Updated July 30, 2013

Rehypothecation may be the news hook that finally gets the U.S. business press to start covering the repurchase market.

Ever since the broker-dealer MF Global filed bankruptcy October 31, and word escaped that $1.2 billion of its clients’ money might be missing, rehypothecation has become the No. 1 suspected – and unproven – villain in the blogosphere.

From the New York Times Dealbook’s live blog during a Senate panel hearing on MF Global:

A favored buzz word of the day has been the positively impenetrable term, rehypothecation.

At the same time, a deepening credit crunch in Europe, caused in part by a shortage of repo collateral, is drawing the attention of reporters to the role that rehypothecation and repos play in the credit markets.

From Bloomberg:

The disappearance of the unsecured credit markets as the sovereign debt crisis deepens has underlined the importance of secured borrowing through repurchase agreements.

For the record: Rehypothecation is what happens when a repo borrower puts up securities as collateral for a repo loan … and then the repo lender uses the same securities as collateral to get its own repo loan … and then the second lender uses the securities as collateral to get its own repo loan … and so on.

This creates a daisy chain of credit secured by one set of collateral.

Rehypothecation can also happen with derivatives and securities lending* transactions that are secured by collateral. (Editor’s note: For more technical information, see below.)

Some critics suspect that MF Global made $1.2 billion disappear by rehypothecating, or re-using, its clients’ money or securities. In this view, rehypothecation is chicanery.

Meanwhile, some economists are saying that distrust in the repo market is shortening the rehypothecation chains and drying up credit. In this view, rehypothecation is a valuable tool in the creation of credit, which is the lifeblood of the economy.

Combined, the two news events put rehypothecation, and by extension repos, on the media map and yielded a flurry of postings in the blogosphere and in the mainstream press.

Could it be that it’s getting harder and harder for the U.S. press to blame failures like MF Global, and credit crises like the one in Europe, on mortgages and credit default swaps?

Could it be that outrage over rehypothecation will finally, three years late, bring reform to the vital but dangerous repurchase market?

As always with repo, first to the pen was the Financial Times in London, with a November 28 story by Tracy Alloway, who wrote this great lead about the shortening rehypothecation chains:

Whoosh! That’s the sound of up to $5,000bn worth of collateral draining from the financial system. And it is not a reassuring one.

The first claim that rehypothecation could explain MF Global’s missing $1.2 billion seems to have come from Christopher Elias writing December 7 in Thomson Reuters’ Business Law Currents:

MF Global’s bankruptcy revelations concerning missing client money suggest that funds were not inadvertently misplaced or gobbled up in MF’s dying hours, but were instead appropriated as part of a mass Wall St manipulation of brokerage rules that allowed for the wholesale acquisition and sale of client funds through re-hypothecation.

(Update: See reader’s comment below, with link to Part 2 of Elias’s report, published January 12, 2012.)

Bloggers quickly picked up the theme, as a Google search for “MF Global rehypothecation” shows.

Here zerohedge channeled the views of David Stockman, former Director of the White House Office of Management and Budget during the Reagan Administration. From Stockman:

The real story of the present is the shadow banking system, the unstable and massive repo market, and the apparent daisy chain of hyper-rehypothecated collateral. It looks like the sound bite version amounts to the fact that the European banking system is on the leading edge of collapse for the whole system.

The scholarship underlying both the MF Global and shortage-of-collateral themes comes largely from International Monetary Fund senior economist Manmohan Singh, who has published several reports on rehypothecation, most recently in July 2010 and in November 2011.

Bloomberg London reporter John Glover mentioned Singh in a smart December 21 overview of repos and rehypothecation:

The chains of loaned securities being pledged and re-pledged in the so-called wholesale money markets are growing shorter, as collateral piles up at central banks where it can’t generate additional borrowing.

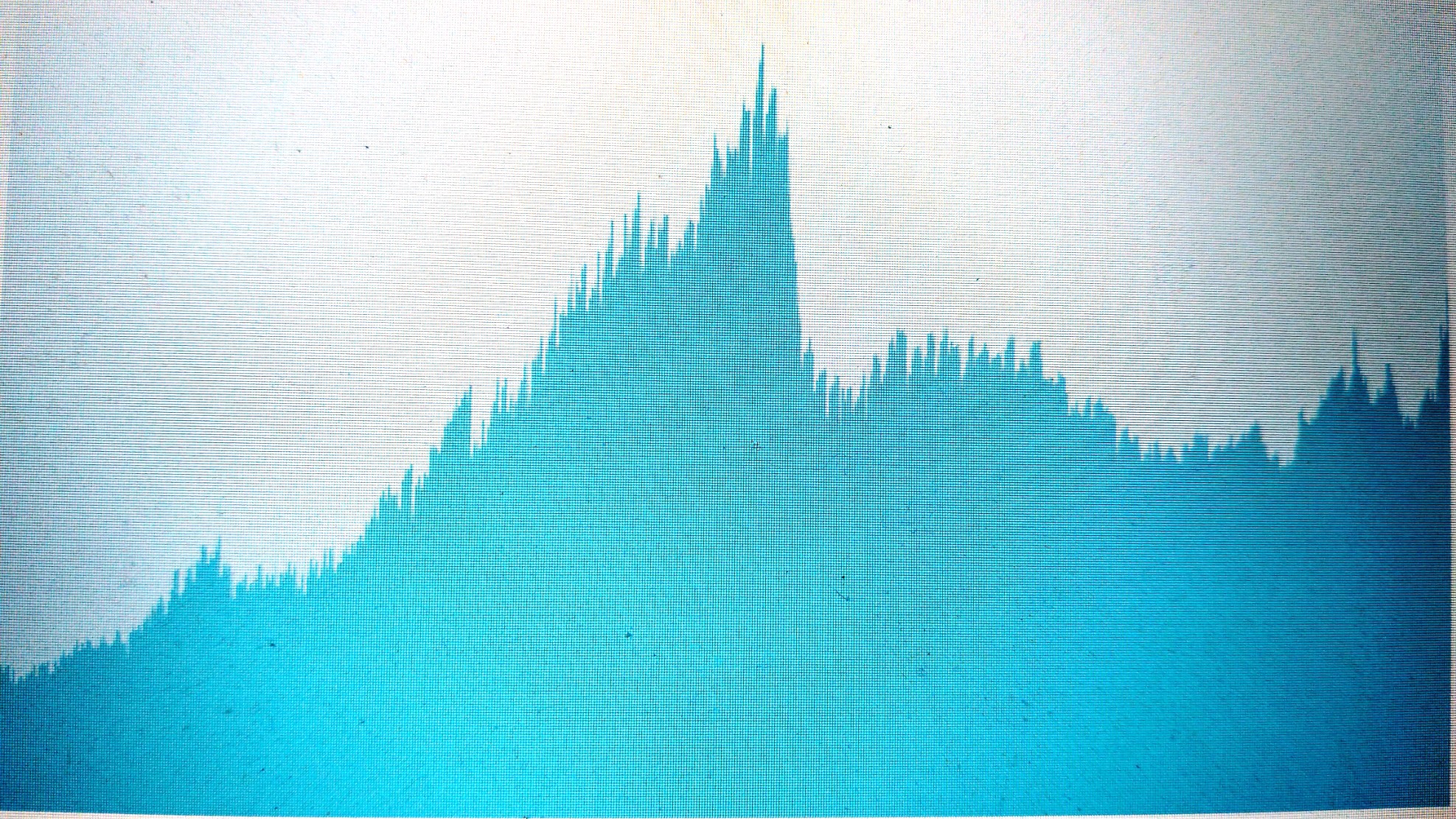

Rehypothecation is the financial alchemy that transmutes $2.45 trillion of assets into $5.8 trillion of collateral at the 14 largest securities dealers, down from a peak of $10 trillion in 2007, according to Manmohan Singh, senior financial economist at the International Monetary Fund in Washington. Once collateral is parked at the central bank, it can’t be recycled, and may become hard to find in times of need.

Then came a December 22 offering from reporters Marcus Baram and Catherine New at the Huffington Post, reverting to the MF Global theme:

The swift implosion of MF Global highlights a common practice used by aggressive speculators, one that experts say makes the broader financial system vulnerable to another crisis. It’s called rehypothecation, and it allows a firm to essentially pledge the same limited collateral to arrange fresh loans.

MF Global is believed to have used client funds as collateral to borrow money to make bets on the risky sovereign debt of Portugal, Spain and Italy, leading to a daisy chain of securitization, Thomson Reuters Business Law Currents reported. It’s akin to using a single home as collateral for several loans and then investing that money to earn dividends before payments are due on the loans.

While many of the rehypothecation reports focus on the dangers of the daisy chain, a December 21 Euromoney interview with Singh gave the IMF economist a chance to explain its value:

Q: What do you make of some recent commentary that has used your research to build a case against, among other things, repo, re-hypothecation and the shadow-banking system?

A. I don’t think that people are linking the big and small pictures.

Re-hypothecation is not a four-letter word. The financial system needs lubrication, and collateral chains help markets get completed. They connect the hedge fund with assets with someone who needs collateral. The question is do we need short or long chains? People can argue that financial stability improves with shorter chains, but if the chain is down to two counterparties, then there is a clear risk of liquidity drying up.

We have tracked a $5 trillion reduction in global source collateral and associated chains. These are big numbers. Monetary policy cannot be achieved in a vacuum and collateral chains cannot be ignored.

But Bloomberg reporter Glover reminded his readers of a different risk, the risk of a run on rehypothecated chains, as happened in the U.S. in 2008 when panicked repo lenders suddenly demanded more collateral or repayment and only government intervention prevented a devastating credit freeze:

The importance of secured lending in the interbank market has grown largely unnoticed in recent years, said Matt King, global head of credit strategy at Citigroup Inc. in London. Its size may make it a source of risk, since borrowers may struggle to find enough acceptable securities should lenders demand more security, he said.

“Risk has become channeled here in an increasing way in recent years, and we just don’t focus on it,” King said. “Everyone is just doing what is efficient under the rules but it’s built up to become a source of systemic risk.” There is “scope for runs on banks due to collateral suddenly becoming very scarce, as in Europe at present,” he said.

In fact, that run is already underway, as Fitch Ratings has repeatedly shown in its analysis of U.S. money market fund lending in Europe and as Glover reports:

Repo trading volumes in Europe are sliding, according to ICAP Plc (IAP), the largest interdealer broker and the owner of BrokerTec, the biggest platform for repo trading, where securities such as government bonds are loaned for a fee.

This is a stunning development for a market that was growing leaps and bounds in the first half of the year. This run is one of the key challenges facing the European Central Bank today.

On the face of it, rehypothecation may seem ridiculous. How can one piece of collateral secure several different loans?

But it’s not so far from what happens with each dollar that a depositor puts in a bank. The bank loans the dollar to a toy store owner, let’s say, who deposits it in his bank. That bank loans the dollar to a builder, who deposits it in his bank. And so on.

Here’s the point: That dollar benefitted the economy much more than if it had stayed in the first depositor’s pocket. In a similar way, securities that are rehypothecated benefit the economy much more than if they had stayed in the first repo borrower’s portfolio.

But here’s the risk: The deposit chain and the rephypothecation chain are both vulnerable to a run, which is what happens when many lenders (including depositors, who are lenders, after all) suddenly demand their money back at the same time. Borrowers who can’t comply can quickly become insolvent.

Technical notes on rehypothecation

-Repo lenders rehypothecate collateral with the permission of repo borrowers. Why would a repo borrower agree? Because the lender then charges the borrower less for the loan, or other services. (This assumes no fraud.)

-The original borrower in the chain gets his collateral back when he repays his loan, although many repo agreements let the borrower get equivalent securities, not exactly the same ones. During the life of the loan, the original borrower collects any interest paid by the collateral securities and owns any rise or fall in their value.

-Collateral typically comes from hedge funds, securities lenders and central banks like the Federal Reserve. Loans typically come from money market funds, S&P 500 companies, pension funds, mutual funds, wealthy individuals, endowments, insurance companies and central counterparty clearing houses, according to IMF economist Zoltan Pozsar.

-Global broker-dealers play key roles as lenders, borrowers, brokers, and clearing banks, especially Goldman Sachs, Morgan Stanley, JP Morgan, Bank of America/Merrill and Citibank in the U.S.; Deutsche Bank, UBS, Barclays, Credit Suisse, Societe General, BNP Paribas, HSBC, Royal Bank of Scotland and Nomura outside the U.S., according to Singh.

-Some reports have compared rehypothecation to several different people putting up the same house as collateral for loans, investing the loan proceeds, and using the investment earnings to make the payments on the loans. As long as they can all make their payments, no problem. But here’s an important difference: In a repothecation, each lender in the chain checks the value of the house every day, and if the house falls in value, the lenders can demand more houses or repayment, regardless of whether the borrowers are making timely loan payments.

-U.S. commercial and investment banks, broker-dealers, bank holding companies and others generally report repos on their balance sheets, albeit netted by counterparty which vastly understates the true volume. (Exceptions are when the borrower structures the transaction as a sale of the securities – such as MF Global’s repo-to-maturity transactions and Lehman Brothers’ Repo 105s – instead of like a collateralized loan.)

But much of repo rehypothecation slips off the balance sheet and into the notes, as Citigroup’s King described in his prescient September 5, 2008, report, “Are the brokers broken?” written 10 days before Lehman Brothers filed bankruptcy. King shows how to estimate the rehypothecation, but it takes work.

-IMF economist Singh says large U.S. dealers do much of their rehypothecation in the UK and Europe, where laws are more flexible than in the U.S. and where parties to a transaction have more leeway to set the terms of their particular contract. Critics complain that the flexibility makes it easier for a dealer to rip off clients. They offer MF Global and Lehman Brothers as examples.

In the U.S., rehypothecation is limited by the Securities and Exchange Commission’s Rule 15c3-3, which says lenders can only rehypothecate collateral worth 140 percent of their loan to the borrower. But 140 percent still allows for generous rehypothecation. Also, the 15c3-3 rule applies only to broker-dealers, it exempts some dealers, it has been expanded through amendments* and it leaves room for interpretation. This means there’s still incentive in the U.S. to rehypothecate.

-The U.S. tri-party repurchase market offers rehypothecation with other tri-party participants. Check out these enthusiastic reports from JP Morgan and Bank of New York, the clearing banks that sit between every tri-party borrower and lender and earn fees at every link in the chain.

-While many fixes have been proposed for repos and rehypothecation, few have been adopted. Instead, it’s mostly up to regulators and the parties themselves to keep an eye on things.

-Securities lending and derivatives trading are also being impacted by the shortage of collateral. Some analysts expect a serious crunch in the derivative markets, as new regulations push more derivative trades to go through central clearing houses and the clearing houses demand more collateral for their own protection.

The following passage is a rare example of a regulator suggesting specific rehypothecation reforms, from “Shadow banking – thoughts for a possible policy agenda,” a speech by Paul Tucker, Bank of England, April 27, 2012:

Securities dealers and the “rehypothecation” of client assets

Major issues arise from the use of client assets – money and securities – to finance the principal risk-taking of some financial firms. This has become apparent from the Lehman and MFG bankruptcies. Quietly in the background, something extraordinary has happened over the past decade or so. Let me explain.

You place £X of your securities portfolio with your broker/dealer in safekeeping (as a sub-custodian in a way). You borrow a much smaller amount of money from your broker and, reasonably enough, they take some of your securities as collateral; in effect, they have financed your holding of that part of your securities portfolio. An observer might think the rest of your portfolio would sit in a segregated client account. Not a bit of it. Unless you have been very careful, the broker/dealer has repoed out your securities for cash, and used the proceeds to finance its own businesses. To make this simpler, imagine you have placed surplus cash with your broker-dealer. As likely as not, it is being used to finance the dealer’s business.

Whether we are talking about your cash or your securities, if you can call them on demand and they are being used to finance your broker’s business, that used to be called ….. banking.

I suggest the following in this area:

-Only banks should be able to use client moneys and unencumbered assets to finance their own business to a material extent; and that should be a clear principal relationship. Legal form should come into line with economic substance.

-For non-banks, any client moneys and unencumbered assets should be segregated and should not be used to finance the business to a material extent. It should, however, remain permissible for non-banks to lend to such clients on a collateralised basis to finance their holdings of securities (‘margin lending’).

This is an area where regimes vary enormously around the world or are non-existent. For example, the US domestic regime is stricter on this than Europe. We need a global discussion.

MF Global was also a futures merchant

Because one of MF Global’s main businesses was to buy and sell futures contracts for clients, it fell under the Commodity Futures Trading Commission’s Regulation 1.25, which sets rules for preserving the principal and liquidity of clients’ funds.

This regulation, and amendments in the past decade, likely played a role in whatever happened at MF Global.

In 2000, as part of a comprehensive reform that included the Commodity Futures Modernization Act of 2000, the CFTC said brokers could invest the funds they held for their clients in an expanded range of instruments – including foreign sovereign debt, mortgage-backed securities and asset-backed commercial paper (ABCPaper), among others – and brokers could use those new investments as collateral for their own repurchase transactions, within guidelines.

Prior to 2000, brokers could only invest their clients’ funds in, and then repo, government-guaranteed securities.

(This change helped fuel demand for the newly approved instruments, which typically earned more than government-guaranteed securities. It also goosed the housing boom, escalated the churn of credit in the financial markets because brokers had more collateral to repo, and showed the interdependence of derivatives and repos.)

In 2004 the CFTC said brokers could repo certain customer collateral without the client’s prior written consent, unless the customer required it. Clients were presumed to know that brokers could repo their collateral.

In 2005 the CFTC said brokers could conduct in-house transactions with certain customer collateral, within guidelines. These in-house transactions “can provide the economic equivalent of repos,” the CFTC said.

But on December 5, 2011, a month after MF Global failed, the commission changed a number of rules, including some that have been implicated in the MF Global collapse: It said brokers can not invest clients’ assets in foreign sovereign debt, and it said brokers can not use clients’ assets as collateral for repurchase agreements with broker affiliates or for in-house transactions within the brokerage. It said repos with affiliates and in-house transactions concentrate credit risk and could pose conflicts of interest during a crisis. It changed CFTC Regulation 30.7 to say that customer funds invested in foreign futures and foreign options have to meet Regulation 1.25 standards. (The commission also eliminated investments in non-government-guaranteed mortgage-backed securities and ABCPaper, among others.)

The CFTC had first proposed the changes a year earlier, as Bloomberg columnist William Cohan discussed in a November 15, 2011, column.

(Update: This column has been updated with the April 27 speech by Paul Tucker and with following sentence, thanks to a heads-up from a reader: “It changed CFTC Regulation 30.7 to say that customer funds invested in foreign futures and foreign options have to meet Regulation 1.25 standards.”)

—–

*Securities lending: Securities lending, a smaller cousin to the repo market, is where asset managers lend securities, mainly stocks, in return for cash or other securities. Securities lenders are mostly hedge funds, exchange traded funds, sovereign wealth funds, central banks, pension funds, insurance companies, mutual funds and custodian banks, according to IMF economist Pozsar. Securities borrowers are mainly hedge funds, asset managers, option traders, and market makers, who borrow securities mostly for short selling but also to use as collateral for loans and for hedging derivatives, according to Federal Reserve economists. The securities and the cash used in securities lending can be rehypothecated.

*Rule 15c3-3 amendment: A 2003 amendment to SEC Rule 15c3-3 said broker-dealers who borrowed securities from their customers could use new kinds of collateral to secure the loan. Previously they’d had to put up cash, U.S. Treasury bills or notes, or irrevocable bank letters of credit. Under the new order, they could also put up mortgage-backed securities, foreign sovereign debt, and non-governmental debt securities (presumably including ABCPaper), among others.

This change boosted the demand for mortgage-backed securities, foreign sovereign debt and ABCPaper. It also escalated the churn of credit in the financial markets, as the securities lenders could rehypothecate the expanded supply of collateral.

The 2003 change was supported by Wall Street bankers like Boston-based State Street Bank, which sent the SEC a supportive letter. The State Street letter mentions in its footnote 13 that the change would help make U.S. dealers more competitive with their UK and EU peers who did not operate under 15c3-3 restrictions.

Did you see the Reuters Part 2 of the rehypo series? http://currents.westlawbusiness.com/Article.aspx?id=3ad720bf-7caf-4086-8464-53a6ef26ca5b&cid=&src=&sp= It has some interesting points on segregated customer accounts

Since the average investor probably hadn’t even heard of ‘re-hypothecation’ before the finanial crisis really got underway with Lehman’s demise (any more than he had heard of a ‘collateralised debt obligation’ or a ‘credit default swap’), once it is explained to him, he would be amazed to hear that the practise is actually permitted. As a former law student, it sounds what I always understood to be ‘fraudulent conversion’. A solicitor in the UK who did that with client funds would go to jail !