One of the failures of the Dodd-Frank Act was in not restructuring shadow banking, with a sturdy repo market at its heart, so it could safely gear back up to boost credit and help the economy thrive.

Today Americans are paying a price for that failure.

From financial blogger Tyler Durden:

If there is one threat above all to the monetary regime, primarily of the US but by extension, global, it is the ongoing collapse in shadow banking ….

The significance of this problem is stark when we consider the size of the market.

Economists led by Zoltan Pozsar have estimated that shadow banking in the U.S. peaked around $20-25 trillion in 2007 and fell to $15-$18 trillion at year-end 2010. RepoWatch calculates shadow banking lost almost another $1 trillion in 2011, using the same data.

By comparison, traditional banking was $11 trillion in 2007 and rose to $14 trillion in 2011, according to Pozsar and RepoWatch.

(Editor’s note: See ** below for an explanation of these numbers, links to sources, and other estimates.)

This means half the credit in the U.S. today is supplied by shadow banking, which has fallen by more than one-fourth since the financial crisis began in 2007. Meanwhile, traditional banking is slowly rising but not enough to offset the shadow loss. The Federal Reserve is trying to make up the difference.

Whether we like it or not, shadow banking matters.

From “When collateral is king” by Credit Suisse research analysts, March 15, 2012:

Shadow banking was not well understood before the crisis and still isn’t. It is a core part of the complex ecosystem of fund flows that is the financial foundation of modern global capitalism.

Well, yes. But shadow banking also was the epicenter of the financial crisis, and it took a serious blow. It’s not likely to recover until its lenders and regulators believe reform has made it safe … or until the lure of lucre overcomes their caution. Signs of risk are emerging. How much better if shadow banking were made reasonably safe first.

From “Shadow banking out of the shadows,” Financial Times editorial, April 10, 2012:

With wise policy, the usefulness of shadow banking activities can be greater than the threats.

(Editor’s note: This story discusses problems with shadow banking today. See “Shadow Banking, part 2” for proposed reforms. See “Shadow Banking, part 3” for proposed safety nets.)

What is shadow banking?

Shadow banking is a fuzzy contraption to most Americans, because they don’t know much about it. But it’s actually pretty easy to understand.

Shadow banking is where large financial institutions borrow, lend and speculate.

(Its name came from economist and PIMCO executive Paul McCulley during remarks at the Fed’s annual symposium in Jackson Hole, Wyoming, in August 2007, and it has since been widely adopted by economists.)

Where do large financial institutions get the money to do this?

A lot of it comes from you.

You used to keep most of your money at a traditional, FDIC-insured bank. Now you keep about half of your money in companies that do shadow banking, like money market funds, pension plans, and insurance companies.

You have a lot at stake in what happens to shadow banking.

To understand it better, let’s first ask: What is banking?

“Banking” is what a financial institution does when it borrows money on a short-term basis, like from a depositor, and then turns around and lends that money on a long-term basis, like for a 30-year mortgage.

You can see the danger, right? If the bank’s lenders, such as depositors, suddenly get scared and demand their money back – this is called a run on the bank – the bank can’t repay them because its money is tied up in the 30-year mortgages. Soon the depositors can force the bank into bankruptcy.

In traditional banking, depositors usually feel safe because they can withdraw their money at any time and because they have FDIC insurance. This protects a bank from runs by its depositors.

In shadow banking, financial institutions don’t get their money from depositors. They borrow it from Wall Street. Wall Street usually feels safe because it lends for very short periods, often overnight, and because it takes back highly rated securities like U.S. Treasuries and bonds as collateral.

But if Wall Street loses faith in the securities and it panics, it will demand its money back. That’s a lot like a run on a bank. That’s what happened in 2007 and 2008, when Wall Street lost faith in the mortgage-backed securities it had taken as collateral. That’s what is happening right now in Europe, as traders lose faith in securities sold by countries like Greece.

It could happen again in the U.S. at any time.

Many economists say shadow banking is still not stable. Some have warned the Federal Reserve to keep open the emergency programs it put in place during the crisis until this “critical issue” is addressed. Some say shadow banking must be shut down if it can not be protected from runs.

From “Shadow Banking Regulation” by Tobias Adrian and Adam B. Ashcraft, Federal Reserve Bank of New York, April 2012:

Despite significant efforts by lawmakers, regulators, and accountants, we find that progress in achieving a more stable shadow banking system has been uneven.

From “The Fall of the House of Credit” by Alistair Milne, Cambridge University Press, 2009:

In future we need either to wean banks off short-term funding or to provide protections that will maintain that funding even when the going gets tough.

The financial institutions that borrow, lend and speculate through shadow banking – in other words, the shadow bankers – are large traditional banks, investment banks, money market funds, hedge funds, mutual funds, university endowments, pension plans, insurance companies, municipalities, exchange traded funds, public and private companies, real estate investment trusts, private equity firms, asset management firms, sovereign wealth funds, securities dealers, securitizing firms, securities lenders, the giant bank holding companies that own many of these financial institutions, Fannie Mae and Freddie Mac, the Federal Home Loan Banks, the Federal Reserve and other central banks.

They’re anybody who has a big pool of money or securities and wants to lend it, or any financial institution that wants to borrow from the pool.

The purpose of shadow banking is to get those big pools of money down to the consumers and businesses who need it.

In five simplified steps, here’s how that works:

1. Make loans: A banking firm makes loans to businesses and consumers. This banking firm might be a traditional bank, a mortgage banker, an investment bank, a finance company, a credit card company, or others. These firms make many kinds of loans, including home loans, car loans, small business loans and student loans.

2. Make securities: The banking firm sells the loans to a securitizing firm. A securitizing firm has one purpose: Pool the loans and make securities backed by the loans. The interest on the loans flows through to whoever owns the security.

This process is called securitization. The securities are often called asset-backed securities. These include mortgage-backed securities. They’re a kind of bond. In more complicated form, the securities may be called collateralized debt obligations. CDOs were responsible for many of the losses in the financial crisis.

3. Sell securities: To make money, the securitizing firms sell the asset-backed securities and the CDOs to banks, companies, governments, universities, mutual funds and others. They also sell asset-backed commercial paper. Asset-backed commercial paper is a kind of short-term IOU that they agree to buy back in a few days.

If you hear that shadow banking is an off-balance-sheet dodge, one reason is because loans move from a banking firm to a securitizing firm. That happens in part because banking firms want to get rid of the loan risk, but also because buyers of the securities consider a securitizing firm to be safer than a banking firm. This is true even though securitizing firms are often offshore and might exist only on paper, with the actual work being done by the banking firm or by a business whose job it is to run securitizing firms.

Securitizing firms have become famous in the financial crisis lexicon. For example: Special purpose vehicle, special purpose entity, structured investment vehicle, variable interest entity, real estate investment trust, conduit, and trust. Or, more commonly, SPV, SPE, SIV, VIE, REIT, conduit, and trust.

4. Insure securities: Credit default swaps are derivatives that pay off when securities default. They’re like insurance. Owners of securities can buy credit default swaps for protection against default. This makes the securities seem safer. Companies that don’t own securities can buy or sell credit default swaps to speculate. Sometimes shadow banking firms both buy and sell credit default swaps with each other. This is a key reason that shadow banks are so interconnected.

Credit default swaps are another off-balance-sheet dodge, because banks do not have to report the value of their swaps in their financial statements. These swaps are the instruments that helped doom AIG. (RepoWatch editor’s note: Experts often do not include credit default swaps or derivatives as part of shadow banking, even though credit default swaps are key ingredients in many shadow banking transactions. The value of credit default swaps is not included in most estimates of the size of shadow banking.)

5. Keep some securities to repo and lend: Almost everyone in this chain – the buyers, sellers, borrowers, lenders and insurers – hold onto some of the asset-backed securities, collateralized debt obligations, and asset-backed commercial paper to use as collateral for short-term loans on the repurchase market or to lend for a few days on the securities lending market. (In the securities lending market, traders borrow securities mostly for short sales but also to use as collateral for loans and for derivative trades. AIG lost almost as much on securities lending as it did on credit default swaps.)

At this step, something surprising happens. The repo lender and the securities borrower – each lends cash and gets back securities – can re-use those securities as collateral to get repo loans for themselves. And the next cash lender, which gets the same securities as collateral, can re-use them again as collateral to get a repo loan for itself. And so on. This creates a daisy chain in which one set of securities gets re-used several times as collateral for several loans. This is called rehypothecation. It’s another key reason shadow bankers are so interconnected.

In another version of the chain, the party that gets the securities can use them as collateral to get a repo loan for itself. Then it can use the repo-loan money to buy more securities, which it can use as collateral to get another repo loan for itself. And so on. It’s a perpetual profit machine, as long as the loans are cheap, the securities are sound, and the repo lenders are happy.

There. That’s it.

That’s how shadow banking worked in the years leading up to the financial crisis. The five-step process helps to explain why credit flowed so freely in the U.S. and Europe.

Yes, shadow banking got vastly more complicated than this, and there could be 100 steps instead of five, but these were the basics:

-Make loans.

-Make securities.

-Sell securities.

-Insure securities.

-Keep some securities to repo and lend.

As you can see, shadow banking is all about the securities. In fact, Yale University professor Gary Gorton calls this market securitized banking, instead of shadow banking.

To review:

The main ways shadow banking gets money is (1) selling asset-backed securities and collateralized debt obligations, and (2) borrowing with asset-backed commercial paper, repurchase agreements and securities lending. All three types of borrowing are for very short periods, often overnight, and are therefore vulnerable to runs.

At the heart of this type of banking is the repurchase market, because it’s often the cheapest way for big borrowers to get quick money and the safest way for big financial institutions to lend. Before the crisis, when shadow bankers bought asset-backed securities, CDOs, asset-backed commercial paper or credit default swaps, they often paid for them by getting a repo loan.

Today some of the money held by shadow bank lenders is sitting in a vault or a bank someplace, going nowhere – in part because demand is weak, but also because the owners of the big pools of money were freaked out by losses on mortgage-backed securities, and now they won’t lend money unless the collateral is government securities.

This has slashed the demand for non-government securities, and the securitization process has withered.

Today shadow bankers are scurrying around, trying to find new collateral that lenders will accept, so they can start growing their businesses again. The future of shadow banking will depend a lot on the quality of that new collateral.

Note: Shadow banking isn’t shadowy because it’s unregulated. As you can see by the list of participants, most are regulated. Further, shadow banking activities are reported in financial statements to about the same extent that other financial activities are. Shadow banking is shadowier than traditional banking – which is plenty shadowy itself – because of the complexity of the five steps outlined above, because it’s banking without a government safety net, because key actions are handled by the odd securitizing firms (which are regulated by the SEC) and in derivative transactions, and because business reporters don’t write about it very much.

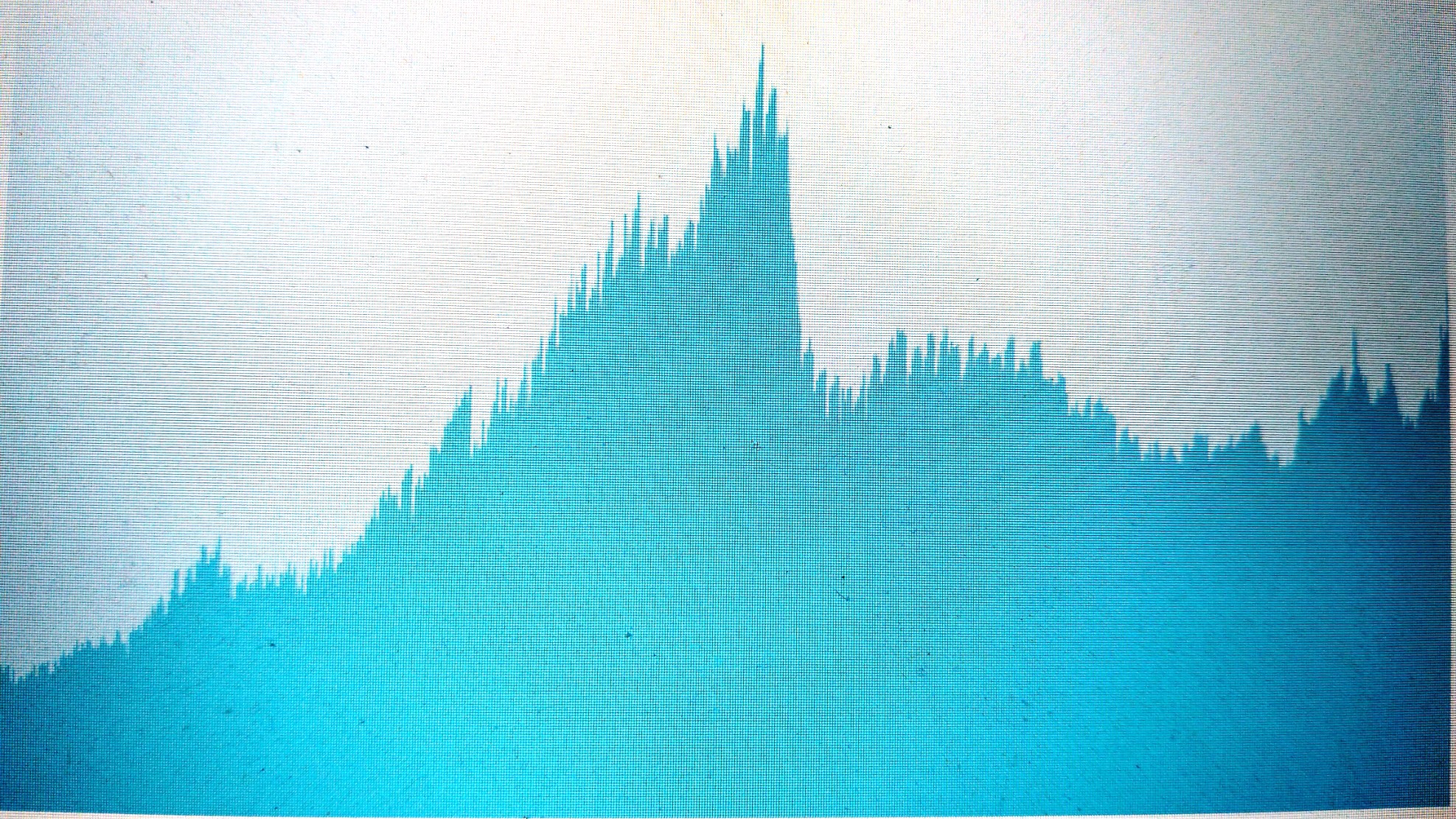

The collapse of securitization

The Securities Industry and Financial Markets Association has tracked the rise and fall of securitization. The collapse of the market is clear.

-Issuance of asset-backed securities, including those backed by loans for cars, credit cards, equipment, home equity lines of credit, manufactured houses and student loans:

-$281 billion in 2000

-$754 billion peak in 2006

-$125 billion in 2011. Only car securitizations are reviving.

-Issuance of commercial mortgage-backed securities:

-$44 billion in 2000

-$229 billion peak in 2007

-$34 billion in 2011

-Issuance of residential mortgage-backed securities without a taxpayer guarantee:

-$58 billion in 2000

-$740 billion peak in 2005

-$3 billion in 2011

-Taxpayers are taking up some of the slack. Here’s the issuance of mortgage-backed securities insured by government agencies like Fannie Mae and Freddie Mac:

-$558 billion in 2000

-$2,758 billion at the peak in 2003

-$1,616 billion in 2011

Following is an alphabetical list of the main types of loans that typically depended on securitization for funding, according to “Securitization” by Yale University professors Gorton and Andrew Metrick, November 17, 2011:

Aircraft leases, auto loans, auto leases, commercial real estate, computer leases, consumer loans, credit card receivables, equipment leases, equipment loans, franchise loans, healthcare receivables, health club receivables, home equity loans, insurance receivables, intellectual property cash flows, manufactured housing loans, mortgages (residential and commercial), motorcycle loans, music royalties, RV loans, small business loans, student loans, trade receivables, time share loans, tax liens, and viatical settlements .

From Gorton and Metrick:

The future of securitization is uncertain. Securitization was a very significant source of funding for mortgages and consumer finance and remains important. It was also an important source of collateral for repo and asset-backed commercial paper. The sheer size of the securitization market, and its decimation during the financial crisis, makes the future of this market a question to ponder.

Meanwhile, repos have fallen about 40 percent, from more than $4.6 trillion in daily lending in March 2008 to more than $2.8 trillion in March 2012, and the share of taxpayer-backed collateral like Treasuries has risen from 88 percent to 95 percent.

As for asset-backed commercial paper, which actually was a short-term loan collateralized by the asset-backed securities now in disgrace – it’s essentially dead. Issuance isn’t published, but amounts outstanding have fallen 72 percent, from $1.2 trillion in July 2007 to $334 billion in March 2012.

Gorton and Metrick have long argued that the fleeing of repo lenders, which began in June 2007 with the collapse of two Bear Stearns hedge funds, was the catalyst for the financial crisis that climaxed in late 2008 and early 2009.

More recently, three economists led by Arvind Krishnamurthy at Northwestern University have used different data to suggest that while the run on repo was devastating to the giant securities dealers like Bear Stearns and Lehman Brothers, and was the Federal Reserve’s key concern, the smaller flight of asset-backed commercial paper lenders actually did the most damage to securitization and shadow banking.

From Krishnamurthy, Stefan Nagel, and Dmitry Orlov in “Sizing Up Repo,” January 2012:

The contraction in both repo and asset-backed commercial paper are consistent with the views of many commentators that a contraction in the short-term debt of shadow banks played an important role in the collapse of the shadow banking sector. However, it is important to note that the ABCP plays a more important role than repo in this regard.

Either way, the same large shadow bankers, listed above, made most of these short-term loans, both repo and asset-backed commercial paper. Their run on shadow banking in 2007 and 2008 triggered the financial crisis. They are now keeping some of their money under their mattresses, or on deposit with their commercial bank.

From the “Outlook for the Securitization Market” by the Organisation for Economic Co-operation and Development, a global development group, May 5, 2011:

Investors were badly burnt by securitised assets during the global credit crisis, and the reputation of the entire asset class was tarnished. Capital flight and illiquidity infected the wider market for collateralised products. Investors are now burdened with more uncertainty regarding regulatory changes and increased due diligence requirements. In the current economic climate, investors have again become risk-averse, and continue to be burdened by legacy structured product that remains on their balance sheets.

Banks have traditionally been the key investor in securitisation markets but are now facing the need to rebuild capital, reduce leverage, and change the mix of assets they have available to meet regulatory liquidity demands. It has been estimated by some market participants that around half of the pre-crisis investor base had disappeared, including bank-sponsored SIV, CDO and ABCP conduits that were responsible for fuelling demand for securitised products at the height of the boom. It also remains uncertain as to which part of the investor community will be capable of filling this void.

To some observers, this is a return to sanity.

From “The Liquidity Crisis Story” by Arnold Kling, adjunct scholar with the Cato Institute, April 11 2012:

In my view, the scale of financial intermediation before the crisis was excessive, perhaps by an order of magnitude, and even today I worry that financial-sector balance sheets and profits are bloated relative to the real economy.

If shadow banking doesn’t revive, that’s just fine, critics say. People will still be able to borrow money. For example, subprime borrowers could revert to getting their credit from private finance companies, as was the case before the securitized banking boom.

From “Subprime is Back, Baby! Never Mind…” by Paul Muolo, Origination News, April 11, 2012:

I continue to believe that there is a dire need in this country for nonbank subprime lenders that operated similar to the way Aames Financial, Associates First Capital Corp., and The Money Store ran their businesses in the 1960s and 1970s. These were private firms that made home equity loans, held the paper in portfolio, and made certain they knew their customers. Don’t get me wrong. These firms were not exactly boy scouts when it came to some of their lending practices, but at least they were willing to extend loans to consumers with damaged credit. Their delinquencies were low – as was their market share but they provided a valuable service and made a decent living. When might we see that again?

Adair Turner, chairman of the Financial Services Authority, which is the UK’s financial services regulator, thinks there may be more value in securitization than in shadow banking, but he has doubts about both.

From “Securitisation, shadow banking and the value of financial innovation,” a speech April 19, 2012:

There is, for instance, no macro-level evidence that the simpler credit intermediation system of the 1940s to 70s held back growth, which was faster across most of the developed world over those 30 years than over the subsequent 30. And other countries, such as Germany, have grown prosperity as fast as the U.S. without such extensive credit creation. Overall, therefore, the case for the positive impact of “securitisation” remains tentative …

Shadow banking, on the other hand, has been a negative, said Turner.

The development of shadow banking entailed large scale and multifaceted financial innovation, pursued with great energy by highly skilled and highly paid people, which has had a severely adverse social welfare effect – producing first an unsustainable credit boom, and then a recession, negative equity and unemployment. …

It is difficult to think of any wave of innovations in any other sector of the economy, about which we would be likely to reach such a negative judgement.

Others believe securitization is useful. From “EBA’s Enria: Securitization By Itself Is Not Necessarily Bad” by Anusha Shrivastava, Dow Jones Newswires, April 11 2012:

The process of bundling loans into bonds and selling to investors is not a bad one, said a European banking regulator on Wednesday.

“Securitization by itself is not necessarily a bad thing,” said Andrea Enria, head of the European Banking Authority, answering audience questions at a conference on Debt, Deficits and Financial Instability organized by the Levy Economics Institute in New York.

If the bank loans were of good quality, there is no harm in securitizing them, he said.

Securitization helps provide access to capital markets to those who may not otherwise have had it, Enria said.

Just this year, news reports have started to note some growth in certain securitizations.

For example, reporter Al Yoon at Dow Jones Newswires noted slight optimism for commercial mortgage-backed securities at JP Morgan Chase and Deutsche Bank. Reporter Shanny Basar with Financial News reported that U.S. asset-backed securities “are limping back to life, driven largely by car loans.” Reuters reporters Aileen Wang and Kevin Yao found modestly growing support for securitization in China. Financial Times reporter Nicole Bullock saw real action:

The market for securitised loans in the US is off to its fastest start this year since the financial crisis, driven by a jump in car sales on the back of an improving economy.

Asset-backed securities sold in the US backed by pools of car-related, credit card, student and other loans have already topped $20bn in 2012, according to Dealogic, the data tracker, the highest year-to-date amount since 2008 and a 23 per cent increase from the same period last year.

The Organisation for Economic Co-operation and Development expects securitization to come back in full some day:

It seems likely that in the long run, structured-finance securitisation will once again become an important channel for debt markets ..

This would be bullish for shadow banking, because it needs the securities to use as collateral for repo loans, asset-backed commercial paper, securities lending, and many derivative transactions.

The need for new collateral

Credit Suisse research analysts argued in a March 15, 2012, report that collateral plays a critical role in the economy:

• Liquid collateral is the lifeblood of the modern economy.

• Liquid and safe collateral is the main form of money for large firms, asset managers, and financial institutions. Unsecured bank deposits can never play that role.

• A globalized/globalizing economy has large liquidity needs, which can only be met by a collateral-based financial system.

• The efficiency advantages of a collateral-based financial system include its adaptability and reduced need for costly relationship-based lending.

Collateral also causes booms and busts, the analysts said:

• But as in any credit system, including one with conventional deposit-taking banks, the velocity of money and collateral, as well as the cost and availability of credit, tends to be pro-cyclical.

• High levels of economic activity tend to make all forms of collateral (including housing financed by conventional mortgages) more liquid, and foster over optimistic expectations about future returns, leading to asset price bubbles.

• And vice versa. When a credit bubble bursts, money-like collateral shrinks, haircuts (margins) rise, and loan-to-value ratios fall. After major shocks such as 2008-2009 and the 2011 euro crisis the velocity of money and collateral falls steeply.

(See the Financial Times’ take on the Credit Suisse report, “When safe assets return,” by Cardiff Garcia, April 5.)

International Monetary Fund economist Laura Valderrama also noted the importance of collateral in “Macroprudential Regulation under Repo Funding,” September 2010:

The use of collateral has become one of the most widespread risk mitigation Techniques in global financial markets. Central banks require collateral in most of their refinancing operations. Banking regulation fosters the use of collateral as an instrument to reduce capital requirements. Financial institutions extensively employ collateral in lending transactions, including reverse repos and securities lending programs. Securities lending programs provide yield to their beneficial owners, including central banks and institutional investors, by reinvesting the collateralized cash in the repo market. These practices have contributed to turn the repo market into the largest financial market today.

But Valderrama noted some of the hazards, as well:

While it brings stabilizing effects to the individual lender we argue that it may exacerbate systemic risk through margin call activation. We show how a liquidity shock to the cash lender may propagate as a solvency shock via liquidity hoarding even if the cash lender remains solvent in all states of nature. Albeit a cost-effective response of the cash lender to a liquidity shock, liquidity hoarding may lead to the bankruptcy of its repo counterparties triggering contagion across asset classes.

Financial markets have always relied on collateral. In the U.S., the economy appears to need one-third of its assets to be “safe” assets that can be used as dependable collateral, according to a survey by Yale professors Gorton, Metrick and Stefan Lewellen. The economists analyzed 60 years of assets in the U.S. economy, 1952-2012, and reported the results in “The safe-asset share,” January 17, 2012.

Assets that have traditionally been considered safe, according to the economists, are bank deposits, money market fund shares, commercial paper, federal funds, repurchase agreements, short-term interbank loans, U.S. Treasuries, agency debt, municipal bonds, asset-backed securities, and high-grade financial-sector corporate debt. The last five categories have often been used as collateral in repo transactions and in the asset-backed commercial paper market, the economists report.

In a best-case scenario, these assets actually will be safe. But if enough truly safe assets can’t be found, then what? Subprime loans?

Today the supply of safe collateral has been reduced by the fall of securitization, by governments reducing their debt, by some European government debt becoming risky, and in other ways. For example, the Dodd-Frank Act, which was Congress’ response to the financial crisis, moves many derivatives to central clearing houses, which will require traders to post more collateral. Also, central banks are buying up securities, both for their own investments and to funnel cash to banks to keep them from failing and to encourage them to lend.

Another reason for the shortage of quality collateral is that the collateral reuse chains, or rehypothecation, have shortened quite a bit, according to International Monetary Fund economist Manmohan Singh in “Velocity of pledged collateral,” November 2011. This makes financial markets more stable but less productive for the economy, said Singh.

From “Money and Collateral ” by Singh and Peter Stella, International Monetary Fund, April 2012:

Regulators may take solace from the fact that lower leverage and shorter collateral chains lessen financial stability risks. However, from a monetary policy perspective, the global financial market transmission mechanism is currently in the midst of an episode of grinding gears. The reduced availability of collateral and shorter “collateral chains”—resulting from constrained collateral trading— lower global financial lubrication and increase the overall cost of capital to the real economy.

From Financial Times reporter Cardiff Garcia, “The decline of ‘safe’ assets,” December 5, 2012, where he discusses a chart from the Credit Suisse 2012 Global Outlook:

It shows how the world’s outstanding stock of safe haven assets denominated in either dollars or euros has evolved, adjusted to account for the Fed’s purchases of US Treasuries and other assets in recent years as part of quantitative easing. You can see just how impressive the decline has been since 2007 ….

From Financial Times reporter Izabella Kaminska, “Shadow banking and the seven collateral miners,” December 9, 2011:

In the words of Goldman Doc, Morgan Grumpy, JP Happy, Bank of Sleepy, Barclays Bashful, Sneezy Citi, and Dopey Deutsche:

We dig dig dig dig dig dig dig from early morn till night

We dig dig dig dig dig dig dig up everything in sight

We dig up diamonds by the score

A thousand rubies, sometimes more

But we don’t know what we dig ‘em for

We dig dig dig a-dig dig.Collateral mining: one of the most overlooked and least understood bank funding sources in the financial system.

From “Institutional Cash Pools and the Triffin Dilemma of the U.S. Banking System” by Zoltan Pozsar, International Monetary Fund, August 2011:

Just as in the 1960s there were too many dollars relative to U.S. gold reserves, today there is too much demand for safe, short-term and liquid instruments relative to the volume of (i) short-term, government guaranteed instruments; (ii) high-quality collateral to “manufacture” alternatives to short-term, government guaranteed instruments; and (iii) capital to support the safety, short maturity and liquidity of such alternatives.

In the shortgage, some see opportunity.

Reuters reports that large banks like JP Morgan, Bank of New York and State Street, which hold huge portfolios of securities for clients, are making a bundle for themselves and their clients by lending those securities.

Financial providers Clearstream and Accenture published a study of 16 global banks in September 2011 that said the financial sector could save €4 billion a year by more efficient allocation of collateral among repo, securities lending, derivative and central bank transactions. A number of companies are selling efficiency services to help – 4sight Financial Software and SunGard are examples. Clearstream and Accenture estimated the total value of cash and securities used as collateral in the financial system globally at more than €12 trillion.

The risk of new collateral

As long as safe collateral is scarce, multiple observers worry about the quality of collateral that will worm its way into the financial markets.

(Editor’s note: See “Shadow Banking, part 3” for proposals to keep shadow banking supplied with safe, stable collateral.)

From The Economist, “Safety First,” February 25, 2012:

This collateral squeeze is fuelling all sorts of innovation. One which has already attracted the attention of regulators is the “liquidity swap”, whereby holders of liquid assets, such as insurers and pension funds with government bonds, lend them to banks to use as collateral in their secured funding. In return, banks lend them less liquid assets and pay a fee. Such deals are not entirely new but there are concerns that they could quickly grow in scale, binding the insurance and banking sectors more closely together. Britain’s Financial Services Authority issued some disapproving guidance about the practice last summer and has reportedly blocked a number of planned swaps since.

If one path is blocked, bankers will try to find others. Christopher Georgiou of Ashurst, a law firm, says that banks are creating guaranteed repackaging structures in which assets are pledged as collateral and guaranteed by the bank.

American regulators are also tracking attempts to launch a new type of funding instrument called “collateralised commercial paper”, which some think has the potential to replace asset-backed commercial paper as a big source of financing. It works by giving investors a claim over collateral used in certain repo agreements without breaching new rules that prevent money-market funds from investing directly in such repo transactions themselves. The market has not yet caught fire, but supervisors are struck by how quickly the industry has started innovating in this area. “I am amazed that these things were developed before the rules were even in place,” says one.

See the Financial Times’ take on liquidity swaps and other structured repos, “Europe’s banks strike funding deals,” by Tracy Alloway and Izabella Kaminska, November 23, 2011.

From “Collateralized Commercial Paper: A New Breed or ABCP 2.0? ” by Capital Advisors Group, May 1, 2011:

Collateralized commercial paper (CCP) made its debut last November to institutional cash investors. This new structure allows investors to purchase commercial paper from entities conducting term repos with broker-dealers. … We think the structure of CCP differs from multi-seller ABCP programs and more closely resembles repo-backed conduits. We advise investors to look to the issuer’s standalone credit, quality and terms of the asset collateral, legal and operational considerations and regulatory uncertainty before investing in specific CCP issues.

(Thanks to iMoneyNet’s Money Market Insight. )

From the Financial Times’ Kaminska, “Go directly to the ECB, do not pass Go, do not collect €200,” January 24, 2012:

Given the extent of the banking system’s exposure to contracted rehypothecation chains, is it any wonder then that some institutions are beginning to seek out alternative forms of collateral, like equities and even less-liquid ABS, just to keep those chains going?

Which makes us wonder if the next phase of the collateral shift might be a return to the use of CDO tranches (though this time correctly priced, of course).

Oh the irony.

It could happen. Check out “Banks test ‘CDOs’ for trade finance” by Patrick Jenkins and Brooke Masters, Financial Times, April 8, 2012:

Some of the world’s biggest banks are trying to extend the principles of securitisation to the plain-vanilla world of trade finance – a market worth an estimated $10tn a year – as concern mounts that regulatory changes could constrain a key lubricant of the global economy.

JPMorgan is among several banks that have begun testing investor appetite for the trade finance equivalent of collateralised debt obligations – the derivative products blamed for compounding the financial crisis – in an attempt to boost lending capacity.

From reporter Anna Reitman at the Securities Lending Times, “US plan sponsors look to alternative repo – Finadium,” January 23, 2012:

US plan sponsors are starting to look closer at alternative repo products as a solution to the challenges they face in securities lending and collateral management programmes, according to the latest Finadium survey.

One of the key findings of the survey is that repo for equities and illiquid assets as well as term repo are slowly gaining in popularity as a way to incrementally increase collateral returns, though they are viewed as riskier.

“In the past few years, there has been a well-known pendulum swing away from using collateral to reach for increased returns towards much more conservative collateral investment choices which limit the level of return…what we are seeing now is more plan sponsors saying they will look at equity or illiquid ABS repos,” said Josh Galper, managing principal at Finadium and author of the report.

From Fitch Ratings, which reported February 3, 2012, in “Repo emerges from the ‘shadow‘” that the prime money market funds it covers have increased their acceptance of distressed structured securities as collateral for repo loans, apparently seeking higher returns. This includes Alt-A and subprime residential mortgage-backed securities and collateralized debt obligations issued by Countrywide, Bank of America and the Royal Bank of Scotland.

Structured finance collateral disappeared completely from the sample in mid-2009. After gradually regaining acceptance in the latter half of 2009, structured finance again represents 20% of the collateral pool as of end-August 2011, a reversion to pre-crisis levels …

Based on Fitch’s sample, repos backed by structured finance collateral yielded more than 50 basis points on average as of end-August 2011. Repos backed by Treasurys, by contrast, yielded roughly 5 basis points, and agencies roughly 15 basis points.

From “Investors place big bets on Buy Here Pay Here used-car dealers,” by Los Angeles Times reporter Ken Bensinger, November 1, 2011:

Private equity firms are investing in chains of used-car lots, and auto loans are being packaged into securities much like subprime mortgages. They’re attracted by the industry’s average profit of 38 percent for each car sold.

A recent report by the International Monetary Fund summarized the situation.

From “Safe assets: Financial System Cornerstone?” International Monetary Fund Global Financial Stability Report, Chapter 3, April 2012:

Safe assets have varied functions in global financial markets, including as a reliable store of value, collateral in repurchase and derivatives markets, key instruments in fulfilling prudential requirements, and pricing benchmarks.

… heightened uncertainty, regulatory reforms, and crisis-related responses by central banks are driving up demand. On the supply side, the number of sovereigns whose debt is considered safe has fallen, which could remove some $9 trillion from the supply of safe assets by 2016, or roughly 16 percent of the projected total. Private sector production of safe assets has also declined as poor securitization in the United States has tainted these securities, while some new regulations may impair the ease with which the private sector can produce safe assets. …

The shrinking set of assets perceived as safe, now limited to mostly high-quality sovereign debt, coupled with growing demand, can have negative implications for global financial stability. It will increase the price of safety and compel investors to move down the safety scale as they scramble to obtain scarce assets …

_____

Further reading

RepoWatch recommends the following more detailed reports on shadow banking:

“Shadow Banking Regulation” by Tobias Adrian and Adam B. Ashcraft, Federal Reserve Bank of New York, April 2012.

“Securities Lending and Repos: Market Overview and Financial Stability Issues” by the Financial Stability Board Workstream, Interim Report, April 27, 2012.

(Update) The Deloitte Shadow Banking Index, “Shedding light on banking’s shadows,” Deloitte Center for Financial Services, by John Kocjan, Don Ogilvie, Adam Schneider, and Val Srinivas, May 29, 2012. See press release for summary of this report.

Further reports

See below for more reports on collateral, repos, securitization, and shadow banking. Items are arranged chronologically, within topics that are listed alphabetically.

Collateral

“Safety Second (Wonkish)” by Paul Krugman, The New York Times, April 12, 2012:

The “safe asset shortage” meme has been gathering force lately, and is now the theme of a report from the IMF. The idea is that low long-term interest rates for the United States, the UK, and basically every country with its own currency that doesn’t have large foreign-currency debts reflect the desperate search of investors for something safe to buy.

So, can I express some skepticism? I don’t think this is wrong, exactly, but I suspect that the search for safety is a distinctly secondary factor here. Surely the main point is that the major economies seem likely to remain depressed for a long time, and that as a result short-term interest rates are likely to stay low for a long time too — which means that long rates, which largely reflect expected short rates, are low right now.

“The Cyclical Dimension of the Safe Asset Problem” by David Beckworth, Macro and Other Market Musings blog, February 2, 2012:

An important problem facing the global economy is the shortage of safe assets, assets that facilitate transactions at both the retail and institutional level.

“Beyond the Zero Bound: Why Treasurys Can Go Negative” by John Carney, CNBC.com, February 1, 2012:

The news that the U.S. Treasury is considering issuing bonds that pay negative interest at maturity is a bit perplexing. Why would anyone want to pay to lend money to the government? …

If the repo rate goes lower than zero, it becomes possible for the underlying bond to also go lower than zero. A market participant who believed that interest rates would remain low for an extended period of time — and therefore the settlement problems of those shorting the bond would continue — would be willing to pay to lend to the government, so long as it was paying less than cash lenders in the repo market.

Eventually, the prices on the repo and the bond should come close to converging.

This isn’t a situation you would expect to last for very long. But it certainly could happen.

The possibility of collateral-driven negative rates may help us understand why we might see some very strange things in the bond market this year.

“The Role of Safe Assets in a Financial System” by Timothy Taylor, Conversable Economist blog, January 18, 2012:

This story of how safe assets relate to the financial system and to the possibility of crisis is still being fleshed out. But to misquote Gertrude Stein, “There is a there there.”

“The Nonbank-Bank Nexus and the Shadow Banking System” by Zoltan Pozsar and Manmohan Singh, International Monetary Fund, December 2011:

The shadow banking system is collateral-intense. … The richest deposits of collateral reside with asset managers, which include hedge funds, exchange traded funds, sovereign wealth funds, central banks, pension funds, insurance companies and mutual funds. The means through which collateral is “mined” from these deposits include the borrowing of securities from asset managers, reverse repos, customer margin loans, and margins stemming from in-the-money OTC derivatives contracts. ..

In this context, asset managers serve as a lot more than just an agglomeration of passive investment vehicles that intermediate households’ long-term savings into long-term investments. Just as households are the ultimate creditors in the economy, asset managers should be thought of as ultimate sources of collateral—or source collateral mines—for the shadow banking system.

“Repurchase Agreements with Negative Interest Rates” by Michael J. Fleming and Kenneth D. Garbade, Federal Reserve Bank of New York, April 2004:

Contrary to popular belief, interest rates can drop below zero. From early August to mid-November of 2003, negative rates occurred on certain U.S. Treasury security repurchase agreements. An examination of the market conditions behind this development reveals why market participants are sometimes willing to pay interest on money lent.

… a lender may be willing to pay interest if the securities offered as collateral on a loan allow it to meet a delivery obligation.

Repos

“NYSE Liffe to launch new repo future market” by Telis Demos, Financial Times, April 10, 2012:

NYSE Liffe US (the New York based futures trading arm of NYSE Euronext) will launch its new repo futures in July, bringing to market a product that the group believes can supplant the troubled existing benchmarks for short-term lending….

Thomas Callahan, chief executive of NYSE Liffe US, said at an investor meeting earlier this month that the product had “massive potential for 2012 and 2013”.

“The two things that market participants would usually look at in terms of a short-term benchmark, fed funds and Libor, are both in their own way broken right now,” he said. “The market needs a new benchmark and we think that this could be it.”

Reuters’ London reporter Douwe Miedema, January 9, 2012: Corporations are also becoming repo lenders, apparently deciding they’d rather make a repo loan to a bank than make a deposit with the same bank.

Europe’s banks are struggling to secure the cash to fund their day-to-day business and have largely stopped lending to each other for fear Europe’s sovereign debt crisis could land any of their peers in trouble.

As a result a group of well-known, cash-rich companies with solid cash flows has stepped in the repo market, which provides a form of lending so far almost exclusively in use between banks, and between banks and central banks….

“Companies in the past were … happy to deposit cash on an unsecured basis to a bank for an interest payment,” said Frank Reiss, who oversees some of the repo business at Euroclear, the Brussels-based settlement house owned by a group of banks.

“Now following the crisis, we have seen that companies are engaging in repos secured with collateral against the cash they are lending,” said Reiss. Euroclear is the largest administrator of repo trades in Europe.

Reuters’ London reporters Miedema, January 9, 2012, and Luke Jeffs, January 10, 2012: This means new business for the banks and clearinghouses that act as middlemen in many of these transactions. From Miedema:

The rise in repos means more business for companies such as Euroclear and its main rival Clearstream — owned by Deutsche Boerse — as well as Bank of New York Mellon, JP Morgan and State Street….

When companies rather than banks engage in repo deals they typically rely on a third party for administering the collateral, in what are known as triparty repos.

The triparty market grew at 22.3 percent in the first half of last year, a survey by the International Capital Market Association (ICMA) showed, versus only a modest rise in the overall business, further prove that companies are increasingly accessing the market.

Crane Data, January 5, 2012: Taxable money market funds held more repos in November 2011 than any other investment, according to the Investment Company Institute.

The Investment Company Institute’s latest “Month-End Portfolio Holdings of Taxable Money Market Funds data series shows that Repurchase Agreements (or Repo) fortified their position as the largest holding among money market mutual funds while Treasury securities surpassed Certificates of Deposit (CDs) to become the second largest segment in November. Repo holdings now account for $539.7 billion, or 22.8%, of the $2.369 trillion in Taxable money fund assets tracked by ICI; repo grew by $34.5 billion, or 6.8%, in November.

Securitization

“The Case of Asset-Backed Commercial Paper During the Financial Crisis of 2007-09” by Viral V. Acharya and and Philipp Schnabl, April 5, 2012:

We show that both banks located in surplus countries and banks located in deficit countries manufactured riskless assets of $1.2 trillion by selling short-term ABCP to risk-averse investors, predominantly U.S. money market funds, and investing the proceeds primarily in long-term U.S. assets. As negative information about U.S. assets became apparent in August 2007, banks in both surplus and deficit countries experienced difficulties in rolling over ABCP and as a result suffered significant losses. We conclude that global banking flows, rather than global imbalances, determined the geography of the financial crisis.

“Investors Speak Out on Ratings Transparency” by Nora Colomer, National Mortgage News, October 24, 2011:

Reinstating trust in the ratings process is key to growing investor interest, according to buyside participants in a panel at an asset-backed securities conference in Miami last week….

“It’s important to remember that securitized products are only a small part of the investment universe; there are people who could just ignore it completely,” John Kerschner, head of securitized products at Janus Capital, said. “The level of distrust in securitization products is very high and the burden is on us as an industry to get people outside this room comfortable with what we are doing.”

“Liquidity management of U.S. global banks: Internal capital markets in the great recession” by Nicola Cetorelli and Linda S. Goldberg, August 2011:

… we posit that the initial shock that hit banks in the United States was proportional to their ex ante reliance on ABCP conduits.

Shadow banking

From a speech by Federal Reserve Chairman Ben S. Bernanke, “Fostering Financial Stability,” at the 2012 Federal Reserve Bank of Atlanta Financial Markets Conference in Stone Mountain, Georgia, April 9, 2012:

As an illustration of shadow banking at work, consider how an automobile loan can be made and funded outside of the banking system. The loan could be originated by a finance company that pools it with other loans in a securitization vehicle. An investment bank might sell tranches of the securitization to investors. The lower-risk tranches could be purchased by an asset-backed commercial paper (ABCP) conduit that, in turn, funds itself by issuing commercial paper that is purchased by money market funds. Alternatively, the lower-risk tranches of loan securitizations might be purchased by securities dealers that fund the positions through collateralized borrowing using repurchase (repo) agreements, with money market funds and institutional investors serving as lenders.

From “New threat emerges from the shadows” by Patrick Jenkins, Tom Braithwaite and Brooke Masters, Financial Times, April 9, 2012:

“One of the many unintended consequences of the brutal regulatory crackdown on banks is that there is now a massive incentive to be a shadow bank,” says the chief executive of a big European bank. …

Yet the resurgence of non-bank financial groups is constrained by difficult markets. “We have created the conditions which allow the rise of the shadow banking system,” says Vikram Pandit, chief executive of Citigroup. “Some is already happening. Some of it takes time because shadow banking needs funding. The fact is if you get to a normalised market then it’s going to grow quickly.”

** Shadow banking, size

The estimates of the size of shadow banking made by Zoltan Pozsar with other economists appear in two reports: “Shadow Banking” in February 2012 and “The Nonbank-Bank Nexus and the Shadow Banking System” in December 2011. Here’s how the “Shadow Banking” report calculates the size of the market, using the Level Tables from the Fed’s monthly Flow of Funds reports:

-Liabilities for traditional banking are the Total Liabilities of Commercial Banking reported in line 19 of Table L109, which includes U.S.-chartered commercial banks, foreign banking offices in U.S., bank holding companies, and banks in U.S.-affiliated areas. (RepoWatch note: For 2011, you must add the Total Liabilities for the four categories yourself, from Tables L110, L111, L112, L113.)

-Liabilities for shadow banking are the sum of Open Market Paper from line 1 of Table L208, Net Securities Lending from line 20 of Table L130, Government-Sponsored Enterprises Total Liabilities from line 21 of Table L124 (RepoWatch note: For 2011, use line 25), Government-Sponsored Enterprises Total Pool Securities from line 6 of Table L125, Total Liabilities of Asset-backed Securities issuers from line 11 of Table L126, and Total Shares Outstanding of Money Market Mutual Funds from line 13 of Table L121. Also add Overnight Repo reported weekly by the Primary Dealers. Note: this calculation does not include credit default swaps.

The “Nonbank-Bank Nexus” report adds re-use of collateral and concludes:

Banks receive funding through the re-use of pledged collateral ‘mined’ from asset managers. Accounting for this, the size of the shadow banking system in the U.S. may be up to $25 trillion at year-end 2007 and $18 trillion at year-end 2010, higher than earlier estimates.

See Box 3 of “The Nonbank-Bank Nexus” for an explanation of how the Flow of Funds data fails to capture all shadow bank activity.

Other estimates of the size of shadow banking:

From “When Collateral is King” by Credit Suisse analysts, March 15, 2012:

Private shadow money was growing better than 15% p.a. in the several years before 2007, but it peaked at $8.9 trillion in Q4 2007 and plummeted to $6.1 trillion only a year later. It began to recover in late 2009 as haircuts improved and some debt issuance resumed. It reached $9.1 trillion in Q3 2010 but has contracted slightly since then. …

Public shadow money grew from $11.2 trillion to $13.5 trillion in the three years before the recession, but then began to grow very sharply, reaching $19.3 trillion recently.

From “Shadow Banking: Strengthening Oversight and Regulation” by the Financial Stability Board, October 27, 2011:

Aggregating Flow of Funds data from six jurisdictions (Australia, Canada, Japan, Korea, UK and US) and the publicly-available euro area data from the European Central Bank (ECB), assets in the shadow banking system in a broad sense (or non-bank credit intermediaries, as broadly proxied by “other financial intermediaries” in Annex 1) grew rapidly before the crisis, rising from $27 trillion in 2002 to $60 trillion in 2007.The total declined slightly to $56 trillion in 2008 but recovered to $60 trillion in 2010 (Exhibit 1-1). …

The US has the largest shadow banking system, with assets of $25 trillion in 2007 and $24 trillion in 2010 on this proxy measure. However, its share of the total for the eleven jurisdictions listed has declined recently to 46% from 54% in 2005 (Exhibit 1-6 and 1-7). …

Among the non-bank credit intermediaries, investment funds other than money market funds seem to constitute the largest share, totalling 32% in 2010 (Exhibit 1-10 and 1-11). Structured finance vehicles form the second largest component,constituting 9% of the total (Exhibit 1-10 and 1-11)