a press release.

Clearly alarmed, the group said repair is needed immediately, both in the U.S. and globally, and they proposed some far-reaching fixes that others have often suggested in the past:

- Standing repo: Create U.S. and global standing repo facilities for Treasury and U.S. agency securities including mortgages so financial institutions know cash is always available, invite a lot more financial companies to participate and charge a slightly-higher-than-market rate to discourage overuse. (The Fed opened these facilities the next day.) Caution: potential moral hazard.

- Central clearing: Require central clearing for Treasury securities and Treasury repos, perhaps eventually creating an all-to-all market to replace bilateral and tri-party trading. Caution: potential systemic risk.

- Post-crisis regulation: Carefully remove Treasuries from some post-2008 capital requirements that limited Treasury repo and other Treasuries trading by bank-affiliated dealers and kept banks stable in March 2020. Caution: potential bank losses.

- Transparency: Collect information on all Treasury securities and repo transactions and make much of it public. Caution: potential refusal to trade.

- Oversight: Dear Treasury Department, Congress put you in charge of the Treasuries markets. Start doing your job.

Will these fix the problems? Well, no, the working group said. But they’ll help.

“Given the importance of the Treasury market to the U.S. and global financial system, even modest improvements in market functioning would have substantial benefits,” Geithner said in the report’s introduction.

*****

Following is a recounting of the fixes that various experts have proposed since 2008. Most are proposals to try to fix repo so it can keep expanding.

Exceptions, that could significantly corral repo, include:

- Keep deposits at banks: Have Congress specify that “deposits” in Section 21 of the Glass-Steagall Act of 1933 include repos, money market funds, commercial paper and any other short-term debt. Section 21 says securities firms and other financial nonbanks cannot accept deposits, which are described as any money that is subject to immediate repayment, but regulators have not enforced it. (Congress has overturned parts of the Glass-Steagall Act but not Section 21.)

- Reduce fire sales: Remove the safe harbor in bankruptcy that repo lenders enjoy if their collateral is Treasuries, mortgages or related securities. These provisions created shadow banking, some analysts have said.

- Other ideas: Create FDIC-type insurance for repurchase transactions and require repo borrowers to buy it. Require all repurchase transactions to be done with designated banks. Don’t let repo lenders mark the collateral to market prices. Forbid financial institutions from doing collateralized lending and borrowing. Treat repo like stocks, bonds, futures and options regulated by the Securities and Exchange Commission.

Early work

The first post-crisis work on repos in the U.S.[2] was done out of the public eye, by some of the same people who brought Americans the credit crisis: The large bank companies, Fannie Mae and the New York Fed.[3]

In 2009, a shaken New York Fed formed a task force[4] of these institutions to study ways to improve tri-party repo,[5] which was thought to represent about 25 percent of the U.S. repo market[6] including Federal Reserve transactions and many of the repos done by money market funds.[7]

The task force issued 16 recommendations in May 2010, but none would have prevented the next run, and some might even make it worse, the New York Fed reported.[8]The task force tried to agree on a solution for panics, but they could not.

In tri-party repo, JP Morgan Chase and Bank of New York Mellon acted as clearing banks for repo transactions, providing such services as settling the transaction and valuing and managing collateral.[9]

In that role, the two banks were Ground Zero for systemic risk in 2007 and 2008, in part because the mechanics of the transactions required them to extend credit to the repo borrowers during the day.[10]The task force recommended eliminating the intraday credit[11] and since then it has been dramatically reduced.

Fear for the safety of the two banks and tri-party repo propelled some of the Fed’s most dramatic actions during the crisis.[12]

“To avert a collapse in confidence in the tri-party repo market, the Federal Reserve took extraordinary actions,” acknowledged a New York Fed report.[13] (JP Morgan withdrew from tri-party clearing in 2017, leaving BoNY as the sole tri-party clearing bank.)

Tri-party repo is a market for the big guys. At that time, on a typical day [14] three dealers – names not disclosed – accounted for almost half of the action, which averaged $1.6 trillion, down from $2.8 trillion at its height in early 2008, according to the New York Fed.[15]

The Federal Reserve itself averaged about $60 billion[16] with the financial markets from its repo desk on Wall Street. The Fed’s traders use tri-party repo to implement monetary policy for the Federal Reserve’s open market committee. They borrow or lend, using repos transacted with their Primary Dealers, to temporarily add or subtract money from circulation.[17] That raises or lowers short-term interest rates and the money supply.[18] The interest income that the Fed gets on the securities it buys is the Fed’s main source of income.

Some economists who praise the tri-party task force’s work nevertheless pointed out that it didn’t apply to most repo agreements, which are not transacted through the tri-party system, and it concentrated a lot of risk in the two clearing banks.

“I think it’s a great step, a really positive thing,” said Yale professor Gary Gorton, a repo expert. But it’s not the final solution, he added.

“I don’t think we want to force all repo into the tri-party system. It’s only two banks. That’s a lot of risk in two banks in lower Manhattan,” Gorton said.

Reform efforts in Washington

After the financial crisis, the Obama Administration[19] and Congress[20] acknowledged the need for repo reform, but their fixes barely chipped at the edges,[21] and their new restrictions on bailouts made it harder for regulators to stop future runs,[22] many analyses concluded.

The Dodd-Frank Act mainly dealt with repurchase funding by assigning oversight to the Federal Reserve, headed by the Federal Reserve chairman, and to the Financial Stability Oversight Council,[23] the new systemic risk regulator headed by the Treasury secretary.[24] The future of repo largely hinges on what they do.[25]

Some critics have wondered why they were entrusted with the job, since they failed last time. Others believe the Fed and top bankers convinced Congress to keep repo out of Dodd-Frank, except to hand it to the Fed, because repo is a critical tool of monetary policy and the Fed didn’t want politicians to mess it up. If, for example, financial institutions had to pay fees to cover the cost of regulating the repurchase market, as commercial banks pay FDIC fees, might that reduce repo volumes, restrict credit and make monetary policy less effective?

The Dodd-Frank Act[26] did give the Fed permission to limit short-term debt if it chose;[27] it tried to improve the quality of collateral by getting tough on derivatives and rating agencies and forcing some companies to take 5 percent of the loss on riskier asset-backed securities they sold to others;[28] it tried to improve data collection; and it put some limits on repo and derivative transactions with affiliates and other financial institutions. This last provision could reduce systemic interconnectedness[29] and cut back on risky insider deals among affiliates,[30] depending on how regulators enforced it, some experts claimed at the time.

Companies involved in the financial crisis had debt-to-equity leverage ratios ranging from 10:1 to 100:1, according to the Financial Crisis Inquiry Commission. This ratio compares how much of a company’s operating money comes from borrowing and how much comes from the owners themselves. [61]Thus, it measures the owners’ skin in the game and their capacity to survive a run by their lenders. A company usually raises equity by selling stock or making profits. Dodd-Frank requires the Fed to enforce a 15:1 debt-to-equity limit on companies that pose a “grave threat” to financial stability.[62]

A safety net for the financial markets

A small but influential group of analysts have said that some form of the safety net that protects traditional banks – FDIC insurance for deposits, access to low-cost loans from the Federal Reserve discount window and guarantee of interbank payments made over Fedwire, the Fed’s payment system[31] – should be extended permanently to repo and other parts of shadow banking, as it was extended temporarily during the crisis.

In 2007 and 2008 the Federal Reserve and Treasury Department took unprecedented steps to stop the runs and stabilize the financial system.[32] Among many actions,[33] they:

– made repo loans to the Primary Dealers to counter the run on repo, especially tri-party repo.[34] This amounted to opening the discount window to broker-dealers.[35] The Primary Dealer Credit Facility[36] was in effect from March 2008 to February 2010.[37]

– lent Treasury securities to the Primary Dealers so they’d have AAA collateral to get loans on the repo market. The Term Securities Lending Facility lasted from March 2008 to February 2010.

– bought asset-backed commercial paper (ABCPaper) and unsecured commercial paper to counter runs. The Commercial Paper Funding Facility lasted from October 2008 to February 2010.[38]

– lent to commercial banks and bank holding companies so they could buy ABCPaper from money market funds to counteract runs. This amounted to opening the discount window to money market funds. The Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility operated from October 2008 to February 2010.[39]

– guaranteed the share price of money market funds, thus extending FDIC-type insurance beyond commercial banks for the first time, even though the money market funds had never paid insurance premiums as commercial banks and their depositors periodically have to do. The Temporary Guarantee Program for Money Market Funds lasted from September 2008 to September 2009.[40]

The Fed and Treasury also started several major initiatives to support the value of mortgage-backed securities. That includes backstopping Fannie Mae and Freddie Mac, who in turn guarantee mortgages that collateralized about one-fourth of the repo market at that time.[41]

FDIC-type insurance for shadow banking

In the 1930s, after decades of bank runs, and against the wishes of key bankers and the Roosevelt Administration, American voters forced Congress to create FDIC insurance for commercial banks, paid for by the banks. Ever since, Americans have banked with confidence that their deposits were safe.

Some economists and analysts have called on Congress and the Financial Stability Oversight Council[42] to consider proposals for a similar safety net for shadow banking, one that would be paid for by those financial institutions. Others have cautioned that the cost of a safety net could make repo and securitization too expensive to be worth doing.

Among the proposals:

-have the government sell banks relatively expensive disaster insurance to guarantee the value of their assets, including mortgage-backed securities. The insurance would be optional, except that banks would be required to buy it for assets financed by short-term loans like repos or asset-backed commercial paper. The insurance premiums would get higher as the bank increased its short-term funding. The insurance would be transferable, if the bank sold the assets to a new owner.

–bring securitization under the oversight of regulators by restricting sales of asset-backed securities to special banks, “Narrow Funding Banks,” that would finance themselves with repo loans and other debt. These Narrow Funding Banks would have capital requirements and discount window access, just like commercial banks, but they wouldn’t be able to do anything except buy asset-backed securities and high-quality securities like U.S. Treasuries. Anyone else that wanted to buy asset-backed securities would buy Narrow Funding Bank debt instead, and that debt could be used as high-quality repo collateral. In other words, Narrow Funding Banks would be regulated collateral creators, or repo banks. Anyone other than Narrow Funding Banks and commercial banks that wanted to repo would have to be licensed and regulated. Any unregulated repurchase transactions would not receive the special “safe harbor” treatment currently given repo agreements in bankruptcy court, where repo lenders get to keep the collateral and do not have to share with other creditors.[43]

-assess companies that securitize and use those premiums to insure asset-backed securities.[44] Fannie Mae and Freddie Mac might play a role here.

-create a repo resolution authority, funded by fees paid by repo lenders and with access to the Fed’s discount window, that in the event of default by a repo borrower would repay the repo lender, liquidate risky collateral, pay out claims and force the parties to take a financial hit.[45]

-have the Treasury Department issue Treasury securities as needed for repo collateral[46] or insure riskier collateral by selling credit default swaps on it.[47]

“Given the still significant size of the shadow banking system and its inherent fragility due to exposure to runs … , it is imperative for policymakers to assess whether shadow banks should have access to official backstops permanently, or be regulated out of existence,” wrote a team of economists at the New York Federal Reserve Bank in July 2010.[48]

Do we need securitization?

“Regulated out of existence” resonates with some people who would like to do away with securitization, go back to the proven credit system of using commercial bank deposits to make loans, and confine repo collateral to Treasuries.

These critics feel securitization will always be corruptible, in part because its fragmented, opaque nature leaves no one accountable. The idea of extending federal safety nets even further – and expanding the moral hazard that goes with it – is abhorrent to some.[49]

They also doubt it’s needed. For example, at the end of 1980 66 percent of Americans owned their homes, according to the Census.[50] By the end of 2000, 68 percent did. In 2004, ownership peaked at 69 percent. In 2010 it was back to 67 percent. Who needs this? some ask.

“In order to revive securitization, taxpayers would have to absorb large risk. The social gains would be small, or perhaps even nonexistent. The best thing to do with the shattered Humpty-Dumpty of mortgage securitization would be to toss the broken pieces into the garbage,” said economist Arnold Kling, a member of the Financial Markets Working Group of the Mercatus Center at George Mason University.[51]

Momentum seemed to lie, however, with the side that wants to try to make repo and securitization safe. Advocates cite the beneficial flow of credit that securitized banking[52] can support.[53]

“Securitization is necessary to guarantee the widespread availability of the long-term fixed-rate mortgage, which has been the cornerstone of American homeownership since the Depression,” write Georgetown University law professor Adam J. Levitin and University of Pennsylvania real estate professor Susan M. Wachter, who want securitization limited to standardized, non-exotic mortgage products.[54]

Relying on regulators

Congress and bank regulators looked to the Bank for International Settlements, which coordinates worldwide financial regulations from its headquarters in Basel, Switzerland, [55] for new rules to help stop runs on large commercial and investment banks.[56] Chief among them are:

-A “net stable funding ratio” to better match the maturities of deposits,[57] loans and repos and try to make sure banks will have reliable sources of financing in a crisis, and

– A “liquidity coverage ratio” to improve the panic-resistant quality of bank assets by trying to make sure they have enough high-quality assets that they can sell quickly to raise cash in a crisis

Some skeptics said the new Basel levels were a big improvement but not high enough. Others doubted banks can ever have enough ready funding or easy-to-sell assets to stop a systemic run.[65]

And at any rate, none of this applies to nonbank financial companies that were the center of the 2008 crisis.

Gaming their capital requirements

Banks got away with a lot less capital in the past decade, thanks in part to new rules in 2001 and 2004. The size of the biggest commercial and investment banks more than doubled, measured by their assets, while their capital levels rose only slightly.[66] By 2007 many appeared to be well capitalized but were not.[67]

Bank assets are mainly the loans and investments that banks make. Capital is bank jargon for equity,[64] which a company usually gets by selling stock or making profits. Capital ratios measure how much of the owners’ own money will be used to cover unexpected losses on loans and investments. In other words, a capital ratio measures the owners’ skin in the game and their capacity to stop a run.

The new rules in 2001 and 2004 were:

–In 2001[68]regulators sharply reduced the amount of capital that commercial banks and thrifts had to have in order to invest in private-label mortgage securities, that is, those not guaranteed by federal agencies like Fannie Mae.[69] These private-label securities had to have an AA or AAA rating. They could get it by being insured by credit default swaps or by being the safest slices of a loan pool,[70] even a CDO pool. For the first time, rating agencies controlled how much capital banks had to hold for their mortgage securities.[71]

The 2001 decision meant banks could create a lot more securities, hold them without needing much capital,[72] collect the interest and use them as collateral for repo loans.

The following year, issuance of private-label mortgage securities rose 32 percent.[73]

–In 2004, bank regulators[74] said commercial banks needed 90 percent less capital for loans they moved off their books to ABCPaper-funded securitization businesses.[75] The same year, the Securities and Exchange Commission let investment banks use their own internal models to calculate risk and capital requirements,[76] so the banks decided they needed a lot less capital to invest in asset-backed commercial paper (ABCPaper), top-rated asset-backed securities (ABS) and ABS insured by credit default swaps (CDS).[77] In other words, in 2004 both commericial and investment banks got permission from their regulators to step up securitization without adding much equity.

At about that time, the Fed began raising interest rates[78] and Americans cut back on home loans. To keep business from falling, financial institutions lowered their underwriting standards, to reach more Americans, and revved up their off-the-books securitization factories[79]and their repo desks,[80] which they were able to do without having to raise much new equity.

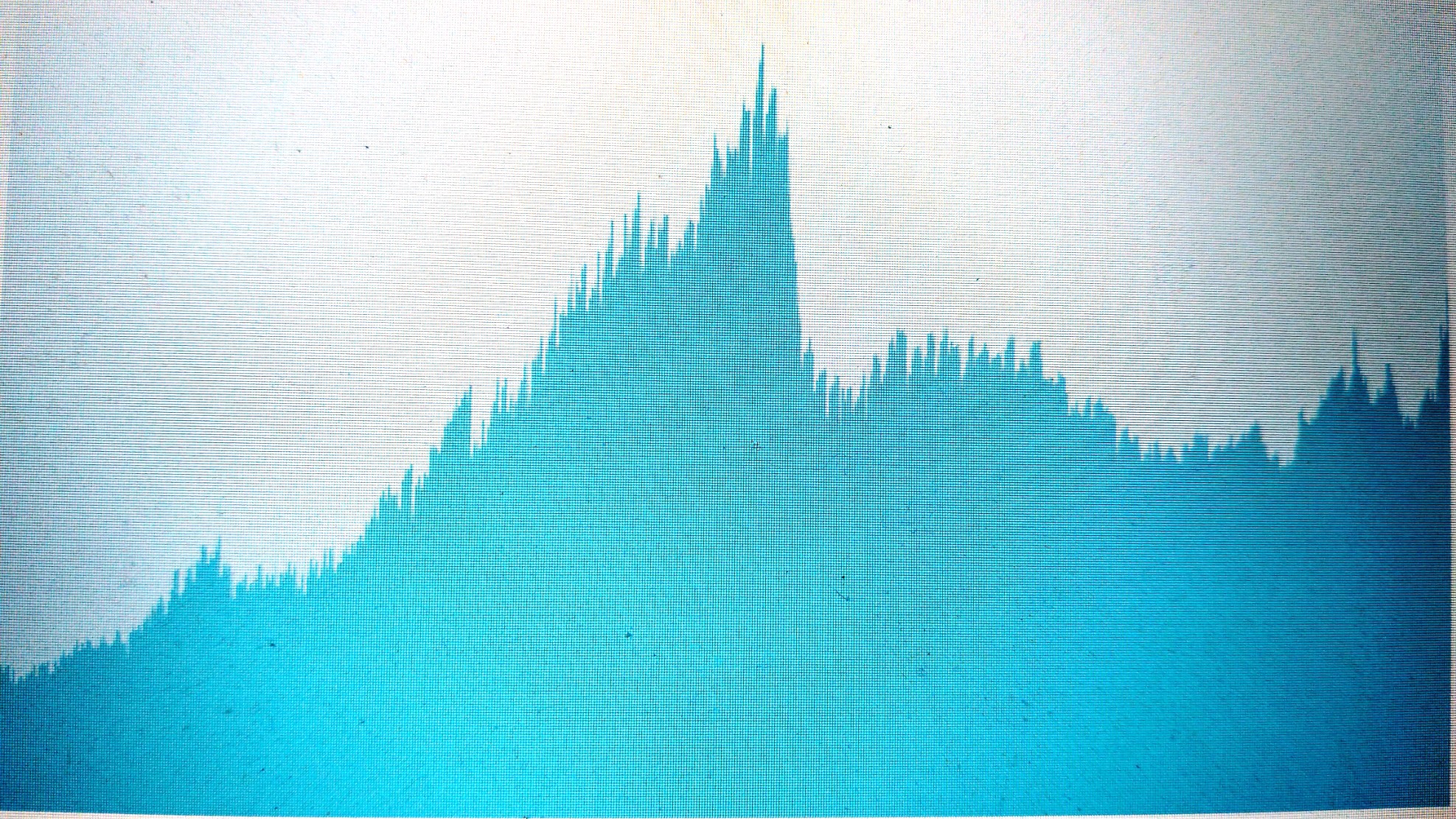

The next year, issuance of private-label securities rose 69 percent,[81] ABCPaper was up 16 percent[82] and repos jumped 33 percent.[83]

Overall during the bubble years, issuance of agency mortgage securities fell by half[84] and private labels tripled,[85] while outstanding repo[86] and ABCPaper doubled.[87]

Several studies by Federal Reserve and academic economists[88] concluded that banks drove securitization in the past decade not to offload risk to investors but instead to be able to do much more business, and make a lot more money, with a lot less capital.

“This was the ‘new model’ of large complex financial institutions during 2003–2007 — to manufacture and take on systemic risk … but do so with little capital on the balance-sheet — which ultimately led to the financial crisis of 2007–2009,” wrote New York University economists Viral Acharya and co-authors in a 2010 study of the crisis.[89]

Proposals to reduce risk

Experts proposed a number of other changes they believed could improve the repurchase and securitizations markets. Among them were:

-Separate commercial banks from investment banks, broker-dealers or any securities underwriting and trading firms. (In other words, bring back key provisions of the 1933 Glass-Steagall Act.)

-Don’t let the Fed lend to nonbanks. (In other words, undo the part of the Federal Deposit Insurance Corporation Improvement Act of 1991 that did away with tough collateral limits on Fed loans to nonbanks.)

-Make financial institutions get much more of their money by selling stock instead of taking on debt.[90] Require a 3:1 or even 2:1 equity-to-debt ratio.[91]

-Harness the power of transparency by making all private (over-the-counter) repo and derivative transactions public.[92]

-Overturn the 1984 law that said repo lenders get to keep the collateral if the repo borrower goes bankrupt[93] – unlike most creditors who have to share loss with other creditors – or make repo lenders pay a fee for the special treatment. [94]Critics say the exemption from bankruptcy (1) lets repo lenders ignore risk and makes them eager to do more repo loans, [95] (2) makes repo borrowers ravenous for more collateral, so they can get some of those repo loans, (3) lets banks get by with less equity because regulators think a bank that is selling securities overnight on the repurchase market, to get a repo loan, is taking less risk that if it holds the same securities longer term, and (4) artificially drives down the value of repo collateral, when repo lenders rush to sell collateral they’ve had to seize.

This was especially true after the 2005 Bankruptcy Act added repos collateralized with mortgages and interests in mortgages, including mortgage-backed securities and CDOs,[96]to the list of exempted repurchase agreements .[97]

“There would clearly be no “shadow banking” industry without the ability to quickly liquidate Repo trades in the event of a bankruptcy,” dealer Scott Skyrm said in 2013.

The 2005 Bankruptcy Act made repos secured with mortgage-backed securities more attractive to repo lenders, spurred demand for mortgage-backed securities to use as repo collateral, played a key role both in the deterioration of the quality of repo collateral and in the growth of the repurchase market, and led to fire sales of mortgage-backed securities and downwardly-spiralling values during the panic, critics claim.[98]

(One immediate result of the Act was that bankers funding mortgage companies like Countrywide, American Home Mortgage and New Century with warehouse lines of credit suddenly switched to repo loans instead.)[99]

Efforts to deal with the bankruptcy exemption included: An FDIC proposal that repo lenders to major failed institutions get only their collateral as repayment, even if it’s worth less than their loan;[100] various challenges to the repo exemption that tried to work their way through the courts;[101] and a study ordered by Dodd-Frank[102] which the Fed completed in 2011 without making any recommendations.

-Several groups had money market funds under the microscope for their role in the crisis. Some economists, including former Fed Chairman Paul Volcker, argued that money market funds do what commercial banks do, but without the costs, regulations or safety net, and that must change.[103] A mutual fund trade group[104] proposed that part of the industry pay for a special bank to back up troubled money market funds. The International Monetary Fund[105] wanted money market funds to stop claiming to preserve principal at $1 per share, since the principal can fluctuate, or buy FDIC-type insurance[106] to back up the claim. Standard & Poor’s rating agency proposed to downgrade the ratings of many companies that repo with money market funds, which could limit transactions.[107]

The Securities and Exchange Commission passed new rules that ordered money market funds to keep at least 10 percent of their assets in securities they can sell in one day and 30 percent in securities they can sell in one week.[108] There was a touch of irony in those new rules. Old rules also required money market funds to use short-term investments, and it was partly the old rules that drove money market funds to overnight repos and ABCPaper in the first place,[109] so they could enjoy the higher yields of long-term mortgages while technically investing in short-term instruments.

-Require financial institutions to report all repo transactions in their financial statements and have Dodd-Frank’s new Office of Financial Research analyze them.[110] For the first time, regulators and the public would have accurate information about the size and complexity of the repurchase market. The best data comes from the New York Fed’s Primary Dealers, whose outstanding repurchase agreements peaked at $4.6 trillion in March of 2008 and fell to $2.2 trillion in September of 2009. They’re thought to be 80-90 percent of the market. Bank financial statements, where repos are reported as collateralized financing and collateralized agreements,[111] are unreliable indicators of volume because they only show the amount at quarter’s end and because Financial Accounting Standards Board (FASB) Interpretation No. 41 lets companies net repo loans with repo borrowings, when conducted with the same company, and report only the difference. But a net amount does not accurately portray the damage that repo lenders can inflict when they unexpectedly demand more collateral or repayment.

-Make sure bank regulators don’t undermine FASB Statements No. 166 and No. 167, passed in 2009, which said companies must start doing more securitization in-house rather than in the off-the-books businesses, variously known as trusts, special purpose entities, special purpose vehicles, variable interest entities, conduits and structured investment vehicles.[112] The FASB ruling could mean securitization would be more transparent, banks would have to have more capital before they could securitize, and investors in asset-backed securities would be more discriminating because they would no longer be protected by the off-the-books businesses if the bank failed. But banks and their regulators have found ways around such rules in the past – as when they evaded new accounting standards put in place after JP Morgan and others were caught in 2001 helping Enron hide debt in special purpose entities[113] – and they presumably they could do it again.[114] Dodd-Frank required a study.[115]

-Limit financial institutions to a maximum of $250 billion to $500 billion in assets, to try to contain systemic risk if they fail. In 2011 seven U.S. bank holding companies exceeded $500 billion.[116] They were Bank of America at $2.3 trillion, JP Morgan at $2.1 trillion, Citigroup at $1.98 trillion, Wells Fargo at $1.2 trillion, Goldman Sachs at $909 billion, Morgan Stanley at $841 billion and MetLife at $617 billion.[117] Assets of the seven companies that failed in 2008 were Merrill Lynch and American International Group at $1 trillion,[118] Fannie Mae at $883 billion, Freddie Mac at $794 billion, Lehman Brothers at $639 billion, Bear Stearns at $395 billion and Washington Mutual at $310 billion, which was the largest failure of an FDIC-insured bank in history.

–limit a bank’s size to 10 percent of all non-deposit borrowings (such as repos, borrowings from the Federal Reserve, commercial paper).

-auction to a country’s financial institutions the total amount of short-term borrowings permitted in that nation’s financial system each quarter, perhaps set as a percent of Gross Domestic Product. After the auction, financial institutions could buy and sell the rights to these short-term borrowings. In other words, this is a cap-and-trade system to control the amount of short-term debt in the financial markets while letting it flow where most needed.

-Require shadow bankers to use only top-quality collateral. Let repo downsize to fit existing bullet-proof securities.[119]

-Permit securitization of standardized, proven mortgages only. Let non-standard mortgages stay on the books of the company that made them.[120]

-Limit the use of repurchase transactions to extremely well-capitalized banks.

-Levy a tax or fee on all short-term instruments like repurchase agreements and ABCPaper, to discourage a financial institution from using them to buy or finance longer-term assets.[121] The FDIC started a version of this idea when it began basing commercial banks’ insurance premiums on all liabilities, including repo loans, not just on deposits.

-Require shadow bankers who are increasing their dependence on short-term money[122] to hold more capital and more easily-sold assets.

–Only allow specially licensed firms to borrow short term.

-Require repo lenders to charge a minimum fee or haircut, the way mortgage bankers sometimes require a down payment, to limit leverage.

-Eliminate rehypothecation.[123]

-Require companies that pool loans and issue securities to produce more detailed prospectuses and quarterly financial statements, so repo lenders and investors can evaluate the securities more accurately.

The chances for reform

Some reformers say they doubt the Federal Reserve and the Financial Stability Oversight Council will do much to fix repo, securitization and shadow banking unless the American public gets engaged.

The public’s silence favors those that benefit from the status quo of taxpayer bailouts, [124] they warn. Without watchdogs, even the limited Dodd-Frank and Basel rules can get watered down.

“So far, all of this has gone largely unnoticed by the public, and that gives shadow banks the opportunity to make their case unopposed. Thus, it’s important for the public to be aware that these changes are happening, and to make sure the public interest is fully reflected in the outcome. As it stands, there’s no guarantee that will happen,” University of Oregon economist Mark Thoma [125] wrote in The Fiscal Times in September 2010.

-30-

Editor’s Note: I collected the following footnotes for my own use, to help me keep track of some of my online sources. I left them here in case they’re helpful to you, too, even though over time some documents get moved and the links no longer work.

[2] http://www.imf.org/external/pubs/ft/gfsr/2010/02/pdf/chap2.pdf see http://www.bis.org/publ/cpss91.pdf

[4] http://www.newyorkfed.org/tripartyrepo/: UBS AG, Bank of New York Mellon, JP Morgan, Dank of America, Barclays, Citigrop, Credit Suisse, Deutsche Bank, Goldman Sachs, Morgan Stanley, Fannie Mae, Federated Investors, Fidelity, Invesco, State Street, Citidel Investment, Depository Trust and Clearing Corp., Investment Company Institute, Securities Industry and Financial Markets Association, Managed Funds, Federal Reserve Bank of New York.

[7] http://www.fitchratings.com/creditdesk/reports/report_frame.cfm?rpt_id=562906 and http://www.newyorkfed.org/research/staff_reports/sr477.pdf

[11] “Regulating Wall Street” pg. 328 and http://www.newyorkfed.org/tripartyrepo/pdf/tpr_proposal_101203.pdf

[12] http://www.ny.frb.org/research/current_issues/ci15-4.html and http://www.newyorkfed.org/tripartyrepo/ and http://www.imf.org/external/pubs/ft/gfsr/2010/02/pdf/chap2.pdf and “Regulating Wall Street” pg. 325

[15] http://www.newyorkfed.org/tripartyrepo/ and http://www.newyorkfed.org/tripartyrepo/margin_data.html and http://www.newyorkfed.org/tripartyrepo/pdf/explanatory_notes.pdf

[21] http://www.ft.com/cms/s/0/692d4184-c72d-11df-aeb1-00144feab49a.html?ftcamp=rss and http://www.nytimes.com/glogin?URI=http://www.nytimes.com/2010/10/01/business/economy/01norris.html&OQ=_rQ3D1Q26partnerQ3DrssQ26emcQ3Drss&OP=ecc2050Q2FEQ25HXEQ7CgnoIggQ20Q3EEQ3E_w_Ew_E_wEXro.KHooEHngKgQ5BLE_wKgII.oP(Q20Q5Bs

[22] http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1571290 page 54 and “Regulating Wall Street” pg. 31

[24] http://www.bis.org/review/r100929a.pdf and http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1676947 and http://www.bis.org/review/r100920d.pdf

[25] http://www.rooseveltinstitute.org/sites/all/files/Will_It_Work_Financial_Interconnection.pdf and http://www.fedfin.com/images/stories/client_reports/payment11.pdf and http://www.fedfin.com/index.php?option=com_content&view=article&id=382:karen-petrou-on-what-will-wreak-havoc-with-repos&catid=13:daily-blog&Itemid=30

[26] http://www.mayerbrown.com/publications/article.asp?id=9307&nid=6 and http://www.kilpatrickstockton.com/en/Knowledge%20Center/Alerts%20and%20Podcasts/Legal%20Alerts/2010/07/Congress%20Passes%20Dodd-Frank%20Wall%20Street%20Reform.aspx

[27] http://online.wsj.com/article/SB10001424052748703713504575475532391301148.html and http://www.mayerbrown.com/publications/article.asp?id=9307&nid=6 and http://www.bloomberg.com/news/2011-03-11/lehman-failed-lending-to-itself-in-alchemy-eluding-dodd-frank.html

[28] http://www.mayerbrown.com/publications/article.asp?id=9307&nid=6 and http://online.wsj.com/article/SB10001424052748704756804575608970681760904.html and “Regulating Wall Street” pg. 479 and 477

[30] http://www.securitization.net/article.asp?id=1&aid=8794 and http://www.sec-oig.gov/Reports/AuditsInspections/2008/446-a.pdf

[32] http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1571290 and http://www.cbo.gov/ftpdocs/115xx/doc11524/05-24-FederalReserve.pdf

[34] http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1571290 and http://www.newyorkfed.org/newsevents/news/research/2009/rp090903.html and http://www.newyorkfed.org/research/staff_reports/sr477.pdf

[35] http://www.imf.org/external/pubs/ft/fandd/2010/09/pdf/bhatia.pdf and http://www.waxman.house.gov/UploadedFiles/Fed_Policy_Responses.pdf

[36] http://www.ny.frb.org/research/current_issues/ci15-4.html and “On the Brink” pg. 219 and http://www.ft.com/cms/s/0/8a5e3ac4-fd89-11df-a049-00144feab49a.html#axzz19KpULT1O

[37] http://www.newyorkfed.org/banking/tpr_infr_reform.html and http://www.federalreserve.gov/monetarypolicy/pdcf.htm

[42] http://www.treas.gov/FSOC/ and http://economistsview.typepad.com/economistsview/2010/11/what-impact-will-the-election-have-on-financial-reform.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+EconomistsView+%28Economist%27s+View+%28EconomistsView%29%29

[43] http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1676947 and http://www.econ.barnard.columbia.edu/faculty/mehrling/papers/the%20REPO%20bank.pdf

[44] http://www.treasury.gov/initiatives/Documents/Reforming%20America%27s%20Housing%20Finance%20Market.pdf and http://www.theatlantic.com/business/archive/2009/07/shadow-banking-what-it-is-how-it-broke-and-how-to-fix-it/21038 and http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1571290 and http://www.federalreserve.gov/pubs/feds/2010/201046/201046pap.pdf and http://www.imf.org/external/pubs/ft/gfsr/2010/02/pdf/chap2.pdf

[45] http://www.cepr.org/pubs/PolicyInsights/PolicyInsight52.pdf and “Regulating Wall Street” pg. 346

[46] http://www.treasury.gov/press-center/press-releases/Pages/js4211.aspx and http://www.newyorkfed.org/research/staff_reports/sr223.pdf

[47] http://www.bloomberg.com/news/2010-12-22/derivatives-blitz-needed-to-tame-anarchic-bonds-mark-gilbert.html

[49] http://mercatus.org/publication/not-what-they-had-mind-history-policies-produced-financial-crisis-2008 and Naked Capitalism blog of 8-4-10

[52] “Slapped by the Invisible Hand”

[55] http://www.ecb.int/press/key/date/2010/html/sp100929.en.html and http://www.imf.org/external/pubs/ft/gfsr/2010/02/pdf/chap2.pdf and http://www.cepr.org/pubs/PolicyInsights/PolicyInsight52.pdf

[58] http://www.bis.org/publ/bcbs188.pdf and “Regulating Wall Street” pg. 159 and http://www.bis.org/publ/bcbs165/spccr.pdf and www.bis.org/publ/bcbs179.pdf and http://www.bis.org/press/p100726/annex.pdf and http://www.cepr.org/pubs/PolicyInsights/PolicyInsight52.pdf and http://www.imf.org/external/np/tr/2010/tr092910.htm and http://www.ecb.int/press/key/date/2010/html/sp100929.en.html and http://www.imf.org/external/pubs/ft/gfsr/2010/02/pdf/chap2.pdf and http://www.bloomberg.com/news/2010-11-12/banks-win-one-year-reprieve-on-limiting-risks-as-g-20-delays-rules-accord.html

[59] http://www.bis.org/publ/bcbs179.pdf and http://www.bloomberg.com/news/2010-10-11/bankers-voice-resistance-as-national-regulators-say-basel-is-just-a-start.html and http://blogs.wsj.com/source/2010/09/14/basel-iii-rules-tougher-than-they-seem/ and http://www.bloomberg.com/news/2010-11-17/banks-in-europe-said-to-be-poised-to-escape-basel-rules-that-curtail-debt.html

[60] http://baselinescenario.com/2010/12/04/what-jamie-dimon-won%e2%80%99t-tell-you-his-big-bank-would-be-dangerously-leveraged/

[61] http://baselinescenario.com/2010/11/11/top-finance-experts-to-g20-the-basel-iii-process-is-a-disaster/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+BaselineScenario+%28The+Baseline+Scenario%29

[62] “Regulating Wall Street” pg. 46

[64] Baseline Scenario blog of 12-5-10

[65] http://www.cepr.org/pubs/PolicyInsights/PolicyInsight52.pdf and http://www.cambridgewinter.org/Cambridge_Winter/Archives/Entries/2010/10/4_CAPITAL,_CAPITAL,_CAPITAL_files/capital%20and%20TBTF%20100410.pdf and http://www.federalreserve.gov/newsevents/speech/bernanke20080513.htm

[66] Critical Review “Causes of the Crisis” pg. 204 and http://www.imf.org/external/pubs/ft/gfsr/2008/01/pdf/chap1.pdf (good) and RegulatoryCapitalArbitrage.pdf and http://www.fcic.gov/hearings/pdfs/2010-0902-Bernanke.pdf and “Regulating Wall Street” pg. 4, 22

[67] “Regulating Wall Street” pg. 147.

[68] http://www.ots.treas.gov/_files/422073.pdf and http://www.securitization.net/pdf/dt_recourse_120501.pdf and http://www.federalreserve.gov/boarddocs/press/boardacts/2001/20011129/default.htm and http://www.fdic.gov/news/news/press/2001/pr8201.html

[69] http://mercatus.org/publication/not-what-they-had-mind-history-policies-produced-financial-crisis-2008 and http://www.securitization.net/pdf/dt_recourse_120501.pdf

[70] http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1669401 and http://mercatus.org/sites/default/files/publication/NotWhatTheyHadInMind(1).pdf

[74] http://www.fdic.gov/news/news/inactivefinancial/2003/fil0373a.html and http://www.federalreserve.gov/boarddocs/press/bcreg/2004/20040720/attachment.pdf and http://www.securitization.net/pdf/bankone_abcp_Jan04.pdf and http://www.imf.org/external/np/res/seminars/2009/arc/pdf/acharya.pdf

[75] http://www.imf.org/external/np/res/seminars/2009/arc/pdf/acharya.pdf and http://newyorkfed.org/research/epr/02v08n1/0205mcca.pdf

[77] “Regulating Wall Street” page 32, 148 and http://info.worldbank.org/etools/docs/library/156603/housing/pdf/Gwinner.ppt and http://www.appraisers.org/Files/Education/ARM/CollateralandRiskBasedCapitalStandardsJC.pdf and http://www.gtnews.com/article/6309.cfm and http://www.highbeam.com/doc/1G1-152570958.html and http://www.gtnews.com/article/6599.cfm and http://www.aciforex.org/docs/briefings/acib_oct05.pdf and http://www.bis.org/publ/bcbs128c.pdf and http://www.ftmandate.com/news/fullstory.php/aid/1220/ and http://ipe.com/articles/print.php?id=16446 and http://reports.celent.com/PressReleases/200706062/EuroRepoMkt.htm and Felix Salmon at http://www.cjr.org/the_audit/ 11-24-10

[79] http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1669401 and http://www.federalreserve.gov/pubs/feds/2010/201046/201046pap.pdf

[80] http://www.americanbanker.com/issues/176_7/column-kahr-next-clever-idea-1031081-1.html?ET=americanbanker:e5476:2274634a:&st=email&utm_source=editorial&utm_medium=email&utm_campaign=ABLA_Daily_Briefing_011111

[82] http://www.sifma.org/uploadedFiles/Research/Statistics/StatisticsFiles/Funding-US-ABCP-Outstanding-SIFMA.xls

[87] http://www.imf.org/external/np/res/seminars/2009/arc/pdf/acharya.pdf and http://www.sifma.org/research/statistics.aspx

[88] http://www.clevelandfed.org/research/commentary/2003/0815.pdf and http://mercatus.org/sites/default/files/publication/NotWhatTheyHadInMind(1).pdf and http://w4.stern.nyu.edu/blogs/riskintelligence/tail_risk.pdf

[90] Baseline Scenario blog 12-5-10 and http://www.ft.com/cms/s/0/966b5e88-c034-11df-b77d-00144feab49a.html#axzz17cnizbrK and http://www.bloomberg.com/news/2011-02-25/fed-runs-scared-with-boost-to-bank-dividends-commentary-by-anat-r-admati.html

[91] Baseline Scenario blog 12-5-10

[95] “Regulating Wall Street” pg 336

[96] “Regulating Wall Street” pg. 330

[97] http://idiosyncraties.blogspot.com/2009/03/is-it-time-to-repeal-derivative-related.html and http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1676947 and http://www.imf.org/external/np/tr/2010/tr092910.htm and “Regulating Wall Street” pg. 330

[98] http://www.imf.org/external/pubs/ft/gfsr/2010/02/pdf/chap2.pdf and http://www.newyorkfed.org/research/epr/forthcoming/1102morg.html and “Regulating Wall Street” pages 229-231.

[100] http://www.fdic.gov/news/news/press/2010/pr10224.html and http://www.housingwire.com/2010/10/12/fdic-proposes-rule-on-creditor-claims-under-dodd-frank

[101] http://www.bloomberg.com/news/2010-11-18/jpmorgan-is-lehman-brothers-next-deep-pocket-target-after-barclays-ends.html

[103] http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a5O9Upz5e0Qc and “Regulating Wall Street” pg. 316

[108] http://www.bankrate.com/finance/investing/sec-new-rules-for-money-market-funds.aspx and http://www.sec.gov/news/press/2010/2010-14.htm and http://www.fitchratings.com/creditdesk/reports/report_frame.cfm?rpt_id=562906 and http://www.imf.org/external/pubs/ft/gfsr/2010/02/pdf/chap2.pdf

[111] lehmanreport.jenner.com and Goldman Sachs 10-K and Citigroup 10-K

[112] http://www.fasb.org/cs/ContentServer?c=FASBContent_C&pagename=FASB/FASBContent_C/NewsPage&cid=1176156240834

[114] http://www.fdic.gov/news/news/financial/2010/fil10003a.pdf and http://www.rooseveltinstitute.org/policy-and-ideas/ideas-database/bring-transparency-balance-sheet-accounting and http://accountingonion.typepad.com/theaccountingonion/2008/08/fas-140-lets-ca.html

[115] “Regulating Wall Street” pg. 486

[120] http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1669401 and http://www.aei.org/docLib/HousingFinance.pdf

[121] http://www.imf.org/external/pubs/ft/gfsr/2010/02/pdf/chap2.pdf and http://www.nytimes.com/2009/11/27/opinion/27krugman.html?_r=1 and http://www.princeton.edu/~hsshin/www/MacroprudentialMemo.pdf and http://www.imf.org/external/np/g20/pdf/062710b.pdf