The big news about the repurchase market in 2015 was that it made the news.

After decades when the largest financial market in the world rarely appeared in public, in 2015 repos finally hit the big time.

At least 140 press and public reports on the repurchase market appeared last year, according to a RepoWatch survey (see story list below).

This important trend makes it less likely that risk can build unseen on that market as it did in the 2000’s. With Federal Reserve officials saying repeatedly that repos are still vulnerable to panic, the news reports and published analyses help the public keep an eye out for trouble.

Four reporters deserve special mention for their roles in 2015 in helping Americans understand the importance and the vulnerabilities of the repurchase market and its smaller cousin the securities lending market, which together are called securities financing transactions.

(Editor’s note: In securities financing transactions, traders borrow or lend cash or securities for a brief period, often for one day, and reuse – or rehypothecate – the cash or securities for trading purposes such as buying securities, borrowing cash or shorting stocks.)

Tracy Alloway, formerly with Financial Times and now at BloombergBusiness, is notable for the years of hard work she has invested in understanding the arcane twists and turns of securities financing and for figuring out how to write about it in a style that is clear, understandable and jargon free. She wrote at least 13 stories about repo and securities lending in 2015.

Alloway readers were delighted when she penned “The Ballad of the Repo Trader” which BloombergBusiness published Nov. 25. Here’s the first stanza:

Oh, it sucks to be a repo guy in post-financial crisis days,

New rules are being implemented and everything’s a haze,

Regulators have no sympathy (for them our goose is cooked),

But stick with me, oh reader, I think some things are overlooked.

Other stand-out reporters on this tough beat last year were Katy Burne at the Wall Street Journal, Liz Capo McCormick at BloombergBusiness and Joe Rennison at the Financial Times.

Also beating the repo drum were Securities Finance Monitor, which continued its more technical coverage of the market, Federal Reserve governors and economists who warned that securities finance – which they often call wholesale funding or short-term funding – is still vulnerable to panics, and the U.S. Treasury’s Office of Financial Research, which worried publicly about the lack of repo data and waded through the weeds trying to figure out how to get it.

In its must-read Financial Stability Report, published Dec. 15, the Office of Financial Research reviewed the state of the capital markets, including repos and securities lending. About the need for timely securities financing data, the authors found no answer except their own voluntary pilot program.

These markets were a source of contagion during the financial crisis. Although data have improved since the crisis, gaps remain in the scope, quality, and accessibility of data about these markets. To fill those gaps, the OFR, Federal Reserve, and Securities and Exchange Commission (SEC) in 2015 launched voluntary pilot data collections.

Many reports published in 2015 produced insights that suggest the repurchase market is changing in ways that no one seems to understand very well.

Three key insights from 2015 are (1) financial markets increasingly serve Wall Street instead of Main Street, (2) repo reform may be within sight and (3) securities finance seems to be moving out of traditional banks and into shadow banks, often within the same giant bank holding company.

Financial markets

Once upon a time financial markets provided working capital for companies that manufactured and distributed goods and services to consumers and businesses. Now financial markets increasingly provide working capital for investors – pension plans, insurance companies, corporate treasuries, endowments, hedge funds, money market funds, broker-dealers, commercial and investment banks, mutual funds, and so on – that want to make more money.

For example, in the 2000’s the housing boom was not driven by borrowers who wanted money to spend, although many didn’t seem to mind taking the cash that lenders offered. Instead, the housing boom was driven by investors who wanted to get a good return on their savings, according to several economic studies.

Wrote economist Zoltan Pozsar in “A Macro View of Shadow Banking,” published Jan. 31, 2015:

The conceptual link between repo and the provision of working capital is clear through the observation that just as working capital refers to the short-term funding of real economy transactions with an aim to satisfy household and business consumers by producing and delivering real goods, repos … aim to satisfy retail and institutional investors’ wealth aspirations by delivering financial goods in the form of excess return.

Pozsar said this may reflect a natural evolution in the financial needs of a maturing economy.

Repo reform

In November regulators made three announcements that suggest major repo reforms may emerge in 2016. Time will tell.

(1) The Financial Stability Board said it is setting minimum haircuts for repo and securities lending transactions between non-banks, launching global data collection of securities financing, studying the risks of rehypothecation, evaluating repo clearinghouses, and seeking improved oversight of shadow banking, including reduced risk of runs on money market funds and improved quality of securitizations.

(2) The Council of the European Union announced new rules that said banks and non-banks conducting securities financing transactions will be required to report the details to regulators to ensure transparency and reduce systemic risk.

(3) The Financial Stability Board and several trade associations said 21 giant global banks had agreed that securities financiers will not be able to sell their collateral for 48 hours after a borrower declares bankruptcy, to give regulators time to arrange an orderly resolution of the failed company.

Securities finance

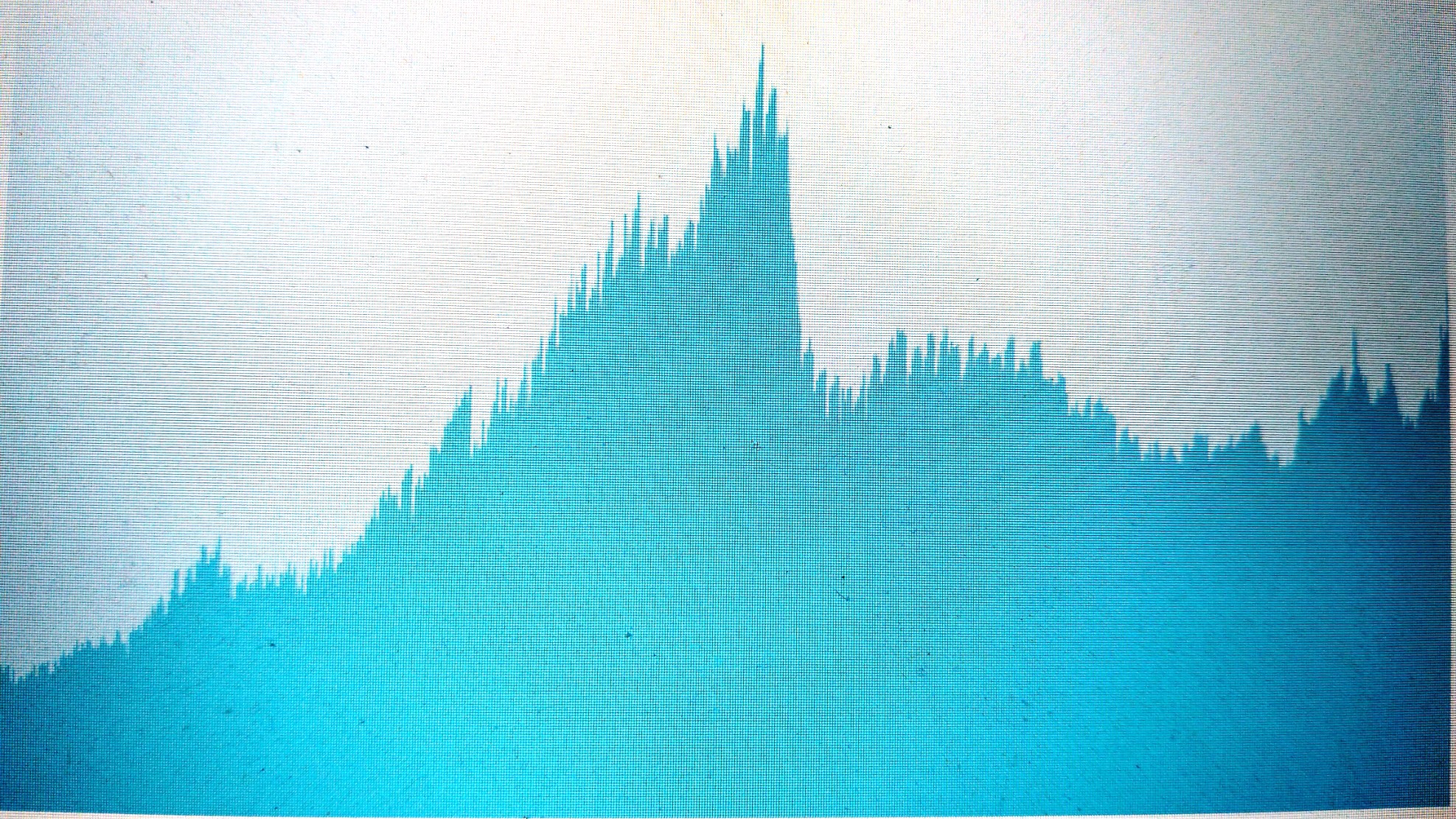

Although repo triggered the 2008 crisis, many analysts say it’s now more important than ever, mainly because risk-wary traders feel more secure with collateral. Yet the U.S. market seems to be shrinking. Repo conducted by primary dealers has shrunk from its post-crisis year-end high of $2.7 trillion in 2012 to $2.1 trillion at the end of 2015. Tri-party repo is down from a post-crisis year-end high of $1.96 trillion in 2012 to $1.6 trillion at the end of 2015.

Or is repo just moving into the shadows? The goal of post-2008 regulations like the Dodd-Frank Act was to prevent another shadow banking shock like the one that occurred in 2008, but instead of regulating shadow banks and securities financing, the Dodd-Frank Act regulated mainly traditional banks and derivatives.

(Editor’s note: Insurance giant AIG was the 2008 poster child for dangerous derivatives, but AIG lost almost as much money on its securities financing deals as it did on derivatives.)

Since the enactment of the Dodd-Frank Act in 2010, more lending has moved into the shadows than at almost any time since 1960, wrote Alloway and McCormick in December.

World Bank data show that the percent of U.S. private-sector funding provided by banks has fallen to almost the lowest point since 1960, illustrating the growing importance of nonbank financing.

Repos and securities lending also appear to be evolving in other uncharted directions, according to the 2015 reports:

— mREITs, pension plans, corporate treasurers, commercial banks, Federal Home Loan Banks, large individual investors – all are showing increased interest in using the repurchase market.

— Giant banks are doing more repurchase transactions internally, which can make the repos invisible to regulators.

— Tri-party reforms have made that market safer … and less popular with repo lenders and borrowers, some of whom seem to be going bilateral.

— Securities financing transactions that are international in scope, and harder for regulators to control, are increasing.

— Tri-party collateral is declining in quality, with 22.2 percent of the collateral being in riskier securities (securities that can not be settled on the Fedwire Securities Service) at the end of 2015, compared to 15.2 percent at year-end 2012.

Survey of repo news in 2015

Following are the 2015 news and analysis reports captured by the RepoWatch survey. They are listed in reverse chronological order, with the most recent report first:

Dec. 22, 2015: The International Capital Markets Association published a report and a series of slides giving a detailed overview of all ongoing regulatory initiatives that involve identifying and reporting securities financing transactions (mainly repo and securities lending) and the impact of those regulations on the different stages of a repurchase transaction.

*****

Dec. 22, 2015: Using purpose-for-purpose (P4P) equity collateral for securities financing is a way for large firms to avoid regulations and cut costs, but risks are “material,” wrote Richard Stinchfield for Securities Finance Monitor.

*****

Dec. 22, 2015: Stocks of shadow banks have experienced “heavy selling” and “brutal” price declines this year, perhaps caused mainly by the end of the Federal Reserve’s asset purchases through quantitative easing, concern that weakness in energy credit may spread to other sectors and warnings from regulators, wrote Michael P. Regan for BloombergGadfly.

*****

Dec. 21, 2015: The New York Fed published a primer on General Collateral Finance Repo (GCF Repo), a financial service offered by the Fixed Income Clearing Corporation, to explain how dealers use GCF Repo, how trades are cleared and settled and how GCF Repo is affected by current repo reforms.

*****

Dec. 17, 2015: Markets are getting very nervous about the rising costs of repo loans and the decline in repo trades, which some attribute to new regulations, wrote Anna Reitman at Securities Finance Monitor.

*****

Dec. 17, 2015: The Basel Committee on Banking Supervision said it’s worried that new regulations have overlooked a potential problem: Banks may have unseen obligations to seemingly independent shadow bankers that the banks will honor in a crisis to protect their reputations. This caused deep losses for banks in 2007 and 2008.

*****

Dec. 17, 2015: A potentially destabilizing unknown in the new world of rising interest rates is how many deposits will leave banks for money market funds and how much money market funds will choose to lend through overnight repos at the New York Fed instead of to bankers, wrote reporter Tracy Alloway at BloombergBusiness.

*****

Dec. 17, 2015: Regulation is making repurchase loans expensive and that could be a problem at year-end when financial institutions need short-term credit to adjust their holdings, wrote Anna Reitman for Securities Finance Monitor. Jeff Kidwell, head of Direct Repo at AVM, told her the four days starting Dec. 31 will be ‘scary.'”

*****

Dec. 16, 2015: Some dealers are choosing bilateral repo over tri-party repo so they can reuse (rehypothecate) the securities as collateral to get a loan if needed, wrote Jeff Kidwell, head of Direct Repo.

*****

Dec. 15, 2015: European regulators worry that lending will move from traditional banks to shadow banks, which could threaten the stability of the financial system, but they believe the economy needs shadow banking and don’t want to excessively limit it, wrote reporter Huw Jones for Reuters.

*****

Dec. 15, 2015: The recent fall in junk-bond prices is partly caused by the shrinking repurchase market, because it’s harder for investors like hedge funds to get quick financing to snap up junk-bond bargains and help stabilize junk-bond prices, wrote reporter Tracy Alloway for BloombergBusiness.

*****

Dec. 15, 2015: The goal of post-2008 regulations was to prevent another 2008-like shadow banking shock, but instead regulations have driven more lending into shadow banks than at almost any time since 1960, wrote reporters Tracy Alloway and Liz McCormick for BloombergBusiness.

*****

Dec. 15, 2015: Money market funds have been pouring cash into overnight and short-term repurchase transactions as they position themselves to seize rising rates expected from the Fed this week, wrote reporter Joe Rennison for the Financial Times.

*****

Dec. 15, 2015: In its first annual Financial Stability Report, the federal Office of Financial Research said the financial system is stronger than it was in 2008. But finance continues to migrate to shadow banking, liquidity sometimes appears fragile, run and fire-sale risks persist in securities financing markets (repo and securities lending) and interconnections among financial firms are evolving in ways not fully understood, for example, in the growing use of central clearing.

*****

Dec. 11, 2015: In 2014 hedge funds rehypothecated 36 percent of the repo collateral they got from borrowers and their lenders rehypothecated 12 percent of the repo collateral they got from hedge funds, according to the 2015 hedge fund survey conducted of 1,486 funds by the International Organization of Securities Commissions.

*****

Dec. 10. 2015: Profound changes are coming to the repurchase market – mainly smarter use of collateral and central clearing – as repo becomes ever more important to financial markets worldwide, said a 43-page research paper “The Future of Wholesale Funding Markets” by BNY Mellon and PwC Financial Services.

*****

Dec. 9, 2015: Collateralized commercial paper (CCP), a relative of the asset-backed commercial paper (ABCP) that played a key role in the financial crisis, gives money market funds a way to evade regulations that restrict them to repos with maturities of less than eight days, wrote Fitch Ratings in “Collateralized Commercial Paper Loses Traction.”

*****

Dec. 9, 2015: The Depository Trust and Clearing Corp., the only clearinghouse in the U.S. for repurchase agreements, may ask its members to commit to contributing $50 billion in the event of another 2008-style crisis, according to sources who said this is part of DTCC’s efforts to expand its repo clearing services, wrote Katy Burne for the Wall Street Journal.

*****

Dec. 9, 2015: It’s getting more expensive for financial institutions to get a repo loan, as lenders hesitate to take chances in advance of the Federal Open Market Committee meeting next week, wrote Joe Rennison for Financial Times.

*****

Dec. 8, 2015: Repurchase agreements that have terms of at least 31 days and can be automatically renewed if borrower and lender agree are increasingly popular with banks that must meet new regulations requiring them to hold enough short-term assets to withstand a 30-day run, wrote Tracy Alloway at BloombergBusiness.

*****

Dec. 3, 2015: In a speech he titled “Financial Stability and Shadow Banks: What we don’t know could hurt us,” Fed vice chair Stanley Fischer said data on some risky activities – like securities lending, bilateral repos, and derivatives trading – is opaque and inadequate, and the Fed plans to set minimum margins for bank and non-bank securities financing transactions. A key problem at AIG, Lehman and Long-Term Capital Management was their complexity, he said.

*****

Nov. 30, 2015: Securities lenders like asset managers are lending out more securities for longer periods, mainly to banks. This increases returns for lenders but also increases risk, wrote reporter Patrick Jenkins for the Financial Times.

*****

Nov. 25, 2015: Reporter Tracy Alloway penned “The Ballad of The Repo Trader” for BloombergBusiness.

*****

Nov. 24, 2015: As broker-dealers cut back on their role as repo market makers, some leading traders are supporting central clearing for repurchase transactions, which are the primary market for short-term funding, wrote reporter Joe Rennison at Financial Times.

*****

Nov. 23, 2015: Repo lenders like money market funds are concerned that they may have a harder time finding borrowers, as tighter regulations cause dealers to reduce their participation in repo markets, wrote Joe Rennison for the Financial Times.

*****

Nov. 2015. Although traders expect the repo market to continue in some form, they fear it may not be able to provide liquidity and collateral flows to the financial system as effectively and efficiently as it has in the past, and that could potentially have negative consequences both for markets and for the broader global economy, reported the International Capital Market Association in a long-anticipated report.

*****

Nov. 17, 2015: U.S. regulators and traders are studying how the repurchase market might benefit from central clearing. Federal Reserve Governor Jerome Powell said he would like to see central clearing “limited to those assets that are highly liquid and expected to remain so even in severely stressed market conditions.”

*****

Nov. 16, 2015: Banks and non-banks conducting securities financing transactions like repo and securities lending would be required to report the details to regulators to ensure transparency and reduce systemic risk under new rules announced by The Council of the European Union.

*****

Nov. 12, 2015: Twenty-one giant global banks agreed today that repo and securities lenders will not be able to sell their collateral for 48 hours after a borrower declares bankruptcy, to give regulators time to arrange an orderly resolution of the failed company, according to joint announcements from international trade associations and the Financial Stability Board.

*****

Nov. 12, 2015: The Financial Stability Board said it is setting minimum haircuts for repo and securities lending transactions between non-banks, launching global data collection of securities financing, studying the risks of rehypothecation, evaluating repo clearinghouses, and seeking improved oversight of shadow banking, including reduced risk of runs on money market funds and improved quality of securitizations.

*****

Nov. 12, 2015: Securities financing transactions including repo and securities lending remain vulnerable to runs and asset fire sales, said Richard Berner, director or the Office of Financial Research.

*****

Nov. 12, 2015: Repo loans with U.S. Treasury collateral has traditionally featured the same rate regardless of counterparty, but lately rates have “fractured,” just one of several strange movements in the financial markets recently, wrote reporter Tracy Alloway for Bloomberg.

*****

Nov. 10, 2015: As investment banks withdraw from the repo market, commercial banks are moving in. “There’s no cause for fear just yet … but regulators need to take care the repo grenade doesn’t blow up in the hands of nonexperts,” wrote Reuters’ columnist Dominic Elliott.

*****

Nov. 10, 2015: Before the financial crisis, broker-dealers borrowed securities on the securities lending market and used those securities as collateral for repo loans, but today they’re more likely to hold on to the securities, wrote contributor Jeffrey Snider at the Seeking Alpha blog.

*****

Nov. 10, 2015: One reason the interest rates on swaps is so low is that hedge funds and other traders that would normally drive up a low price are less able to get financing through the shrinking repo market, wrote reporters Michael Mackenzie and Joe Rennison for Financial Times.

*****

Nov. 9, 2015: Regulators are trying to convince banks that have made repo loans to wait 48 hours after their borrower files bankruptcy before selling the collateral. This would give regulators time to put in place a plan to unwind the borrower’s finances without a taxpayer bailout, wrote BloombergBusiness reporters Silla Brush and Jesse Hamilton.

*****

Nov. 8, 2015: U.S. Treasury officials are considering issuing two-month Treasury bills and letting the Fed be the lender of last resort for non-banks as ways to deal with the shortage of good repo collateral, which is caused in part by post-crisis regulation and is restricting repo volumes, wrote analyst Karen Shaw Petrou.

*****

Nov. 6, 2015: The Shell Group invests in 7- to 90-day tri-party repos and puts its overnight money in money market funds, reported Steve Lethaby with Clearstream.

*****

Nov. 3, 2015: Corporations are increasingly investing through tri-party repo instead of putting their cash in bank certificates of deposit, bank deposits or commercial paper, according to a report out of the Sibos financial industry conference.

*****

Nov. 1, 2015: Money market fund holdings of repurchase agreements hit an all-time high in September, reported Crana Data.

*****

Oct. 29, 2015: Non-U.S. bank broker-dealers with relatively low capital ratios appear to temporarily remove an average of $170 billion in borrowing from the U.S. tri-party repo market before each quarter-end in order to appear safer and less levered. This amount is more than double the $76 billion market-wide drop in tri-party repo during the 2008 financial crisis. This drives lenders to the Fed’s reserve repo program during that time, reported the U.S. Treasury’s Office of Financial Research.

*****

Oct. 29, 2015: The European Parliament has approved a new law that introduces mandatory reporting of securities financing transactions to help regulators spot the build up of overly risky positions, wrote reporter Huw Jones for Reuters.

*****

Oct. 27, 2015: The International Capital Markets Association will publish its study of the current and evolving European Repo Market on November 18. “… the European Repo Market is being re-shaped; in some instances with unintentional consequences. And the end of regulation impacting the market is still not in sight,” the ICMA notice said.

*****

Oct. 9, 2015: UK pension funds are afraid that when interest rates rise they will not be able to borrow enough on the repurchase market to meet their obligations to customers who bought their derivatives. They want the Bank of England to be their lender of last resort. wrote Frederico Mollet for Risk.net.

*****

Oct. 7, 2015: To try to make sure banks can withstand a 30-day run by their short-term lenders and avoid a crisis like the one in 2008, regulators are requiring banks to hold enough high-quality liquid assets, but the new Liquidity Coverage Ratio used to calculate that amount is confusing and could be misinterpreted, wrote two analysts at the Office of Financial Research.

*****

Oct. 5, 2015: Surprisingly, in Europe there’s been an increase in directly negotiated repo deals which typically use lower quality collateral, in using equities as collateral and in the amount of repo conducted by a few giant banks, wrote Jonathan Cooper at Securities Finance Monitor.

*****

Oct. 4, 2015: U.S. regulators are a long way from knowing how to prevent a 2008-style financial crisis, according to speakers at a conference at the Federal Reserve Bank of Boston, wrote New York Times reporter Binyamin Appelbaum.

*****

Oct. 2, 2015: The U.S. still does not have the tools it needs to deal with a buildup of risk in the financial markets, Federal Reserve Vice Chairman Stanley Fischer said in a speech.

*****

Oct. 2, 2015: Non-banks provide 14 percent of the credit in the U.S. system. These include broker-dealers, money market mutual funds (MMFs), finance companies, issuers of asset-backed securities, and mortgage real estate investment trusts, often associated with substantial reliance on short-term wholesale funding, Federal Reserve Vice Chairman Stanley Fischer said in a speech.

*****

Oct. 2, 2015: Regulators have been taking snapshots of big banks’ balance sheets — on July 31, August 24 and September 30 — to assess their reliance on repo and other short-term wholesale funding in case the banks need to increase capital, wrote Financial Times reporter Joe Rennison.

*****

Oct. 1, 2015: Some major players say the drop in repo volume is not a problem, while others express concern, wrote Liz McCormick at BloombergBusiness.

*****

Oct. 1, 2015: A judge has ruled that J.P.Morgan, Lehman Brothers’ clearing bank, did not improperly grab $8.6 billion in repo collateral when Lehman failed, wrote Wall Street Journal reporter Patrick Fitzgerald.

*****

Sept. 2015. A raft of regulation has made repos unprofitable, transforming it from a profit center to a service add-on for valuable clients, wrote Andy Hill with International Capital Market Association.

*****

Sept. 30, 2015: “The Financial Industry Regulatory Authority this week issued guidance on liquidity risk management. The move suggests that five years after the 2008 crash broker-dealers need to upgrade and invest in significant new measures in preparation for the next perfect storm,” wrote Richard Satran for Reuters.

*****

Sept. 30, 2015: “A pilot by the Office of Financial Research, aimed at filling data gaps in the market for bilateral repos, is encountering a host of challenges because of data inconsistencies, its lead researchers said in July at a panel in Washington,” wrote Wall Street Journal reporter Katy Burne.

*****

Sept. 30, 2015: Bank of New York Mellon has introduced a set of indexes tracking repo rates, which could allow the development of futures on the indexes as a hedging instrument when the Fed moves to raise rates, wrote Wall Street Journal reporter Katy Burne.

*****

Sept. 30, 2015: “Regulatory pressure on banks is colliding with a squeeze in Treasury bills to roil the U.S. money markets as the third quarter draws to a close” and overnight rates triple, wrote BloombergBusiness reporter Liz McCormick.

*****

Sept. 2015: Measured in June, the European repurchase market is experiencing a decline in volume, an increase in directly negotiated transactions, a surge in cross-border business, a decline in tri-party repo and in the quality of its collateral, a drop in the share of government-bond collateral and an increase in non-government bond and equity collateral, according to the International Capital Market Association’s semi-annual repo survey.

*****

Sept. 28, 2015: A run in the short-term wholesale funding markets, such as repo and securities lending, that cuts off funding to widely held assets is a greater risk to the system than a conventional bank run without deposit insurance, said Federal Reserve Governor Daniel K. Tarullo.

*****

Sept. 18, 2015: “The development of Asian markets for repos would help deepen the region’s capital markets and benefit its real economy,” wrote Patrick Pang, managing director and head of fixed income and compliance for the Asia Securities Industry & Financial Markets Association.

*****

Sept. 16, 2015: Some banks expect a near-term rate increase for repos, which provide a critical source of funding for Wall Street securities dealers, wrote Wall Street Journal reporter Katy Burne.

*****

Sept. 16, 2015: “Efforts to improve data reporting so far have been little short of a mess,” wrote Financial Times’ reporter Philip Stafford reviewing new studies of the repurchase market.

*****

Sept. 15, 2015: Stress tests of 43 broker-dealers found six that did not have resources, staff or liquidity plans to be likely to survive a 30-day period of the kinds of stress that have caused broker-dealers to fail in the past, reported the Financial Industry Regulatory Authority.

*****

Sept. 15, 2015: How can we explain “those incredible dropping repo rates?” asked the Financial Times’ Alphaville blog.

*****

Sept. 12, 2015: Historically, primary dealers absorbed liquidity shocks in the financial markets, but that system failed in 2008 and we’re still trying to figure out how to replace it, blogged Barnard College professor Perry Mehrling.

*****

Sept. 9, 2015: U.S. regulators are a long way from having the data they need to adequately oversee the securities financing markets, the Office of Financial Research concluded in its “Reference Guide to U.S. Repo and Securities Lending Markets.”

*****

Sept. 8, 2015: The general mREIT strategy is to buy Residential or Commercial Mortgage-Backed Securities, finance their purchases with repo agreements, and hedge part of their interest rate risk through a derivative, explained the Colorado Wealth Management Fund.

*****

Sept. 8, 2015: Traders who use derivatives called Exchange-Traded Funds as collateral for repos and securities lending may be having second thoughts after ETFs traded at “enormous discounts” during the recent market turmoil, wrote Jeff Cooper at Securities Finance Monitor.

*****

Sept. 7, 2015: Market appetite for repo is growing, but new regulation has made the major banks more reluctant to provide the product, so “this has created an opportunity for new entrants which could spawn healthier competition, a reduction in costs to the end user and a less concentrated risk profile throughout the market,” wrote Iain Colquhoun, global head of repo marketing for ICBC Standard Bank.

*****

Aug. 25, 2015: Non-bank financial institutions have entered the core of the UK repo network and some are using repo to obtain leverage, which regulators should monitor, wrote two analysts in Bank of England’s “Bank Underground” blog in an article “What do we know about non-bank interconnectedness?”

*****

Aug. 6, 2015: It’s more expensive to borrow on the repurchase market these days, and that is protecting some securities from speculators who would otherwise borrow the securities on the repo market, short them and drive down their value, wrote Reuters reporter John Geddie.

*****

Aug. 5, 2015: The Fed’s new reverse repo agreement program could cause costs for mortgages to go up and mortgage financing to get scarcer, wrote Bloomberg reporter Tracy Alloway.

*****

Aug. 3, 2015: “Post-crisis reforms have made the repo market safer but also raised the costs of repo transactions. Greater use of central clearing could potentially lower these costs by allowing participants to net more of their transactions,” Federal Reserve Governor Jerome H. Powell told a gathering at The Brookings Institution.

*****

Aug. 1, 2015: The Great Financial Panic of 2007 was a good old-fashioned banking panic like those of the 19th and early 20th centuries and was not driven by banks that were Too Big To Fail, blogged University of Pennsylvania professor Francis X. Diebold in support of work by Yale University professor Gary Gorton.

*****

July 2015: The U.S. has a long way to go before it achieves stability in its financial markets, including still-needed reforms in the repurchase market and securities lending, said the International Monetary Fund in its most recent Financial System Stability Assessment for the United States.

*****

July 27, 2015: The Fed’s reverse repo facility could help stabilize the repurchase market in a crisis by providing a safe haven for lenders, as the Fed did in 2007-2008 but without its chaotic improvisation, wrote reporter Cardiff Garcia at the Financial Times’ Alphaville blog.

*****

July 21, 2015: Corporate treasurers with cash to invest should realize that “repo is simply a straightforward securitized deposit,” Clearstream told Treasury Insider.

*****

July 20, 2015: Eight U.S. global systemically important bank holding companies will have to put more of their own money at risk if they want to rely on short-term wholesale funding like repos, because during the crisis “reliance on this type of funding left firms vulnerable to runs and fire sales,” said the Federal Reserve.

*****

July 19, 2015: Barney Frank, one of the authors of Dodd-Frank, told the Wall Street Journal, “Look, I was never a total expert in this, [but] there is an argument from some that the triparty repo market [where large institutions get funding for their trading businesses] has not been fully regulated. If I were in Congress today I’d be looking to have hearings and learn about that and it may be that that needs to be better regulated.”

*****

June 29, 2015: With the growing demand from lenders to make repo loans, and the declining interest from borrowers like banks and broker-dealers, the most likely borrower to fill the gap is the Federal Reserve, wrote Tracy Alloway and Liz McCormick at BloombergBusiness.

*****

June 28, 2015: In its annual report, the Bank for International Settlements worried that asset managers like hedge funds are picking up the business that banks are abandoning and in so doing may be creating unstable markets.

*****

June 25, 2015: Transactions on the Denmark repurchase market are disappearing, potentially weakening the entire financial system, wrote BloombergBusiness reporter Frances Schwartzkopff.

*****

June 25, 2015: The European Central Bank is charging banks to deposit money with it, and this is causing confusion in the European repurchase market because it causes repo lenders like money market funds to have to pay borrowers like broker-dealers or hedge funds to borrow, reported Naomi Rovnick for the Financial Times.

*****

June 24, 2015: Several REITs have joined Federal Home Loan Banks via their captive insurers, to get funding and a cheap and flexible way to warehouse mortgages, among other things, wrote Nora Colomer for National Mortgage News.

*****

June 24, 2015: Improvements have been made in the tri-party repurchase market, the epicenter of the financial crisis, but an important problem remains and likely will continue beyond the 2015 deadline the Fed set for reform: The two giant clearing banks still can not transact repos quickly enough to prevent fire sales for some transactions when the parties are not represented by the same clearing bank, according to the New York Fed and a story by Wall Street Journal reporter Katy Burne.

*****

June 23, 2015: Josh Galper at Securities Finance Monitor said he thinks the proposal from Jose Vinals, director of the IMF capital markets department, that central banks may need to become market makers to counteract very low liquidity in fixed income markets is an “incredibly bad idea.”

*****

June 17, 2015: In a detailed look at short-term repos with long-term corporate bonds as collateral, Fitch Ratings said these repos are vulnerable to fire sales in times of market turmoil, for example when the Fed finally starts increasing interest rates.

*****

June 17, 2015: Repos and repo-like transactions that use stocks or bonds as collateral for loans will be required to be more transparent under new rules reached by the European Union, reported Reuters from London.

*****

June 17, 2015: With repo declining, mutual funds and exchange-traded funds are taking its place, taking short term money and putting it in long term investments, said a Barclays analysis reported by Tracy Alloway with BloombergBusiness.

*****

June 17, 2015: Fitch Ratings is warning that financial institutions that have corporate bonds as repo collateral may not be able to renew the repo loan or sell the collateral if interest rates rise and the value of the bonds falls, and that could trigger market turmoil, reported Joe Rennison of Financial Times.

*****

June 16, 2015: One of the world’s biggest clearing houses warns that it may soon reach the limit of its ability to clear repo transactions for clients because regulations are creating a shortage of counterparties, wrote Joe Rennison and Phillip Stafford for Financial Times.

*****

June 11, 2015: Data exists on U.S. repo deals done with middlemen, but there’s very little U.S. data on bilateral repos. The Office of Financial Research is trying to collect the bilateral data but they won’t get it all, wrote Jonathan Cooper at Securities Finance Monitor.

*****

June 11, 2015: Stricter regulation is gumming up the repo market, wrote reporter Robin Wigglesworth in the Financial Times.

*****

June 10, 2015: Bond prices are more volatile in the post-crisis financial markets and Jonathan Cooper at Securities Finance Monitor wondered if repo lenders are getting enough collateral to cover that potential volatility.

*****

June 10, 2015: Repo lenders are looking for new borrowers as primary dealers cut back, wrote reporter Liz McCormick at BloombergBusiness.

*****

June 8, 2015: The Office of Financial Research, created by the Dodd-Frank Act, is collecting data on the little-known bilateral repo market. “Because the repo market remains vulnerable to runs and asset fire sales, obtaining more information about these transactions will fill an important data gap,” director Richard Berner told the Brookings Institution.

*****

June 2, 2015: Efforts are underway to make it easier for corporations to become repo lenders, said an article in Treasury Today and a review of the article by Securities Finance Monitor.

*****

May 28, 2015: “Despite reforms, vulnerabilities (including the reliance on two clearing banks) in the triparty repo market remain large,” said the International Monetary Fund in its regular report on the U.S. economy.

*****

May 19, 2015: The repurchase market “continues to pose a significant threat to financial stability” and bilateral repo needs more transparency, said the Financial Stability Oversight Council in its 2015 annual report.

*****

May 13, 2015: For a variety of reasons, riskier deals soared on the tri-party repo market in the years leading up to the market’s collapse in 2008 and recently they’ve begun rising again, but slowly, wrote Liberty Street economists Antoine Martin and Susan McLaughlin in their two-part history of tri-party repo.

*****

May 13, 2015: When Congress threatened to force a default on U.S. debt in 2011 and 2013, the Federal Reserve researched whether in the event of market panic it could lend support to the tri-party repo market, which is one of the pillars of short-term lending on Wall Street, Reuters reported.

*****

May 12, 2015: BNY Mellon, the largest of the two clearing banks for tri-party repo, said today it has met most of the tri-party reforms recommended by regulators and industry leaders after the financial crisis, including “the practical elimination” of intraday credit by reducing it 97 percent.

*****

May 11, 2015: Tri-party repo was created in the late 1970s by Salomon Brothers and Manufacturers Hanover to reduce transaction costs for Salomon, and it grew in the 1980s and 1990s as a way to reduce costs for dealers and risks for lenders, wrote Liberty Street economists Antoine Martin and Susan McLaughlin in “Financial Innovation: The Origins of the Tri-Party Repo Market.”

*****

April 30, 2015: Regulators may end a repo lender’s right to avoid getting bogged down in a borrower’s bankruptcy by immediately selling collateral, wrote portfolio managers for Wells Fargo Advantage Funds in “Focus piece: Repurchase agreements.”

*****

April 29, 2015: Growing signs suggest that unintended consequences of post-crisis regulations may be making the financial markets more dangerous, wrote Federal Financial Analytics in a new study.

*****

April 2015: To reduce shadow banking risk, all money market funds should have variable NAVs, securitization should be standardized, simplified and more transparent, and reuse of collateral needs greater transparency and more consistent regulation, said the CFA Institute in a 105-page “Shadow Banking” report.

*****

April 27, 2015: Steps taken by regulators to reduce systemic risk still permit significant hidden leverage, such as in the netting of unrelated repo borrowing and lending, wrote financial author and former banker Satyajit Das in the Financial Times.

*****

April 26, 2015: There is “a huge wall of money moving into the capital markets from the banking system” and regulators will assess these private pools of money for systemic risk, David Wright, secretary general of the International Organization of Securities Commissions, told BloombergBusiness reporters.

*****

April 24, 2015: The biggest securities lenders are State Street, Bank of NY Mellon, J.P. Morgan, and Northern Trust, and they usually use the cash they receive to make short-term investments, like prime money market funds do but without Securities and Exchange Commission oversight, wrote J.P. Morgan analysts as reported by Crane Date.

*****

April 23, 2015: Regulators still don’t have the data on repo and securities lending transactions that they need, reported the Office of Financial Research which is studying the problem. “Repo and Securities Lending: Improving Transparency with Better Data,”

*****

April 23, 2015: The Federal Reserve is worried that asset managers like hedge funds or mutual funds don’t have enough cash to withstand large investor withdrawals like those during the 2008 financial crisis, wrote Michael Flaherty and Jonathan Spicer for Reuters.

*****

April 22, 2015: Mortgage backer Ginnie Mae does not have the resources to make sure the non-banks that make most mortgages today are financially secure, wrote Kate Berry for the National Mortgage News.

*****

April 2015: Although much of the discussion concerning the federal bailout of AIG has centered on the losses from its credit default swap business, losses from its securities lending business were of a similar magnitude, wrote economists Robert L. McDonald and Anna Paulson in “AIG in Hindsight.”

*****

April 20, 2015: Economists at the New York Fed argued in “Credit Supply and the Housing Boom” that the fundamental factor behind that boom was not relaxed lending standards but instead it was an increase in the supply of mortgage credit, which was brought about by securitization and shadow banking, along with a surge in capital inflows from abroad.

*****

April 20, 2015: Financial regulators know next to nothing about the true level of risk that big banks are exposed to because they still have very little information about money market mutual funds, overnight repurchase agreements, over-the-counter derivatives, and loans to hedge funds, wrote Robert Lenzner in the Financial Times.

*****

April 17, 2015: The cost to borrow overnight in the repo market surged at the end of the first quarter, and the U.S. Treasury is asking Primary Dealers why this happened and how it might be avoided, wrote reporter Karen Brettell for Reuters.

*****

April 15, 2015: Crane Data reported on Barclays analyst Joseph Abate’s comments on the future of repo, which he expects regulators will force to get smaller in the coming year.

*****

April 14, 2015: The Office of Financial Research is collecting data on the opaque bilateral repo market and will make aggregated repo data public, Director Richard Berner said in a speech to the Securities Industry and Financial Markets Association.

*****

April 14, 2015: International regulators want repo traders to agree to halt trading briefly when a counterparty stumbles, to give regulators time to resolve the troubled institution and avoid a Lehman-like panic, wrote Katy Burne in the Wall Street Journal.

*****

April 13, 2015: Repurchase transactions may soon move to centralized clearing systems to minimize risk, wrote Liz McCormick at BloombergBusiness.

*****

April. 8, 2015: A new International Monetary Fund report repeats the IMF’s concern that trouble may be brewing unseen in the shadow banking industry, wrote Ian Talley in the Wall Street Journal.

*****

April. 7, 2015: “Investors and small firms” are replacing broker-dealers and banks as lenders in the repurchase market, wrote Katy Burne in the Wall Street Journal.

*****

April, 6, 2015: CalPERS, California’s enormous public employees’ pension system, has become the first big pool of money to agree to be a source of emergency repo financing for a clearinghouse, assuming a role once reserved for investment banks like Lehman Brothers, said Rick Baert, writing for Pensions and Investments.

*****

April 2, 2015: “A shortage of high-quality bonds is disrupting the $2.6 trillion U.S. market for short-term loans known as repurchase agreements,” wrote Katy Burne in the Wall Street Journal.

*****

April 2, 2015: Yale professor Gary Gorton, who first explained the role of the repurchase market in the financial crisis of 2007-2009, authored “The Maze of Banking,” a collection of his essays published by Oxford University Press.

*****

March 23, 2015: The worst job in investment banking for 2015 is the repo desk as it’s being squeezed by regulators, wrote Sarah Butcher for efinancialcareers.

*****

March 22, 2015: Lending in the shadow-banking system finally appears to have bottomed out, a reversal that could presage a long-awaited uptick in U.S. economic growth, wrote Michael J. Casey in the Wall Street Journal.

*****

March 17, 2015: Economist Zoltan Pozsar said regulators will be better able to contain the build-up of risk in shadow banking if they understand the important role that securities financing transactions play in the modern economy, wrote Wall Street Journal reporter Ryan Tracy.

*****

March 8, 2015: No one at the Securities and Exchange Commission oversees the $7.7 trillion corporate bond market, wrote Financial Times reporters Tracy Alloway and Michael Mackenzie, Financial Times.

*****

March 2015: “Investment banks play a key role in capital markets and contribute to the efficient functioning of financial markets. As demonstrated in the recent financial crisis, however, investment banks can create and propagate risks in the financial system,” wrote Kushal Balluck in “Investment Banking,” Bank of England.

*****

March 4, 2015: “US banks could lose more than 7 per cent of their annual profits to the rapidly expanding group of non-bank financial intermediaries known as ‘shadow banks,’ according Goldman Sachs,” reported Tracy Alloway, Financial Times.

*****

Feb. 27, 2015: Shadow banking – meaning repurchase agreements, money market funds, and commercial paper – is shrinking because of post-crisis regulation, according to a study reported by Liz McCormick at Bloomberg.

*****

Feb. 24, 2015: New rules aimed at increasing bank capital and reducing the risk of a run in the “repo market” — Ground Zero for the financial crisis — are driving many investors to exchange-traded funds, mutual funds and credit default swaps, wrote Tracy Alloway, Financial Times.

*****

Jan. 31, 2015: We need a much better understanding of shadow banking as the system that enables “the shift in finance away from funding real economy transactions and toward funding financial economy transactions,” wrote economist Zoltan Pozsar in “A Macro View of Shadow Banking.”

*****

Feb. 17, 2015: In a frantic search for yield, investors are gobbling up risky corporate bonds on the shadow banking market, which could freeze like 2008 if many try to sell at once, wrote John Plender, Financial Times.

*****

Feb. 10, 2015: The new eBonds – corporate bonds with an embedded credit default swap derivative – sound a lot like deals that failed in 2008, especially if they use repo financing, wrote Securities Finance Monitor.

*****

Feb. 5, 2015: Leveraged shadow banking, such as repo, is a place where risks still remain, and there’s quite a lot of urgency to address them, said former Federal Reserve Governor Jeremy Stein.

*****

Jan. 30, 2015: We still need to address the risks associated with repo and other short-term wholesale funding, Federal Reserve Governor Daniel K. Tarullo warned at a conference in Virginia.

*****

Jan. 12, 2015: Much banking, including repo and securities lending, is now done by and within Bank Holding Company conglomerates, not by separate companies, wrote Nicola Cetorelli for Liberty Street Economics in “Hybrid Intermediaries.”

*****

Jan. 9, 2015: “Big banks park beat-up energy sector bonds in U.S. money funds” by using the bonds as collateral for repo loans from the money funds, wrote Tim McLaughlin for Reuters.

*****

Some people have written about the ill effect on our economy due to the rehypothedation market. Please see “Bad Money”,by Kevin Philips. However, no one has attributed the current economic malaise to the process of banks using small business equity for their own gambling. If people & small businesses cannot use their own equity to grow their own enterprises, then there is no such thing as free market capitalism!

No wonder that business start ups are at an historic low. They do not have any equity to offer the high priests of finance for their own purposes!

Pingback: 2016 news round-up: So little has changed | RepoWatch