RepoWatch recommends the following reports.

Search for the topics that interest you: DataWatch, Financial crisis, Finding a fix, Hedge funds, Regulation, Repurchase market, Securities lending, Securitization, Shadow banking, Too big to fail, and Tri-party repo. Items are arranged chronologically, within topics that are listed alphabetically.

DataWatch

From “LEIs are almost here”” by Tom Steinert-Threlkeld, Securities Techology Monitor, May 3:

Legal entity identifiers, or LEIs, are almost here. Fire up your browser.

That’s because registering to get 20-character identification codes for your firm or your counterparties will be similar to the sign-up process for a Web site.

The Web portal that will take in names, addresses and other basic details of firms registering for the codes will be opened June 1, by The Depository Trust and Clearing Corporation.

Driving that date is the launch of centralized clearing of credit-default and interest-rate swaps, under the supervision of the Commodity Future Trading Commission. The CFTC is requiring the codes beginning July 16.

Both LEIs and the central clearing of swaps are outgrowths of the Dodd-Frank Wall Street Reform Act of 2010. The clearing of swaps puts a central counterparty in between both sides of a trade. The idea is to shield each party from each other, with the central counterparty guaranteeing each end of the transaction.

But all parties need to know who, ultimately they are dealing with. And the LEI system, in the end, is to allow financial firms and regulators track transactions and positions back to whatever “legal entity” is the “ultimate parent” of a firm taking part in a securities transaction.

This will help the firms and the market overseers see whether positions are building up to risky levels with any given entity or type of security.

From “Statistics to deliver price stability and mitigate systemic risk,” a speech by Mario Draghi, President of the European Central Bank, at the Sixth ECB Statistics Conference in Frankfurt, April 17:

The financial crisis has dramatically increased the need for very timely granular data. And it has led to a rethinking of a number of organisational and conceptual aspects in statistics. …

As we have learned, systemic risk may stem from any part of the financial system, including the shadow banking sector. That is why we also need more data to monitor unregulated financial institutions and markets. In recent years, significant steps have been taken to identify the data gaps and to fill them by gathering more and more detailed quantitative information. But we are just at the beginning of this process ….

From “Systemic Risks in Global Banking: What Can Available Data Tell Us and What More Data Are Needed?” by Eugenio Cerutti, Stijn Claessens and Patrick McGuire, Bank for International Settlements, April 2012:

The recent financial crisis has shown how interconnected the financial world has become. Shocks in one location or asset class can have a sizable impact on the stability of institutions and markets around the world. But systemic risk analysis is severely hampered by the lack of consistent data that capture the international dimensions of finance.

While currently available data can be used more effectively, supervisors and other agencies need more and better data to construct even rudimentary measures of risks in the international financial system. Similarly, market participants need better information on aggregate positions and linkages to appropriately monitor and price risks.

Ongoing initiatives that will help close data gaps include the G20 Data Gaps Initiative, which recommends the collection of consistent banklevel data for joint analyses and enhancements to existing sets of aggregate statistics, and enhancements to the BIS international banking statistics.

Financial crisis

From “Some Reflections on the Crisis and the Policy Response.” a speech by Federal Reserve Chairman Ben Bernanke, April 13:

A key vulnerability of the system was the heavy reliance of the shadow banking sector, as well as some of the largest global banks, on various forms of short-term wholesale funding, including commercial paper, repos, securities lending transactions, and interbank loans. The ease, flexibility, and low perceived cost of short-term funding also supported a broader trend toward higher leverage and greater maturity mismatch in individual shadow banking institutions and in the sector as a whole. …

To a significant extent, the crisis is best understood as a classic financial panic … Indeed, panic-like phenomena arose in multiple contexts and in multiple ways during the crisis….

The multiple instances of run-like behavior during the crisis, together with the associated sharp increases in liquidity premiums and dysfunction in many markets, motivated much of the Federal Reserve’s policy response….

To avoid or at least mitigate future panics, the vulnerabilities that underlay the recent crisis must be fully addressed. As you know, this process is well under way at both the national and international levels.

Finding a Fix

From “New Research Paper Calls For ‘Repo Resolution Authority’” by Dow Jones Newswires, April 27, 2012:

The new resolution authority created by the Dodd-Frank financial overhaul law is ill-suited to handle a run in the repo market, a new paper says, and a “Repo Resolution Authority” is needed to prevent a repeat of the financial meltdown that followed Lehman Brothers Holdings Inc.’s collapse.

From “A Proposal for the Resolution of Systemically Important Assets and Liabilities: The Case of the Repo Market” by Viral V. Acharya and T. Sabri Oncu, New York University Stern School of Business, March 23, 2012:

One of the several regulatory failures behind the global financial crisis that started in 2007 has been the regulatory focus on individual, rather than systemic, risk of financial institutions.

Focusing on systemically important assets and liabilities rather than individual financial institutions, we propose a set of resolution mechanisms, which is not only capable of inducing market discipline and mitigating moral hazard, but also capable of addressing the associated systemic risk, for instance, due to the risk of fire sales of collateral assets.

Furthermore, because of our focus on systemically important assets and liabilities, our proposed resolution mechanisms would be easier to implement at the global level compared to mechanisms that operate at the level of individual institutional forms.

We, then, outline how our approach can be specialized to the repo market and propose a repo resolution authority for reforming this market.

Hedge funds

From “Citadel, Millennium Above $115 Billion With Rule Change” by Miles Weiss, Bloomberg, April 13:

Citadel Advisors LLC and Millennium Management LLC said their assets soared ninefold when tallied under a new rule that requires hedge funds to disclose investments financed through borrowings. …

“If you are heavily levered, obviously that will result in you having a larger gross asset number,” said Gary Kaminsky, a principal in the business advisory services group at Rothstein Kass, a Roseland, New Jersey, accounting firm that audits hedge funds.

That’s because, under the SEC approach, “all that matters is what’s on the asset side of the balance sheet,” Kaminsky said.

Hedge funds are relying less on margin loans from prime brokers, the securities firms that provide credit and facilitate trading, and more on repurchase agreements, leveraged exchange- traded funds, and derivatives such as total return swaps, according to Josh Galper, the managing principal at Finadium LLC, a Concord, Massachusetts, investment research and consulting firm.

From “Hedge funds were peripheral players” by Andrew Baker, CEO of The Alternative Investment Management Association, April 9, responding in the Financial Times to the following April 1 commentary by Photis Lysandrou:

Sir, Photis Lysandrou distorts recent history by saying that hedge funds helped to cause the financial crisis. He expresses surprise that all the official reports into the financial crisis concluded that hedge funds did not cause the crisis because, as he puts it, hedge funds held “about 47 per cent of $3tn worth of CDOs [collateralised debt obligations]”, or $1.4tn worth, by the end of 2006. But those data were not taken seriously by those given the task of investigating the causes of the crisis, including Lord Turner in the UK and the US House Committee on Oversight and Government Reform, for a very good reason: the entire worldwide hedge fund industry was managing only slightly more – $1.7tn – in 2006.

The reality, as the official reports showed, was that hedge funds were peripheral long players in the CDO market, and in a few celebrated cases were in fact short CDOs.

The primacy of hedge funds in the subprime crisis” by Photis Lysandrou, professor of Global Political Economy at London Metropolitan Business School, Journal of Post Keynesian Economics, Winter 2011-2012 (see also “The real role of hedge funds in the crisis”by Lysandrou, Financial Times, April 1):

Ever since the subprime crisis broke out in the summer of 2007, the hedge funds have strongly denied any responsibility for causing it….

This article puts forward a completely different view. …

There should not have been a mass market for the subprime-backed securities given that their complex and opaque structure broke all the rules of commodity exchange, and without the hedge funds such a market would not in fact have existed. …

There were other buyers of these products as has often been pointed out not only by the hedge funds themselves but also by many other commentators, but as we will now see, the hedge funds were by far the most important buyers.

How could hedge funds afford to buy CDOs worth four times the amount of money they had to invest? By borrowing, mainly using repo loans but also securities lending and margin loans, writes Lysandrou. Hedge funds were using CDOs as collateral for repo and securities lending loans, to get the cash to buy more CDOs, she argues.

Regulation

From “Unleashing liquidity” by Will Duff Gordon, Data Explorers, May 7:

Markets have been set a challenge for which there is as yet no answer. Basle III’s Liquidity Coverage Ratio dictates that banks must at all times have liquid assets to satisfy at least 30 days worth of liabilities . Overnight funding is no longer acceptable. Judging by the lack of ready ‘term’ funding this 30 day rule is more of a mountain than a mere hurdle. However, here lies a great opportunity for the securities financing market – or so one would hope.

From “Rules for Bank Capital Still Broken After Four Years,” Bloomberg News editorial, May 6:

It has been four years since the global financial crisis first struck, and the system that helped cause the deepest economic slump since the 1930s is still broken.

Sure, laws have been passed and financial rules tweaked; the U.S., for instance, in 2010 approved the wide-ranging Dodd- Frank law. But a critical component of a stronger financial system — an internationally coordinated increase in bank capital — is missing.

U.K. and European Union finance ministers fell out over this last week. And it’s already clear that the new capital- adequacy rules, when finally in place, will be too weak.

From “Banks face tougher trading capital rules” by Brooke Masters, Financial Times, May 3:

Bank trading desks face a new threat to their profitability after global regulators unveiled proposals on Thursday to force them to hold more capital against the risk of heavy losses when markets freeze.

The Basel Committee on Banking Supervision’s “fundamental review of the trading book” aims to close loopholes that have allowed banks to cut capital requirements by parking assets in their trading books. …

The proposed changes are so fundamental that if they are approved, a long phase-in period would be needed to give banks time to adjust, regulators said.

From “Bank Encumbrance Limit to Face Europe Opposition, Fitch Says,” by Bloomberg News, May 2:

Banks that encumber their balance sheets by tying up assets as collateral for securities such as covered bonds or in repurchase agreements, or repos, with central banks, have fewer available to meet claims if an institution fails.

The International Monetary Fund in a report last week suggested that lenders should be required to hold a minimum quantity of unsecured debt that could be swapped into equity, or bailed in, to avoid a disorderly default.

From “Regulatory Reform since the Financial Crisis,” a speech by Daniel K. Tarullo, Federal Reserve Board, May 2, 2012:

… there were two major regulatory challenges revealed by the crisis. First was the problem of too-big-to-fail financial firms, both those that had been inadequately regulated within the perimeter of prudential rules and those like the large, free-standing investment banks that lay outside that perimeter. Second was the problem of credit intermediation partly or wholly outside the limits of the traditional banking system. This so-called shadow banking system involved not only sizeable commercial and investment banks, but also a host of smaller firms active across a range of markets and a global community of institutional investors.

To date, the post-crisis regulatory reform program has been substantially directed at the too-big-to-fail problem, and more generally at enhancing the resiliency of the largest financial firms. …

I am often asked whether the reforms I have just described will “solve” the too-big-to-fail problem. … Of one thing I am sure: If we do not complete rigorous implementation of this complementary set of reforms, we will have lost the opportunity to reverse the pre-crisis trajectory of increasing too-big-to-fail risks.

While there is a well-defined set of regulatory measures to address too-big-to-fail, the same cannot be said for the second major challenge revealed by the crisis: the instability of the shadow banking system. Although some elements of pre-crisis shadow banking are probably gone forever, others persist. Moreover, as time passes, memories fade, and the financial system normalizes, it seems likely that new forms of shadow banking will emerge. Indeed, the increased regulation of the major securities firms may well encourage the migration of some parts of the shadow banking system further into the darkness–that is, into largely unregulated markets. …

Interesting and productive academic debates continue over the sources of the rapid growth of the shadow banking system, the precise reasons for the runs of 2007 and 2008, and the possible sources of future problems. … Domestically, among member agencies of the Financial Stability Oversight Council, and internationally, among members of the Financial Stability Board, policy officials are engaged in these debates and their implications for reform. But policymakers cannot and should not wait for the conclusion of these deliberations to address some obvious vulnerabilities in today’s shadow banking system.

Two areas where the case for reform in the short-run is compelling are money market funds and the tri-party repo market.

From “Forget Bailouts, Watch Out For European Bank Bail-Ins: Fitch” by Catherine Boyle, CNBC.com, April 30, 2012:

European banks need bail-ins rather than bailouts of fresh capital, as the European Central Bank’s liquidity operations come to an end, according to ratings agency Fitch.

Bail-ins – where banks convert debt on their books into new equity rather than looking for fresh capital elsewhere – could expose banks’ creditors to greater risk. However, they would avoid the taxpayer being exposed even further to banks’ failure.

From “Dodd-Frank avoidance – the changing faces of international banking” by Christopher Elias, Business Law Currents, April 24:

International banks are becoming shape-shifters, undertaking creative restructuring measures to elude the most stringent measures of the Dodd-Frank act. …

Under the new rules, beginning in 2015 all bank-holding companies must comply with the minimum federal capital requirements, regardless of where their parent is based. Rather than increase their capital ratios a few international banks have chosen some subtle corporate restructuring to get around these provisions.

From “Bank Funding at Risk From Rules Considered by EU Lawmakers” by Esteban Duarte, Bloomberg, April 19:

European Union lawmakers are considering rules to protect bank depositors that may stymie two of the main funding sources for the region’s lenders….

Sharon Bowles, chairwoman of the European Parliament’s Economic and Monetary Affairs Committee, said she’s among legislators pushing for banks to increase disclosure of the assets earmarked for collateral in covered bonds and repurchase agreements. Banks may also have to set aside reserves when secured funding exceeds a set limit….

Under Bowles’s proposal, regulators should know of banks’ repos, securities lending and all forms of transactions where creditors have a claim on assets. She’s suggesting that information be reported to a central trade or securities repository.

From “Credit conditions for firms – stability and monetary policy,” a speech by Paul Tucker, Deputy Governor for Financial Stability at the Bank of England, to the Association of Corporate Treasurers’ Annual Conference in Liverpool April 18:

You have faced first tightening, then in late 2008 frozen, and now a prolonged period of tight credit conditions. …

A number of initiatives are underway. … Dare I say it, but securitisation might even play a role. Nearly £1bn of long-term financing was recently raised in the London markets by offering investors a first claim on a £1.5bn portfolio of loans to small businesses with a typical turnover of under £2 million per annum. The funds were raised at a lower cost than many bank issuers would face in their own name. A few other banks are thought to be exploring similar deals.

It is important, though, that the lessons from badly designed securitisations in the past should be learnt.

Almost the most important lesson is that to be healthy the securitization market, like any other capital market, needs a bedrock of real, unlevered investors. Holders and traders who have borrowed to make their purchases have a tendency to sell when the weather deteriorates. We have seen where that can lead. … sadly, the repair of the credit system will take time. So will the even broader task of putting in place better “rules of the game” for the financial system.

For all the measures in train internationally on banks’ capital, resolution regimes, over-the-counter derivative markets, central counterparties, shadow banking and so on, they will I fear eventually be found wanting. Conditions change. …

At its simplest, that is why the government has established the Bank of England’s new Financial Policy Committee – to ensure that the moment when the financial system’s resilience is critically impaired does not get overlooked; that it is anticipated and appropriate action is taken ….

(RepoWatch’s editor’s note: The Financial Policy Committee is the UK’s systemic risk watchdog, like the Financial Stability Oversight Council in the U.S. and the European Systemic Risk Board in Europe.)

From “The Big Flaws in Dodd-Frank,” an interview by Gene Epstein, Barron’s, April 14:

Barrons: When President Obama signed the Dodd-Frank bill into law on July 21, 2010, he was photographed embracing former Federal Reserve Chairman Paul Volcker, who helped shape some of its provisions. Can Dodd-Frank prevent another financial crisis?

Charles Calomiris, Columbia Business School: I don’t know anyone who understands what happened who would say that Dodd-Frank solves the problems that created the financial crisis.

From “Banks urge Fed retreat on credit exposure” by Tom Braithwaite, Financial Times, April 15:

Wall Street banks are resisting a Federal Reserve plan to limit their exposure to individual companies and governments, warning it will cut a combined $1.2tn from credit commitments at Goldman Sachs, JPMorgan Chase, Morgan Stanley, Bank of America and Citigroup….

The single counterparty limit was part of the Dodd-Frank Act reforms which are being implemented by regulators including the Fed, and is due to come into force next year. In an effort to prevent dangerous domino collapses, the law restricts the amount of exposure banks can have to a single counterparty to 25 per cent of their regulatory capital. The Fed is proposing to go further, adding a 10 per cent limit to the amount of exposure that financial groups with more than $500bn in assets can have to each other.

Repurchase market

From “Goldman’s repo ‘optimizer’” by Cardiff Garcia, Financial Times, May 15:

An interesting passage from a recent CreditSights note on Goldman, following a meeting with the bank’s CFO, David Viniar:

“Goldman explained that a further defense against a stressed funding situation driven by problems rolling over the repo book was what it referred to as its ‘secured funding excess.’ Goldman noted that it raises repo funding in excess of current financing needs, in order to reduce its secured funding rollover risk.

“Basically, Goldman uses additional repo above and beyond its needs as a sort of an ‘insurance policy’ against potential stress situation in which it could not roll its repo with some counterparties.

“Goldman noted that it often uses US treasuries as the collateral for this secured funding excess, and then it can substitute different assets into the repo transaction if needed.” …

This is a staightforward example of the shadow banking safe asset grab in action. But it’s also notable in that four years after the crisis, repo markets continue to be viewed nervously by at least one bank that taps them for funding. Good. …

We wonder about the extent to which Goldman’s caution also applies to the repo funding of other broker-dealers. (Though we’ll hasten to add that after MF Global, there’s also a limit to just how comfortable we can get.) …

“The company noted that the bulk of its repofunding is via tri-party repo, rather than via clearinghouses.”

From “Moody’s Downgrade Watch: What Will the Buy-Side Do?” by Securities Finance Monitor, May 10:

The likelihood that Moody’s will downgrade bank debt in the coming weeks and months is bad news for the banks themselves. But we would like to look at the other side of the equation: what will the Bank’s customers do in response? ….

Depending on how severe and broad the downgrades are, our estimate is as much as US$1 trillion of the US$10 trillion global repo industry could be returned overnight. Literally. Since 85% to 90% of repo is overnight, money market funds just wouldn’t buy them the next day. The seriousness of this shock to the global financial system must not be underestimated, and a sudden loss of repo funding is what killed more than one Wall Street firm.

Concurrently, non-affected repo and other financial products that meet 2a-7 eligible security requirements would see a spike in asset prices. Anyone holding this paper already will be in great shape. Banks and broker/dealers who dodge the Moody’s bullet will be in huge demand as a counterparty. This is a major market dislocation waiting to happen.

From “Analysis: Turning point emerges for Chinese central bank’s market operations” by Lu Jianxin and Jason Subler, Reuters, May 9:

China’s central bank is changing the way it conducts monetary policy as the world’s second-largest economy looks inward for growth ….

For the People’s Bank of China, it is focusing less on draining liquidity from the market – which has been a necessary result of its controlling the exchange rate over the past years – and working towards using tools like the repo market to signal its interest rate intentions. …

Traders said the PBOC’s increased repo market action is a pointer that it will try to guide interest rate expectations in a similar way to how the Federal Reserve and some other central banks in mature economies signal their intentions in their open market operations.

From “The coming Moody’s bank downgrades: funding and collateral will feel the heat” by Securities Finance Monitor, May 9:

Moody’s is reviewing 17 global banks for downgrades that may come as early as June. The news is starting to fill with stories on how much extra collateral banks will have to pony up if they are downgraded and what could happen to funding sources. It’s not pretty. …

The other side of a downgrade is access to funding. B of A gets right to the point, noting that their access to repo might be damaged. Some banks fund more illiquid / funky assets via repo conduits. These conduits rely on the rating of the cash borrower and pretty much ignore the collateral. There is cliff & wrong-way risk associated with using these conduits. If the credit rating doesn’t pass muster, then access is cut off. That happens right when funding gets tight.

The last time there was a funding shock, the problem turned systemic and Bear and Lehman evaporated. The Fed stabilized the system by pumping in liquidity through (among other programs) the Primary Dealer Credit Facility (PDCF). Perhaps it is time for the Fed to dust off the PDCF manual?

From “Repo Trades” by Carla Main, Bloomberg News, May 7:

Repurchase agreements are set to be excluded from a proposed European Union financial transaction tax, an EU official said.

At a working group meeting May 4 in Brussels, a consensus emerged to remove repos from the types of trades covered by the proposed tax in order to prevent potential damage to banks’ funding markets, the official said on condition of anonymity because the discussions are private.

From “Heat’s on Triparty Repos” by Jon Hilsenrath and Liz Rappaport, Wall Street Journal, May 3:

U.S. bank regulators are turning up the heat on the financial industry to reduce risk in an obscure but massive corner of the credit market known as triparty repos, where many large institutions get funding for their trading businesses. …

Some regulators have informally discussed the idea of having the Financial Stability Oversight Commission designate the entire market “systemically important” and in need of closer oversight, according to several people familiar with the matter….

Meanwhile, bankers say supervisors have made clear to them that without progress, they could demand that the business be spun out of the big banks and run through a supervised utility. Moving in this direction would pose complicated challenges which supervisors at this point don’t appear to have embraced. …

Dealers and banks are working to adjust massive, complicated technology systems. But at some point, “throwing money and bodies at the problem doesn’t work,” said a person involved in the matter at one bank. “At some point, people need time.”

From “Haircuts on repos will jeopardise recovery” by Richard Comotto, Senior Visiting Fellow at the ICMA Centre, University of Reading, Financial Times commentary, May 2:

In recent weeks, Lord Turner, chairman of the UK’s Financial Services Authority, has been outlining proposals for the regulation of “shadow banking” that might be put to the Group of 20 leading economies later this year. He has paid special attention to repurchase agreements, known as repos. …

Paradoxically, regulators are worried about the use of haircuts and margining, measures designed to ensure that there is always sufficient collateral in place. They fret that haircuts may amplify the “procyclicality” of financial markets. …

The proposed solution to such procyclicality is a minimum haircut on collateral, high enough to act as a brake on leverage in an up-cycle and preclude banks having to raise their own haircuts in a down-cycle.

The intellectual wellspring of the haircut spiral thesis is a paper called Securitised Banking and the Run on Repo by US academics Gary Gorton and Andrew Metrick. They argue that changes in haircuts were the main cause of the crisis. Their conclusions are based on data from a single US broker-dealer, which showed average haircuts rising from zero before July 2007 to 45 per cent by September 2008.

Unfortunately, Gorton and Metrick’s data were only for collateral in the form of structured securities, such as collateralised debt obligations and collateralised loan obligations, and only for bilateral US repo. But the vast bulk of collateral in the US repo market is Treasuries and/or public sector debt, and most transactions are not bilateral but triparty (where collateral management is delegated to third-party custodians).

The limited scope of Gorton and Metrick’s data is demonstrated by a study on repo investment by US money market mutual funds and securities lenders which supplied about two-thirds of the funding of US shadow banking. (RepoWatch editor’s note: This study was “Sizing up Repo” by Arvind Krishnamurthy, Stefan Nagel and Dmitry Orlow.) Fifteen to 20 per cent of their investments were in repos, mainly triparty, of which, just 14-19 per cent were against structured securities – that is, 2-4 per cent of total funding to shadow banks. The study also found that there was no increase in the haircuts on Treasuries and agencies, and haircuts on non-government collateral rose only modestly. This last point was confirmed by the Federal Reserve’s Taskforce on Triparty Repo Market Infrastructure. The facts are inconsistent with the idea that a “run on repo” played a central role in the crisis. What may be valid within a narrow segment of the US repo market has been naively over-extrapolated.

From “Financial regulators take aim at repo trading activities” by Brooke Masters and David Oakley, Financial Times, April 26:

Opaque securities lending and repurchase markets are potential threats to stability and can exacerbate cyclical downturns, global regulators warned on Thursday.

The Financial Stability Board, in their first report on the sector, said the markets pose a particular risk when collateral is poorly managed and subject to repeated reuse. …

This is part of a broader project to rein in the dangers posed by the world of “shadow banking”, or non-deposit taking institutions that extend credit and otherwise compete with banks.

From “Shadow Banking Regulation” by Tobias Adrian and Adam B. Ashcraft, Federal Reserve Bank of New York, April 2012:

Collateralized commercial paper is a new alternative to repo funding used by several banks for risky assets. To issue collateralized commercial paper, a bank sets up a special purpose entity that issues commercial paper and uses the proceeds of that issuance to enter into a reverse repo agreement with the bank’s broker dealer. This is similar to an asset-backed commercial paper conduit, except that the asset-backed commercial paper conduit would normally buy term assets instead of entering into repo agreements….

Because only two firms have issued collateralized commercial paper to date and the amounts outstanding are small, the financial stability risks posed by collateralized commercial paper currently are de minimis. However, because collateralized commercial paper increases the linkages between the commercial paper and repo markets, if the collateralized commercial paper market were to grow to account for a nontrivial source of repo funding or of commercial paper issuance, collateralized commercial paper could increase the speed of propagation of financial disruptions across commercial paper and repo markets. …

Monitoring future growth and evolution in the product will be challenging. … Even more challenging will be monitoring new related structures that may not be classified as collateralized commercial paper, which are reportedly being discussed by sponsoring financial institutions.

From “Fed Paper on Repo Exposes Inadequacy of Financial Reforms” by Yves Smith, Naked Capitalism blog, April 25:

I’m late to write on a terrific and largely unnoticed paper presented at the Federal Reserve Board’s research conference on “Central Banking: Before, During and After the Crisis” in late March (hat tip Michael C). “A Proposal for the Resolution of Systemically Important Assets and Liabilities: The Case of the Repo Market” by Viral V. Acharya and T. Sabri Öncu could be more accurately titled, “What Financial Reform Missed.” …

The authors politely point out that the new Dodd Frank resolution powers would have done squat to prevent chaos in the wake of the Lehman implosion.

From “The case against Lehman Brothers” by Steve Kroft, CBS’ 60 Minutes, April 22:

On September 15, 2008, Lehman Brothers, the fourth largest investment bank in the world, declared bankruptcy — sparking chaos in the financial markets and nearly bringing down the global economy. It was the largest bankruptcy in history — larger than General Motors, Washington Mutual, Enron, and Worldcom combined. The federal bankruptcy court appointed Anton Valukas, a prominent Chicago lawyer and former United States attorney to conduct an investigation to determine what happened.

Included in the nine-volume, 2,200-page report was the finding that there was enough evidence for a prosecutor to bring a case against top Lehman officials and one of the nation’s top accounting firms for misleading government regulators and investors. That was two years ago and there have been no prosecutions. Anton Valukas has never given an interview about his report until now.

Securities lending

From “Effects of LTRO on securities lending and record fees” by Will Duff Gordon, Data Explorers, April 17:

The LTRO (longer-term refinancing operations by the European Central Bank) has lowered spreads in the repo world. According to Societe Generale Securities Services input into our forthcoming Quarterly Review, the repo spread versus EONIA (Euro OverNight Index Average) for two month Commercial Paper has fallen from 75bps in December to 35bps today. It has also made finding suitable instruments for cash re-investment purposes more difficult since most of the usual suspects have been pledged to the ECB since they widened the list of eligible collateral to include corporate bonds, ABS and other bonds yielding more than straight government debt.

Though this is undoubtedly making life even more difficult for the European lenders with low interest rates and low leverage on the buy side not helping, the situation is not as bleak as it might appear. According to the securities lending flow reported to Data Explorers, the total daily return from lending across all asset classes is both on an upward trajectory as well as being consistently greater than USD 20 million for the first time in three years.

Securitization

From “There’s plenty of money for junk” by Gregory Zuckerman and Matt Wirz, Wall Street Journal, April 30:

Banks and investors are showering junk-rated companies with easy money, the latest sign that risk-taking is spreading through parts of the financial markets. …

Banks and other firms are able to make loans at easy terms because they are finding it easy to sell them to investors. Recently, individual investors and managers of collateralized-loan obligations, as well as traditional buyers of junk bonds, have been especially eager buyers.

“Investors are willing to do that because they are searching for yield in a yieldless environment,” said Kevin Sherlock, head of loan and high-yield capital markets at Deutsche Bank.

From “Fitch warns over EU insurer rules” by Robin Wigglesworth, Financial Times, April 29:

The EU’s new regulatory regime for insurers could imperil the region’s already struggling securitisation market and further constrict credit supply to Europe’s economy, Fitch Ratings says in a report.

In the past banks often securitised – or bundled large portfolios of loans such as mortgages or auto loans into one interest-paying security – to clear their balance sheet for further lending.

European insurance groups were among the biggest buyers of these securities, snapping up as much as a fifth of the entire regional market.

Solvency II changes how much capital insurers need to set aside for various assets – depending on their risk and duration – and penalises securitised products relative to government debt and short-term corporate bonds.

This could limit banks’ ability to securitise a wide variety of loans, and thereby hamper lending in the eurozone, Fitch says.

From “Big banks seek regulatory capital trades” by Tracy Alloway, Financial Times, April 29:

Big banks are aiming to help smaller lenders cut the amount of regulatory capital they need to hold against loans in an attempt to make money from deals similar to those first created in the early days of securitisation more than a decade ago. …

Such trades, also known as synthetic securitisations, involve repackaging loans on a bank’s balance sheet, then slicing them up into different tranches.

The bank typically then buys protection on the riskiest or mid-level tranche from an outside investor such as a hedge fund, insurance company or private equity firm.

Doing so allows a bank to reduce the amount of regulatory capital it has to hold against the loans …

The trades hark back to the early days of securitisation in the late 1990s, which helped fuel the financial crisis.

“It’s almost as if you’re seeing the start of the securitisation market coming back in a very modest way,” said Walter Gontarek, chief executive of Channel Advisors, which operates Channel Capital Plc, a vehicle with $10bn in portfolio credit transactions with banks and has started a new fund dedicated to these structures. …

The insurers, hedge funds or private equity firms are not bound by the same, relatively onerous capital regulations as the banks. That makes it easier for them to write protection on the underlying loans in a classic case of regulatory arbitrage.

From “Corporate finance: innovative offerings in a soft securitization market” by Thomson Reuters staff, Business Law Currents, April 27:

Securitizations, once a vast swath of financial instruments that produced superb profits for financial institutions and law firms alike, have not really reemerged in the wake of the subprime mortgage crisis. Market analysts never predicted a substantial rebound in activity, and yet there are some signs that indicate bespoke transactions could be making a small resurgence….

At the end of the day, there is considerable market confidence that securitizations will continue to survive in some form. Trillions of dollars are wrapped up in securitizations, and with new regulatory frameworks emerging and investor appetite recuperating the markets may be in for increased deal flow. Companies are continuously structuring their offerings in novel ways so that their notes are palatable to as wide a range of investors as possible and in order to keep ahead of regulatory changes. New deals will constantly emerge and evolve but the offerings will likely continue as a trickle for a while yet.

From “Credit Suisse Bonus Bonds Lead Embrace of Relief Deals” by Bradley Keoun, Bloomerg News, April 24:

Using techniques similar to the ones that packaged mortgages into bonds, lenders are turning holdings of corporate loans, export-import credit or derivatives-trading gains into triple-A securities. The transformation — usually requiring a cash infusion from investors, or in Credit Suisse’s case, a commitment from employees — makes the assets look safer so banks can hold less capital as a loss reserve….

While financial innovation can be helpful, “I would be just as pleased to see a lot of these banks raise new equity capital,” said Darrell Duffie, a Stanford University business- school professor who joined the Moody’s Corp. board in October 2008. “It’s a cleaner way for us all to see that systemic risk is going down.”

Regulators are pressing banks to trim holdings of risky assets and bolster capital — the buffer between assets and liabilities that helps protect depositors from losses and prevent the need for government bailouts.

In response, some banks have turned to “synthetic transactions,” built from credit-default swaps that work like insurance to reimburse the lender whenever a borrower defaults or a customer fails to pay up on a trading contract.

From “UBS, Barclays Ready $1.1B CMBS, Spreads Wider Than Recent Bonds” by Al Yoon , Dow Jones Newswires, Apil 24:

UBS Securities and Barclays PLC plan to sell $1.1 billion of publicly registered commercial mortgage-backed securities with risk premiums above other recent issues, according to an investor familiar with the deal.

From “Securitization Accounting and Grand Theft Auto” by Tom Selling, The Accounting Onion blog, April 19:

Many books and articles have been written to describe the mishaps that led to the Great Recession of 2008, but few have done so while putting the role of accounting standards and auditing in context. …

A recent paper by S.P. Kothari and Rebecca Lester of MIT, The Role of Accounting in the Financial Crisis: Lessons for the Future, is very strong in its description of flawed accounting and its potential role in the past crisis. These are some of the basic messages:

-The accounting rules provided originators of subprime mortgages (SFAS 140) the opportunity to record economically specious gains on securitization transactions.

-The accounting rules also permitted regulated financial institutions that invested in financial instruments created out of subprime mortgages (MBOs and CDOs) to delay recognition of likely losses; which, in turn, distorted measures of capital adequacy.

-Estimation errors, most significantly estimates of fair value, committed by issuers of financial statements and their auditors exacerbated the accounting misstatements inherent in the accounting rules.

Although the Kothari/Lester did not provide much in the way of “lessons for the future,” I would still highly recommend it. Accounting students could, and should, read it if only for its lucid examples and explanations of the arcane and flawed accounting rules that are applicable to securitizations. The purpose of this post is to distill the analysis of Kothari/Lester so as to further discuss “lessons for the future.”

From “SEC Seeking Fair Value Disclosure From Banks on Structured Notes” by Matt Robinson, Bloomberg, April 17:

The U.S. Securities and Exchange Commission is asking banks that issue structured notes to boost disclosures to investors, including the banks’ own estimates for the securities’ market value at the time of sale. …

The U.S. structured note industry, which sells bank bonds bundled with derivatives for customized bets, has come under scrutiny from regulators for the securities’ complexity and lack of transparency. Some notes have higher fees than their potential returns. Banks sold $45.9 billion of SEC-registered securities in 2011, down from a record $49.5 billion a year earlier, according to data compiled by Bloomberg.

“The SEC finally understands these products,” said Frank Partnoy, a University of San Diego law professor and former Morgan Stanley derivatives structurer. “I’m very encouraged by these questions that the SEC is asking.”

From “$1 Trillion in Mortgage Risk Mitigated by Tradeweb Technology,” press release by PRNewswire, April 12:

Tradeweb Markets LLC announced that more than $1 trillion of risk has been offset in the TBA-MBS (To-Be-Announced Mortgage-Backed-Securities) market through the use of pioneering trading technology. The Tradeweb “round-robin” functionality, introduced 16 months ago to the TBA-MBS marketplace, has significantly lowered the number of failed TBA mortgage pool trades by enabling institutional investors to electronically pair-off TBA mortgage pool transactions with dealers, replacing a manual process and providing an efficient solution for round-robin fails. … the new functionality has become particularly useful following the implementation of new fails charges by the Treasury Market Practices Group (TMPG) on February 1, 2012. …

TBA-MBS represents the majority of all institutional residential mortgage trading. Launched in February 2001, there has been over $140 trillion in transactions executed by asset managers and other institutional clients on Tradeweb since inception. In 2012, monthly trading volumes have exceeded $2 trillion on the electronic multi-dealer-to-customer platform, nearing record levels of $2.1 trillion seen in August 2011.

From “PennyMac Strikes Repo Deal with CSFB,” by Paul Muolo, National Mortgage News, April 13, 2012:

PennyMac Mortgage Investment Trust has a struck a new master repurchase facility with Credit Suisse First Boston that will help the REIT fund its correspondent mortgage business. …

The publicly traded PennyMac has been ramping up its third-party platform the past six months and is predicting explosive growth in this area.

Shadow Banking

From “ETFs, unregulated banks in disguise” by Izabella Kaminska, Financial Times, May 3:

If one article sums up how ETFs have come to change the market structure of the equity universe, it’s this one from Paul Amery at Index Universe on Thursday.

As he recounts, the thing that really worries regulators is the role ETFs play in the shadow banking world today. To what degree do their security deposits fund banks, and what sorts of maturity transformation is going on behind the scenes?

Also, to what degree do ETF providers fulfil a credit intermediation role by transferring capital and liquidity from savers to borrowers, even when most ETF investors are unaware of the fact that their “deposits” may not be fully capitalised at all times? …

Interestingly, while a lot of attention has been paid to synthetic funds, which exploit the funding potential of ETFs in a much more obvious fashion (even though they themselves are hugely opaque about how they do it… the point is we know they’re doing it), funds that focus on securities lending and repo to supplement official income have drawn less scrutiny.

From “Regulatory spotlight on shadow banking” by Will Duff Gordon, Data Explorers, April 30:

Late last week saw shadow banking mania descend on Europe. Speeches by Michel Barnier and Paul Tucker set the backdrop for the release of the Financial Stability Board’s initial paper on Securities Lending and Repos. All three make for interesting reading, given the sceptre of regulation set to impact this industry. …

… one is left with the impression that the powers that be are mainly supportive of shadow banking but are eager for reform in certain key areas like haircuts, money market funds, re-hypothecation and transparency.

From “Towards better regulation of the shadow banking system,” speech by Michel Barnier, European Commissioner, April 27:

The fact that so many of you have chosen to join us today shows how much of a challenge this phenomenon of “shadow banking” presents:

First of all by its size:

-In 2010, the Financial Stability Board estimated that the shadow banking system amounted to 46 trillion euro. This represented between 25 and 30% of the total financial system

-by the practices on which it is based: according to the latest IMF estimates, the same security is on average lent 2.4 times….

Based on the work carried out by the FSB, we have so far identified two main activities worthy of our attention: firstly, securitisation, and secondly, securities lending or borrowing with repurchasing (“repo”)….

I am thinking in particular of practices such as securities lending, rehypothecation and repurchasing, which can lead to excessive risk-taking, sheep-like behaviour (“runs”) and excessive volatility in liquidity provision. These practices, left unchecked, played a decisive role in the difficulties faced by AIG, Bear Stearns and Lehman Brothers.

From “Towards better regulation of the shadow banking system,” a speech by Vítor Constâncio, European Central Bank, April 27, 2012:

I will first address the general problems created by the unregulated shadow banking as well as the main guidelines for the necessary regulatory reform that is progressing internationally under the aegis of the Financial Stability Board.

In the second part of my remarks I will focus on repo markets, given their importance for the functioning of money markets and consequently for central banks.

To address concrete practical issues, I will make some proposals on how to create a database, which I believe is indispensable to provide us with basic information about the functioning of the European repo market, at least on a similar basis to the one existing in the US. I will also briefly discuss some policy proposals concerning repo markets that have been raised in the international debate.

From “Securitisation, shadow banking and the value of financial innovation,” a speech by Adair Turner, Financial Services Authority, April 19, 2012:

I aim to do two things – first, consider how and why the wave of financial innovation in the area of securitised credit ended in the financial crash of 2008. And second, consider what we know about the value of financial innovation in general …

From “Strengthening the Oversight and Regulation of Shadow Banking – Progress Report to G20 Ministers and Governors” by the Financial Stability Board, April 16:

At the Cannes Summit in November 2011, the G20 Leaders agreed to strengthen the oversight and regulation of the shadow banking system, and endorsed the Financial Stability Board’s initial recommendations with a work plan to further develop them in the course of 2012….

… five workstreams have been launched to advance the work to develop proposed policy recommendations in the following five areas:

(i) Banks’ interactions with shadow banking entities;

(ii) Money market funds (MMFs);

(iii) Other shadow banking entities;

(iv) Securitisation; and

(v) Securities lending and repos.The first, second and fourth of these workstreams will prepare their recommendations by July

2012. The recommendations from the other shadow banking entities workstream are expected by September 2012, while the securities lending/repo workstream is to prepare recommendations by the end of 2012.

From “Regulation to diminish banks’ fixed income gains – Bernstein” by The Trade News, April 16:

Fixed income trading may have boosted US institutional broking revenues in Q1 2011, but new legislation impacting bond trading will cause banks to adapt their business models to maintain returns….

The warning comes as part of the latest ‘US capital markets quarterly’ research from Bernstein Research, an arm of US broker Sanford C. Bernstein.

“Volcker will change the way fixed income units operate within banks, raising the costs of liquidity and trading to market participants,” read the Bernstein Research note. “It will shift the competitive landscape and provide an opportunity for non-bank broker dealers to take share from the banks.”

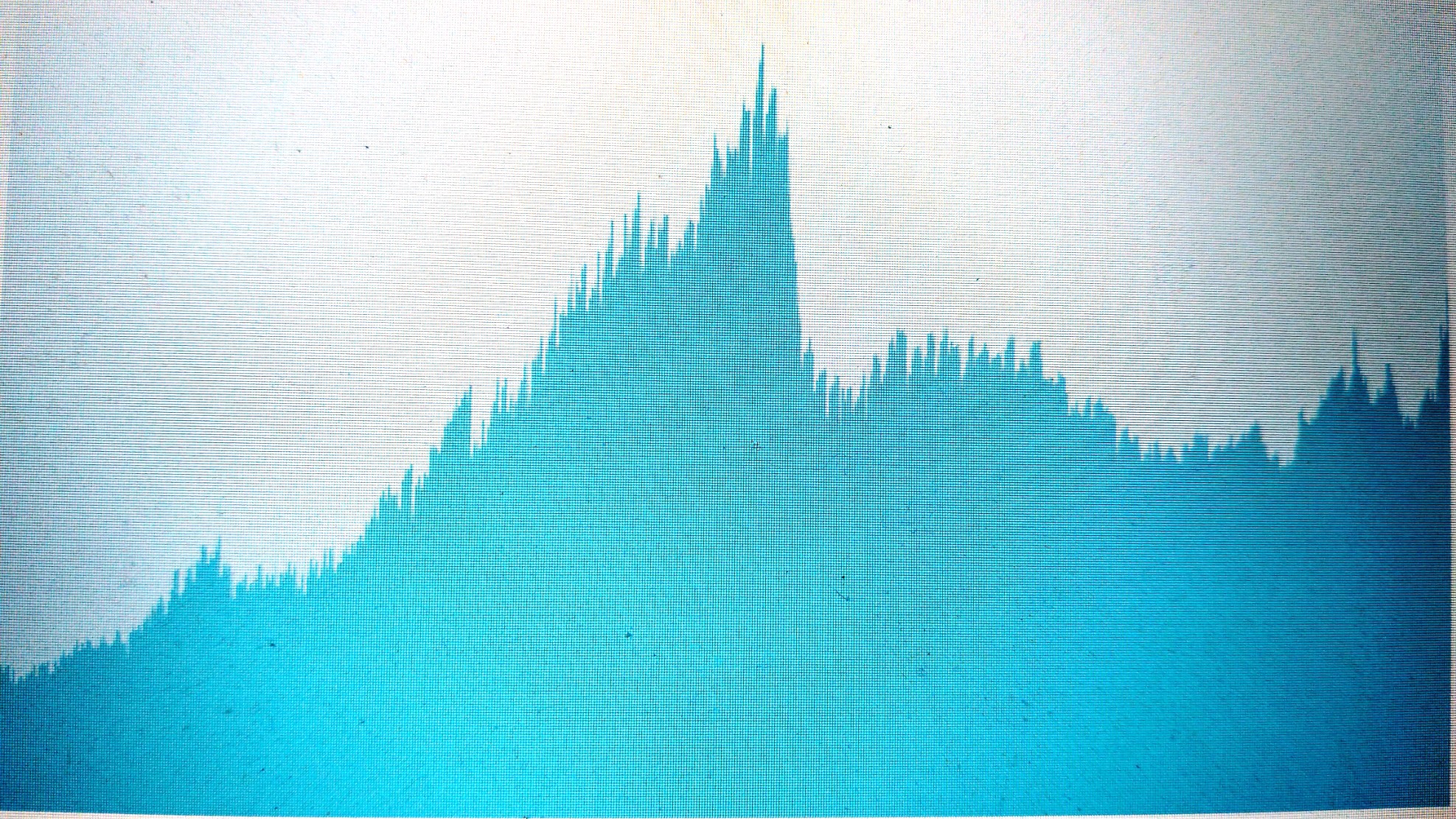

“The Response to the Financial Crisis – In Charts” by Tim Massad,U.S. Treasury, April 13, 2012:

This report shows that at the four largest U.S.banks, JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, short-term wholesale funding in 2002 was 32 percent, peaked in 2008 at 36 percent, and by mid-2011 had fallen to 22 percent. Short-term wholesale funding usually includes repos, unsecured and asset-backed commercial paper, Fed funds, jumbo certificates of deposits, large brokered deposits, and eurodollar deposits.

Too Big To Fail

From “Brown Introduces Bill to End ‘Too Big to Fail’ Policies, Prevent Mega-Banks from Putting our Economy at Risk,” press release, U.S. Senator Sherrod Brown, May 9:

With the nation’s six largest Wall Street banks controlling assets equal to 64 percent of U.S. Gross Domestic Product, U.S. Sen. Sherrod Brown (D-OH) today introduced a bill protect American taxpayers by placing sensible size and leverage limits on our nation’s largest financial institutions. …

The SAFE Banking Act of 2012:

-Imposes a strict 10 percent cap on any bank’s share of the total amount of deposits of all insured banks in the U.S. This would eliminate loopholes in the existing statutory cap.

-Imposes a strict 10 percent cap on the liabilities that any one financial company can take on, relative to the U.S. financial sector. Like the deposit concentration limit, this closes loopholes in existing law.

-Imposes a limit on the non-deposit liabilities (including off-balance-sheet (OBS) exposure) of a bank holding company of 2 percent of GDP. No bank holding company could exceed $1.3 trillion.

-Imposes a limit on the non-deposit liabilities (including OBS exposure) of any non-bank financial institution of 3 percent of GDP. No non-bank financial company could grow larger than $436 billion.

-Codifies a 10 percent leverage limit (including OBS exposure) for large bank holding companies and selected nonbank financial institutions into law.

From “Resolution – A progress report,” a speech by Paul Tucker, Deputy Governor for Financial Stability at the Bank of England, May 3:

The EU have made a massive contribution to global planning for resolution regimes to address the fundamental problem of Too Big To Fail …

For those who hesitate to grasp the nettle of implementing resolution regimes, I want to stress that the genie is out of the bottle. While myopia gripped the financial markets in the years leading up to the crisis, they are now seized of the risks on bank balance sheets. That will be reflected in the prices of the debt of those who bear that risk. If the risk in banking is not incorporated into the yields of bonds issued by banks themselves, then it will be reflected in higher sovereign borrowing costs. There is nowhere to hide.

Quietly maintaining a policy of bailing out banks is not a free option for governments and their taxpayers. Anyone tempted to argue against pursuing the resolution policy agenda would effectively be wanting to increase the (contingent) burden on the taxpayer. That would be liable to increase the pressure for fiscal austerity.

From “Variation in systemic risk as U.S. banks during 1974-2010” by Armen Hovakimian, Edward J. Kane, and Luc Laeven, May 2012:

The ongoing global financial crisis has underscored the need to devise a timely and comprehensive measure of the risk that individual institutions impose on the financial system as a whole. This paper introduces a theoretically sound measure for systemic risk that is easy to implement using publicly available financial and stock market data. …

… we find that bank size is a key driver of systemic risk.

From “When Too Big to Fail Gets Bigger” by Peter Eavis, The New York Times, April 17:

Goldman Sachs is still growing. Does that mean financial reform is proving a big fail on the too big to fail question? …

One camp of reformers is O.K. with the fact that Goldman has more assets than in 2008, because the bank has increased its capital over that period, making it more resistant to losses and market shocks. It also has less hard-to-sell, hard-to-value assets, and more liquid securities. …

For others size is critical. Even if a bank has higher capital and better quality assets, it can still be subject to a run, and if it’s huge, the taxpayer would have to step in to save it. They say the government should force banks to be made small enough to fail without bringing down the system.

A middle camp fuses the two approaches. It wants banks to be smaller over time, but it expects tougher regulations will surely, but gradually, cause that over time.

From “Banks Seen Dangerous Defying Obama’s Too-Big-to-Fail Move” by David J. Lynch, Bloomberg News, April 16:

Two years after President Barack Obama vowed to eliminate the danger of financial institutions becoming “too big to fail,” the nation’s largest banks are bigger than they were before the nation’s credit markets seized up and required unprecedented bailouts by the government.

Tri-party repo

RepoWatch’s News Round-up thanks New York Times reporter Peter Eavis for the following article, in which he begins the process of educating New York Times readers – and the nation – about the repurchase market. When the New York Times writes about repo, others follow, for example: “JPMorgan Chase: The Great White Whale Of The Global Economy”by Mark Gongloff in The Huffington Post, April 12, and “Bloomberg Scrutinizes JPMorgan Chase” by Ryan Chittum for Columbia Journalism Review’s blog The Audit, April 13. This New York Times story is an important breakthrough for a publication that has studiously avoided using the word “repo” and focused its guns on credit default swaps instead. Note that “repo” is even in the headline.

From “Bernanke Quietly Criticizes Lack of Repo Reforms” by Peter Eavis, New York Times, April 10:

Ben S. Bernanke, the chairman of the Federal Reserve, doesn’t sound very happy with the state of affairs in a crucial part of the financial system. In a speech Monday night, Mr. Bernanke highlighted the lack of progress in overhauling something called the tri-party repo market, through which banks and other financial firms borrow and lend money.

From “JPMorgan’s practices bring scrutiny” by Tom Braithwaite, Telis Demos and Tracy Alloway, Financial Times, April 5:

Three times a pallbearer, never a corpse – that is JPMorgan Chase’s experience of the brutal financial markets of the past few years. At the demise of Bear Stearns, Lehman Brothers and, most recently, MF Global, the bank has been deeply involved: in a rescue bid for Bear and in a complex network of relationships with Lehman and MF Global. Its unrivalled reach raises inevitable questions about its role.

From “CFTC Orders JPMorgan Chase Bank, N.A. to Pay a $20 Million Civil Monetary Penalty to Settle CFTC Charges of Unlawfully Handling Customer Segregated Fund,” Commodity Futures Trading Commission press release, April 4:

The U.S. Commodity Futures Trading Commission today filed and simultaneously settled charges against JPMorgan Chase Bank, N.A. for its unlawful handling of Lehman Brothers, Inc.’s customer segregated funds. The CFTC order imposes a $20 million civil monetary penalty against JPMorgan. …

The Commodity Futures Trading Commission order finds that from at least November 2006 to September 2008, JPMorgan was a depository institution serving Lehman, a futures commission merchant registered with the Commodity Futures Trading Commision. During this time, Lehman deposited its customers’ segregated funds with JPMorgan in large amounts that varied in size, but almost always more than $250 million at any one time.

According to the order, during the same time period, JPMorgan extended intra-day credit to Lehman on a daily basis to facilitate Lehman’s proprietary transactions, including repurchase agreements, or “repos.” JPMorgan would extend intra-day credit to LBI to the extent that LBI’s “net free equity” at JPMorgan was positive. As of November 17, 2006, JPMorgan included Lehman’s customer segregated funds in its calculation of Lehman’s net free equity, even though these funds belonged to Lehman’s customers, not to Lehman, the order also finds.

The Commodity Exchange Act and Commodity Futures Trading Commission regulations prohibit depository institutions, like JPMorgan, from using or holding segregated funds that belong to a futures commission merchant customer as though they belong to anyone other than that customer, and also prohibit the extension of credit based on such funds to anyone other than that customer.

From “J.P. Morgan Gets Carded By the Fed” by David Reilly, Wall Street Journal, April 1:

Weeks after their release, aspects of the Federal Reserve’s bank “stress tests” still have investors puzzling over what may be underappreciated risks.

Projected loss rates for bank credit-card portfolios are an example, particularly those for J.P. Morgan Chase.

RepoWatch editor’s note:

An important “underappreciated risk” at JP Morgan is the role it plays as a clearing bank for the tri-party repo market.

When the Federal Reserve released the result of its stress tests in March,

RepoWatch asked Federal Reserve spokeswoman Barbara Hagenbaugh by

e-mail if the stress tests took into account the tri-party risk that

Fed officials have said poses serious potential harm to clearing banks

JP Morgan and Bank of New York. She never replied.